6 Tech Stocks Trading With Low Price-Sales Ratios

According to the GuruFocus All-In-One Screener, a Premium feature, the following companies were trading with low price-sales ratios as of April 14.

EPlus

Shares of ePlus Inc. (NASDAQ:PLUS) were trading around $62.36 each with a price-sales ratio of 0.55 and a price-earnings ratio of 11.81.

The holding company, which provides information technology solutions, has an $844.7 million market cap. The stock has risen at an annualized rate of 22.41% over the past decade.

The discounted cash flow calculator gives the company a fair value of $59.60, suggesting it is undervalued with a 58% margin of safety, while the Peter Lynch fair value is $79.35.

The company's largest guru shareholder are Hotchkis & Wiley and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.16% of outstanding shares.

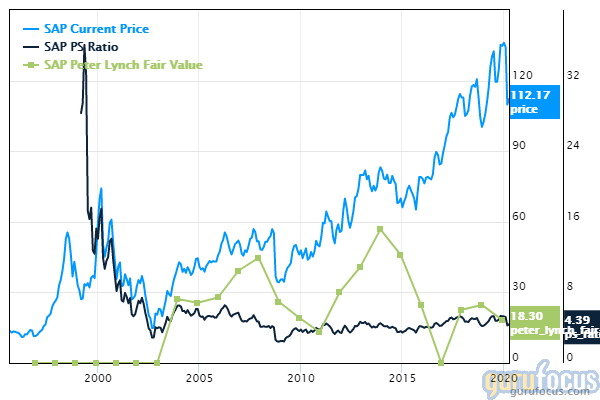

SAP

As of Tuesday, SAP SE (NYSE:SAP) was trading around $120.52 per share with a price-sales ratio of 4.73 and a price-earnings ratio of 39.13.

The developer of software for business enterprises has a market cap of $143 billion. The stock has risen at an annualized rate of 10.59% over the past 10 years.

The DCF calculator gives the stock a fair value of $37.44, suggesting it is overpriced by 221%. The Peter Lynch earnings line gives the stock a fair price of $46.5.

With 0.64% of outstanding shares, Ken Fisher (Trades, Portfolio) is the company's largest guru shareholder, followed by Paul Singer (Trades, Portfolio)'s Elliott Management with 0.06% and Sarah Ketterer (Trades, Portfolio) with 0.02%.

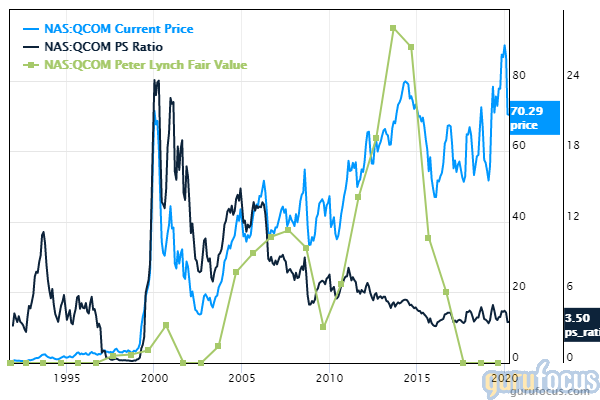

Qualcomm

Qualcomm Inc. (NASDAQ:QCOM) was trading around $73.25 on Tuesday with a price-sales ratio of 3.54 and a price-earnings ratio of 20.42.

The wireless technology giant has a market cap of $83 billion. The stock has risen at an annualized rate of 7.7% over the past decade.

The DCF calculator gives the company a fair value of $37.67, suggesting it is undervalued with a 93% margin of safety. The Peter Lynch earnings line gives the stock a fair price of $53.

With 2.07% of outstanding shares, PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder, followed by Barrow, Hanley, Mewhinney & Strauss with 0.53% and the T Rowe Price Equity Income fund with 0.53%.

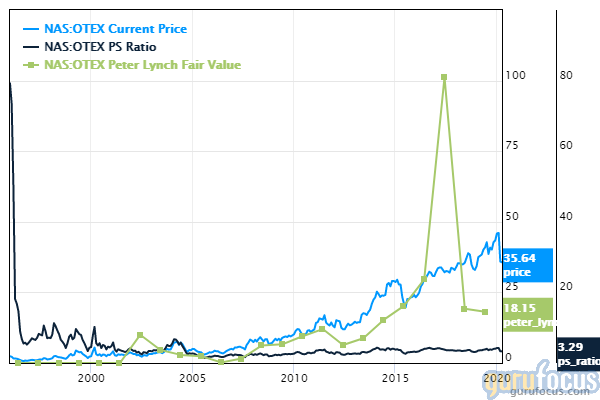

Open Text

Open Text Corp. (NASDAQ:OTEX) was trading around $35.8 with a price-sales ratio of 3.5 and a price-earnings ratio of 31.52.

The software developer has a market cap of $9.69 billion. The stock has climbed at an annualized rate of 12.93% over the past 10 years.

The DCF calculator gives the company a fair value of $34.45, suggesting the stock is overpriced by 3%. The Peter Lynch earnings line gives the stock a fair price of $18.

Some notable guru shareholders are Simons' firm with 0.54% of outstanding shares, Richard Snow (Trades, Portfolio) with 0.12% and Pioneer Investments (Trades, Portfolio) with 0.09%.

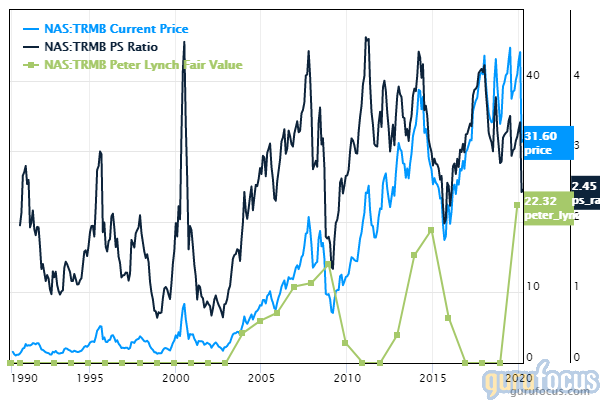

Trimble

Trimble Inc. (NASDAQ:TRMB) was trading around $32.44 with a price-sales ratio of 2.52 and a price-earnings ratio of 15.96.

The provider of location solutions and other inertial technologies has a market cap of $8.15 billion. The stock has risen at an annualized rate of 9.05% over the past decade.

The DCF calculator gives the company a fair value of $33.4, suggesting it is undervalued with a 3% margin of safety. The Peter Lynch earnings line gives the stock a fair price of $30.6.

The company's largest guru shareholder is PRIMECAP Management with 3.36% of outstanding shares, followed by Jerome Dodson (Trades, Portfolio) with 0.29%.

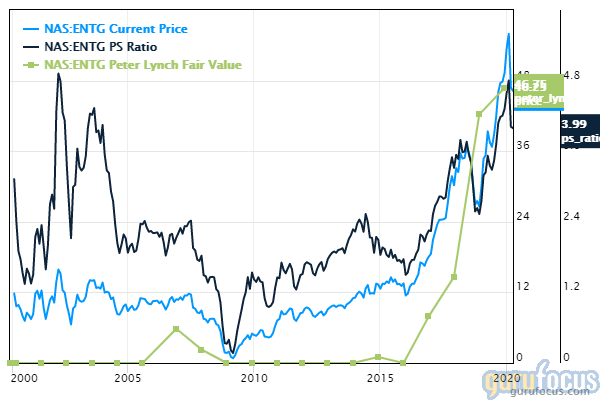

Entegris

Entegris Inc. (NASDAQ:ENTG) was trading around $48.8 with a price-sales ratio of 4.18 and a price-earnings ratio of 26.01.

The provider of specialty electronic materials has a market cap of $6.57 billion. The stock has risen at an annualized rate of 26.01% over the past decade.

The DCF calculator gives the company a fair value of $20, suggesting it is overpriced by 144%. The Peter Lynch earnings line gives the stock a fair price of $28.

The company's largest guru shareholder is PRIMECAP Management with 3.43% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.28% and First Eagle Investment (Trades, Portfolio) with 0.25%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Utilities Trading With Low Price-Sales Ratios

6 Financial Companies Boosting Book Value

Insiders Roundup: Carnival, Bank of New York Mellon

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.