6 Poorly Performing High-Yield Stocks

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, the following stocks have high dividend yields but performed poorly over the last 12 months.

Hurco Companies Inc.'s (HURC) dividend yield is 1.06% with a payout ratio of 14%. Over the last 52 weeks, the stock price has fallen 7.6%. The stock is trading with a price-earnings ratio of 13.8 and a price-sales ratio of 1.

Warning! GuruFocus has detected 2 Warning Signs with HURC. Click here to check it out.

The intrinsic value of HURC

The company, which designs and manufactures computerized machine tools, has a market cap of $272.3 million.

The profitability and growth rating is 7 out of 10. The return on equity of 9.55% and return on assets of 6.78% are outperforming the sector and are ranked higher than 57% of competitors. Its financial strength is rated 9 out of 10. The cash-debt ratio of 52.46 is outperforming 80% of competitors, and the equity-asset ratio of 0.70 is above the industry median of 0.57.

With 14.7% of outstanding shares, Chuck Royce (Trades, Portfolio) is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio) with 1.51% and Hotchkis & Wiley with 0.81%.

Hamilton Beach Brands Holding Co.'s (HBB) dividend yield is 1.66% with a payout ratio of 21%. Over the last 52 weeks, the stock price has fallen 41%. The stock is trading with a price-earnings ratio of 18.59 and a price-sales ratio of 0.4.

The company, which manufactures home appliances as well as commercial restaurant equipment, has a market cap of $312 million.

The company has a profitability and growth rating of 3 out of 10. The return on equity of 48.54% and return on assets of 6.45% are outperforming the sector and are ranked higher than 72% of competitors. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.02 is underperforming 99% of competitors, and the equity-asset ratio of 0.14 is below the industry median of 0.57.

Simons is the company's largest guru shareholder with 0.44% of outstanding shares, followed by Royce with 0.4%.

Miller Industries Inc.'s (MLR) dividend yield is 2.93% with a payout ratio of 29%. Over the last 52 weeks, the stock price has fallen 7.7%. The stock is trading with a price-earnings ratio of 9.83 and a price-sales ratio of 0.44.

The company, which manufacturers towing and recovery equipment, has a market cap of $282.91 million.

GuruFocus rated its profitability and growth 7 out of 10. The return on equity of 13.84% and return on assets of 8.55% are ranked higher than 78% of competitors. Its financial strength is rated 8 out of 10. The cash-debt ratio of 1.24 is outperforming 67% of competitors. The equity-asset ratio of 0.61 is above the industry median of 0.48.

Royce is the company's largest guru shareholder with 10.04% of outstanding shares, followed by Hotchkis & Wiley with 8.25%, Simons with 0.65% and Robert Olstein (Trades, Portfolio) with 0.62%.

Dynagas LNG Partners LP's (DLNG) dividend yield is 14.42% with a payout ratio of 476%. Over the last 52 weeks, the stock price has fallen 28.9%. The stock is trading with a price-earnings ratio of 35.72 and a price-sales ratio of 2.2.

The company, which owns and operates a fleet of liquefied natural gas carriers, has a market cap of $291.02 million.

The company has a profitability and growth rating of 5 out of 10. The return on equity of 4.66% and return on assets of 0.64% are underperforming the sector and are ranked lower than 78% of competitors. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.08 is underperforming 83% of competitors. The equity-asset ratio of 0.29 is below the industry median of 0.46.

With 4.04% of outstanding shares, Francisco Garcia Parames (Trades, Portfolio) is the company's largest guru shareholder, followed by Simons with 0.23%.

Panhandle Oil and Gas Inc.'s (PHX) dividend yield is 0.92% with a payout ratio of 18%. Over the last 52 weeks, the stock price has fallen 23.5%. The stock is trading with a price-earnings ratio of 20.25 and a price-sales ratio of 6.

The oil and gas producer has a market cap of $294.8 million.

GuruFocus rated its profitability and growth 6 out of 10. The return on equity of 12.16% and return on assets of 7.47% are outperforming the sector and are ranked higher than 88% of competitors. Its financial strength is rated 6 out of 10. The equity-asset ratio of 0.66 is above the industry median of 0.54.

Royce is the company's largest guru shareholder with 1.22% of outstanding shares.

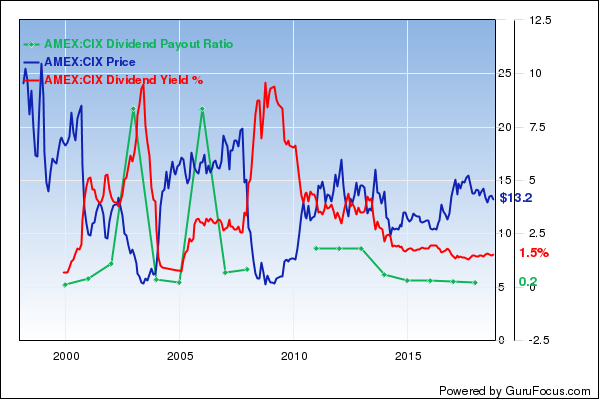

Compx International Inc.'s (CIX) dividend yield is 1.52% with a payout ratio of 16%. Over the last 52 weeks, the stock price has fallen 7.9%. The stock is trading with a price-earnings ratio of 10.6 and a price-sales ratio of 1.4.

The company, which makes locks and other security solutions, has a market cap of $295.25 million.

The company has a profitability and growth rating of 7 out of 10. The return on equity of 11.30% and return on assets of 10.19% are outperforming the sector and are ranked higher than 57% of competitors. Its financial strength is rated 10 out of 10 with no debt. The equity-asset ratio of 0.91 is above the industry median of 0.48.

With 2.33% of outstanding shares, Royce is the company's largest shareholder among the gurus, followed by Simons with 1.34%.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

5 Cheap Stocks With Predictable Businesses

5 Health Care Stocks Gurus Are Buying

6 Companies Growing Earnings

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with HURC. Click here to check it out.

The intrinsic value of HURC