6 Stocks With High Business Predictability Ratings

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, the following companies have high business predictability ratings and a wide margin of safety.

IPG Photonics Corp. (IPGP)

The company has a five out of five-star business predictability rank and, according to the discounted cash flow calculator, a 31% margin of safety at $137 per share.

The manufacture of fiber lasers has a market cap of $7.31 billion. Over the last five years, its revenue has grown 17.60% and earnings per share have grown 17.80%.

The stock has fallen 42% over the last 12 months and is currently trading with a price-earnings ratio of 19.73. The share price has been as high as $261.77 and as low as $104.64 in the last 52 weeks. As of Monday, it was 47.69% below its 52-week high and 30.86% above its 52-week low.

The company's largest guru shareholder is Chuck Royce (Trades, Portfolio) with 0.44% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.25% and Ken Fisher (Trades, Portfolio) with 0.24%.

BJ's Restaurants Inc. (BJRI)

The company has a five-star business predictability rank and, according to the DCF calculator, a 31% margin of safety at $50 per share.

The company which owns and operates restaurants, has a market cap of $ 1.06 billion. Over the last five years, its revenue has grown 14.4 0% and its earnings per share have grown 2 0 . 8%.

The stock has tumbled 35% over the last 12 months and is currently trading with a price-earnings ratio of 16.75 and a price-book ratio of 3.35. The share price has been as high as $76.50 and as low as $35.51 in the last 52 weeks. As of Monday, it was 34.98% below its 52-week high and 40.07% above its 52-week low.

With 1.81% of outstanding shares, Ron Baron (Trades, Portfolio) is the company's largest guru shareholder, followed by the Simons' firm with 0.14%, Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.49% and Paul Tudor Jones (Trades, Portfolio) with 0.02%.

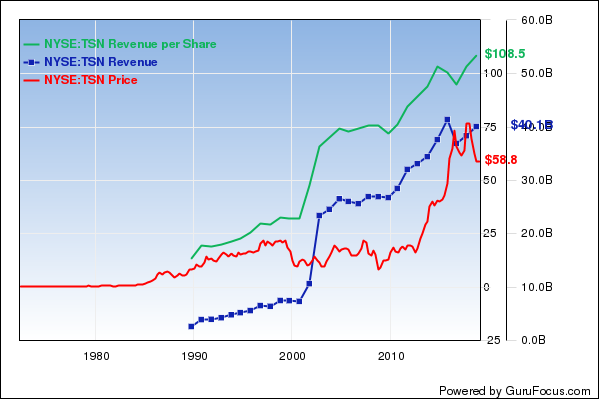

Tyson Foods Inc. (TSN)

The company has a 3-star business predictability rank and, according to the DCF calculator, a 26% margin of safety at $61.92 per share.

The company which processes and distributes value-added beef and related allied products, has a $22.64 billion market cap. Over the last five years, its revenue has grown 2.0% and its earnings per share have grown 28.80%.

The stock has fallen 15% over the last 12 months; it is currently trading with a price-earnings ratio of 7.56 and a price-book ratio of 1.77. The share price has been as high as $77.62 and as low as $49.77 in the last 52 weeks. It is currently 20.23% below its 52-week high and 24.41% above its 52-week low.

With 1.19% of outstanding shares, T Rowe Price Equity Income Fund (Trades, Portfolio) is the company's largest guru shareholder, followed by Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.35%, Barrow, Hanley, Mewhinney & Strauss with 0.31% and Richard Snow (Trades, Portfolio) with 0.29%.

Cheesecake Factory Inc. (CAKE)

The company has a 4.5-star business predictability rank and, according to the DCF calculator, a 27% margin of safety at $44.97 per share.

The company, which operates casual dining restaurants, has a $2.06 billion market cap. Over the last five years, its revenue has grown 8.20% and its earnings per share have risen 12.40%.

The stock price was stable over the last 12 months; it is currently trading with a price-earnings ratio of 15. The share price has been as high as $60.19 and as low as $41.63 in the last 52 weeks. It is currently 25.29% below its 52-week high and 8.02% above its 52-week low.

The company's largest guru shareholder is Snow with 2.42% of outstanding shares, followed by Baron with 1.76%, Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 1.27% and Lee Ainslie (Trades, Portfolio)'s Maverick Capital Ltd., with 0.49%.

PVH Corp. (PVH)

The company has a three-star business predictability rank and, according to the DCF calculator, a 27% margin of safety at $108.76 per share.

The apparel company has a market cap of $8.24 billion. Over the last five years, its revenue has grown 4.90% and its earnings per share have increased 15.70%.

The stock has fallen 26% over the last 12 months; it is currently trading with a price-earnings ratio of 12.15 and a price-book ratio of 1.47. The price has been as high as $169.22 and as low as $86.46 in the last 52 weeks. It is currently 35.73% below its 52-week high and 25.79% above its 52-week low.

With 1.0% of outstanding shares, Cohen's firm is the company's largest guru shareholder, followed by Louis Moore Bacon (Trades, Portfolio) with 0.65%, Leon Cooperman (Trades, Portfolio)'s Omega Advisors with 0.34% and the Ainslie's firm with 0.28%.

Maximus Inc. (MMS)

The company has a three-star business predictability rank and, according to the DCF calculator, a 26% margin of safety at $70.16 per share.

The business process services provider, has a $4.5 billion market cap. Over the last five years, its revenue has grown 14.1% and its earnings per share have risen 14.80%.

The stock price was stable over the last 12 months; it is currently trading with a price-earnings ratio of 20.94. The share price has been as high as $72.45 and as low as $60 in the last 52 weeks. It is currently 3.16% below its 52-week high and 16.93% above its 52-week low.

The company's largest guru shareholder is Baron with 3.79% of outstanding shares, followed by the Simons' firm with 0.63% and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.08%.

Disclosure: I do not own any stocks mentioned.

This article first appeared on GuruFocus.