6 Stocks With High Business Predictability Ratings

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, the following companies have high business predictability ratings and a wide margin of safety.

AutoZone Inc. (AZO)

The company has a 3.5 out of five-star business predictability rank and, according to the discounted cash flow calculator, a 35% margin of safety at $822.88 per share.

The retail company, which sells automotive replacement parts, has a market cap of $20.74 billion. Over the last five years, its revenue has grown 13.10% and earnings per share have grown 11.90%.

The stock has risen 4% over the last 12 months and is currently trading with a price-earnings ratio of 15.74. The share price has been as high as $896.03 and as low as $590.76 in the last 52 weeks. As of Monday, it was 8.16% below its 52-week high and 39.29% above its 52-week low.

The company's largest guru shareholder is Tweedy Browne (Trades, Portfolio) with 0.71% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.4% and Lee Ainslie (Trades, Portfolio) with 0.19%.

JB Hunt Transport Services Inc. (JBHT)

The company has a five-star business predictability rank and, according to the DCF calculator, a 35% margin of safety at $97.48 per share.

The supplier of surface transportation and delivery services has a market cap of $10.64 billion. Over the last five years, its revenue has grown 8.30% and its earnings per share have grown 16.50%.

The stock has fallen 19% over the last 12 months and is currently trading with a price-earnings ratio of 13.73 and a price-book ratio of 5.12. The share price has been as high as $131.74 and as low as $88.38 in the last 52 weeks. As of Monday, it was 26.01% below its 52-week high and 10.30% above its 52-week low.

With 0.29% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.13% and Chuck Royce (Trades, Portfolio) with 0.01%.

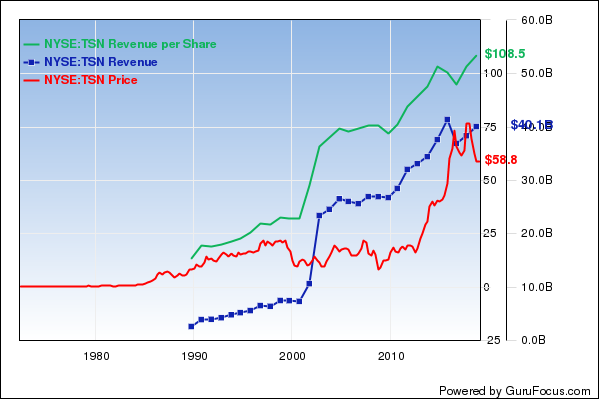

Tyson Foods Inc. (TSN)

The company has a three-star business predictability rank and, according to the DCF calculator, a 34% margin of safety at $57.83 per share.

The company, which packages value-added beef, chicken, pork and related allied products, has a $21.14 billion market cap. Over the last five years, its revenue has grown 2% and its earnings per share have grown 28.80%.

The stock has fallen 28% over the last 12 months; it is currently trading with a price-earnings ratio of 7.06 and a price-book ratio of 1.65. The share price has been as high as $81.51 and as low as $49.77 in the last 52 weeks. It is currently 29.05% below its 52-week high and 16.19% above its 52-week low.

With 0.35% of outstanding shares, Steven Cohen (Trades, Portfolio) is the company's largest guru shareholder, followed by Barrow, Hanley, Mewhinney & Strauss with 0.31%, Richard Snow (Trades, Portfolio) with 0.29% and PRIMECAP Management (Trades, Portfolio) with 0.16%.

ASE Technology Holding Co. Ltd. (ASX)

The company has a 3.5-star business predictability rank and, according to the DCF calculator, a 32% margin of safety at $3.66 per share.

The provider of semiconductor packaging and testing services has a $7.81 billion market cap. Over the last five years, its revenue has grown 6.10% and its earnings per share have risen 7.10%.

The stock has fallen 30% over the last 12 months; it is currently trading with a price-earnings ratio of 9.57. The share price has been as high as $8 and as low as $3.46 in the last 52 weeks. It is currently 8% below its 52-week high and 8.34% above its 52-week low.

The company's largest guru shareholder is Ken Fisher (Trades, Portfolio) with 1.89% of outstanding shares, followed by Simons' firm with 0.02%.

Leggett & Platt Inc. (LEG)

The company has a four-star business predictability rank and, according to the DCF calculator, a 30% margin of safety at $38.34 per share.

The company, which operates in the Global Home Furnishings and Fixtures industry, has a market cap of $5 billion. Over the last five years, its revenue has grown 2.30% and its earnings per share have increased 12.60%.

The stock has fallen 21% over the last 12 months; it is currently trading with a price-earnings ratio of 17.92 and a price-book ratio of 4.29. The price has been as high as $49.22 and as low as $33.48 in the last 52 weeks. It is currently 22.10% below its 52-week high and 14.52% above its 52-week low.

With 0.43% of outstanding shares, Pioneer Investments is the company's largest guru shareholder, followed by Royce with 0.07%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Bargain Stocks With Positive Earnings Growth Estimates

6 Poorly Performing Gurus' Stocks

Largest Insider Trades of the Week

This article first appeared on GuruFocus.