6 Restaurants Trading With Low Price-Earnings Ratios

As of Thursday, the GuruFocus All-in-One Screener, a Premium feature, found that the following restaurants stocks have low price-earnings ratios and have been bought by gurus. While some of them are great value investments, others may need to be researched more carefully, according to the discounted cash flow calculator.

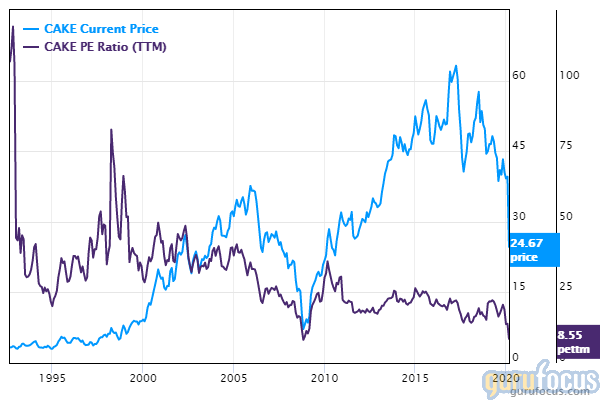

Cheesecake Factory

With a market cap of $848 million, Cheesecake Factory Inc. (CAKE) has a price-earnings ratio of 6.62. According to the DCF calculator, the stock has a fair value of $46.05 while trading at $18.87.

The stock has lost 60% over the last 12 months and is now 63.11% below the 52-week high and 29.96% above the 52-week low.

The company has a GuruFocus profitability rating of 8 out of 10. The return on equity of 23.07% and return on assets of 5.96% are outperforming 73% of companies in the restaurants industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.36.

The company's largest guru shareholder is Ron Baron (Trades, Portfolio) with 1.79% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 1.2% and Richard Snow (Trades, Portfolio) with 0.52%.

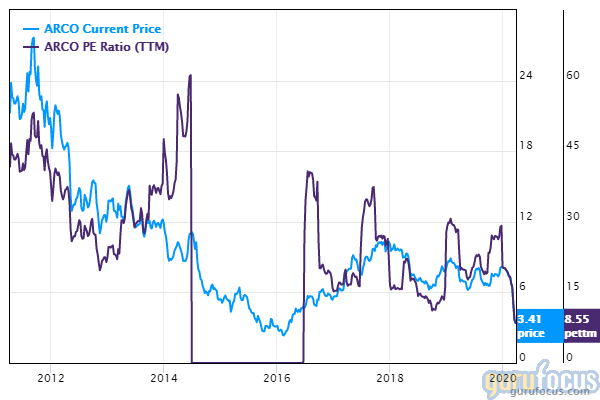

Arcos Dorados Holdings

With a $733 million market cap, Arcos Dorados Holdings Inc. (ARCO) is trading with a price-earnings ratio of 8.65.

The share price has declined 49% over the past 12 months and is now 59% below the 52-week high and 12.7% above the 52-week low.

The operator of restaurants under the McDonald's brand has a GuruFocus profitability rating of 7 out of 10. The return on equity of 14.98% and return on assets of 3.09% are outperforming 57% of companies in the restaurants industry. Its financial strength is rated 4 out of 10. The equity-asset ratio of 0.16 is below the industry median of 0.38.

Bill Gates (Trades, Portfolio)' Foundation is the company's largest guru shareholder with 1.49% of outstanding shares, followed by Charles de Vaulx (Trades, Portfolio) with 0.45% and IVA International Fund (Trades, Portfolio) with 0.36%.

Bloomin Brands

With a market cap of $671 million, Bloomin Brands Inc. (BLMN) is trading with a price-earnings ratio of 5.36 and a price-book ratio of 4. According to the DCF calculator, the stock has a fair value of $15.41 while trading at about $7.70.

Shares have tumbled 61% over the last 12 months and are now trading 68.22% below the 52-week high and 70% above the 52-week low.

The operator of casual dining restaurants has a Gurufocus profitability rank of 7 out of 10. The company's return on equity of 86.44% and return on assets of 3.94% are outperforming 59% of companies in the restaurants industry. The cash-debt ratio of 0.03 is below the industry median of 0.36.

The company's largest guru shareholder is Jana Partners (Trades, Portfolio) with 9.18% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio)'s GMO with 0.65% and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.11%.

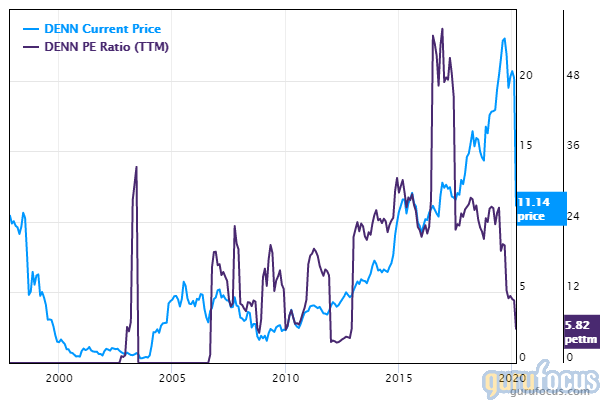

Denny's

Denny's Corp. (DENN) has a market cap of $529 million and is trading with a price-earnings ratio of 4.98. According to the DCF calculator, the stock has a fair value of $28.21 while trading at about $9.50.

Shares have tumbled 48% over the last 12 months and are now trading 60.39% below the 52-week high and 110% above the 52-week low.

GuruFocus gives the company a profitability rating of 8 out of 10. The return on assets of 27.98% is outperforming 98% of companies in the restaurants industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.36.

With 5.25% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technology is the company's largest guru shareholder, followed by GAMCO Investors with 0.33% and Robert Olstein (Trades, Portfolio)'s firm with 0.09%.

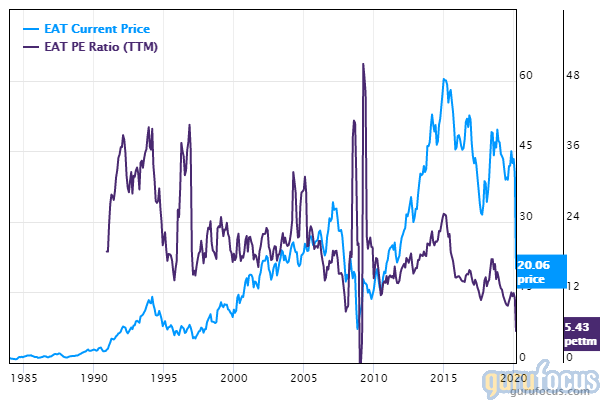

Brinker International

Brinker International Inc. (EAT) has a market cap of $578 billion. Its shares are trading with a price-earnings ratio of 4.24. According to the DCF calculator, the stock has a fair value of $78 while trading at $15.47.

Share prices have declined 65% over the past 12 months and are currently trading 67.48% below the 52-week high and 121% above the 52-week low.

The Dallas-based restaurant company has a GuruFocus profitability rating of 8 out of 10. The return on assets of 7.9% is outperforming 81% of companies in the restaurants industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.01 is far below the industry median of 0.36.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.95% of outstanding shares, followed by Renaissance Technologies with 0.50% and Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.48%.

Dave & Buster's Entertainment

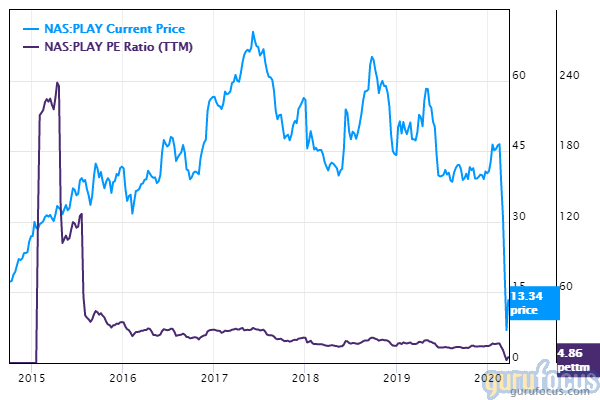

Dave & Buster's Entertainment Inc. (PLAY) has a market cap of $440 million. Its shares are trading with a price-earnings ratio of 5.15 and a price-book ratio of 2.97. According to the DCF calculator, the stock has a fair value of $29.96 while trading at $14.41.

Shares have declined 70% over a 12-month period and are currently trading 75.82% below the 52-week high and 212% above the 52-week low.

The owner of entertaining restaurants has a GuruFocus profitability rating of 7 out of 10. The return on equity of 33.33% and return on assets of 5.66% are outperforming 71% of companies in the restaurants industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.01 is below the industry median of 0.36.

The company's largest guru shareholder is Steven Cohen (Trades, Portfolio)'s Poin72 Asset Management with 0.71% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.16% and Snow with 0.15%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Cycical Companies Boosting Book Value

6 Retailers Gurus Are Buying

6 Tech Companies Growing Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.