6 Underperforming Stocks in Gurus' Portfolios

Although gurus hold positions in the following companies, their share prices and returns have suffered declines recently. These are the worst-performing stocks over the past six months that have a long-term presence in more than five gurus' portfolios.

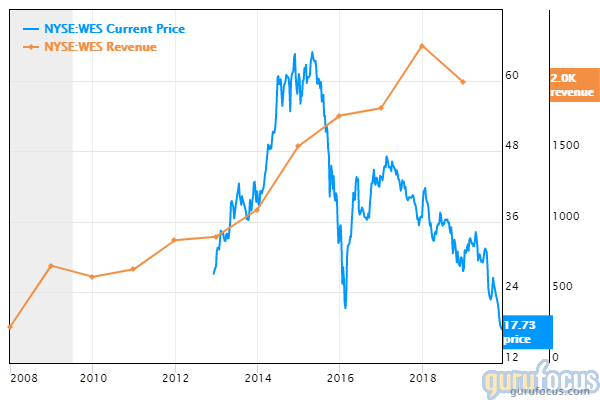

Western Midstream Partners

Shares of Western Midstream Partners LP (NYSE:WES) have declined 35.12% over the past six months. The stock is held by three gurus.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.06% of outstanding shares, followed by George Soros (Trades, Portfolio) with 0.02% and T Boone Pickens (Trades, Portfolio)' BP Capital with 0.01%.

The company, which operates midstream energy assets, has an $8.15 billion market cap and was trading with a price-earnings ratio of 13.15. As of Thursday, the share price of $18 was 49.65% below the 52-week high and 3.09% above the 52-week low.

Over the past 10 years, the stock has tumbled 35.71%. The return on equity of 19.91% and return on assets of 3.65% are outperforming 70% of companies in the oil and gas industry.

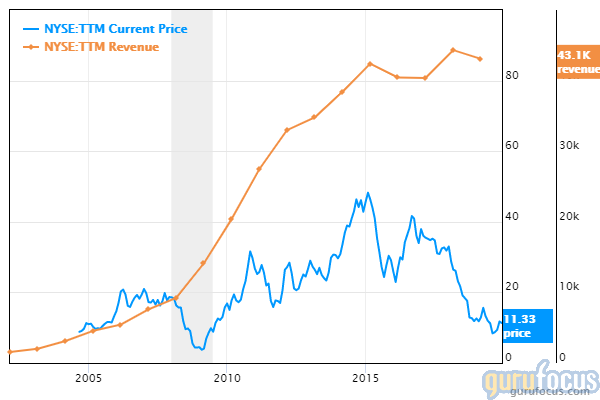

Tata Motors

Tata Motors Ltd. (NYSE:TTM) is held by two gurus. The stock tumbled 6.55% over the past six months.

With 0.92% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder, followed by Sarah Ketterer (Trades, Portfolio) with 0.01%.

The automaker has a market cap of $8.05 billion. The stock was trading with a forward price-earnings ratio of 13.85. As of Thursday, the share price of $11.85 was 31.78% below the 52-week high and 58.40% above the 52-week low.

Over the past decade, the stock has fallen 22.28%. The return on equity of -40.13% and return on assets of -9.42% are underperforming 92% of companies in the vehicles and parts industry.

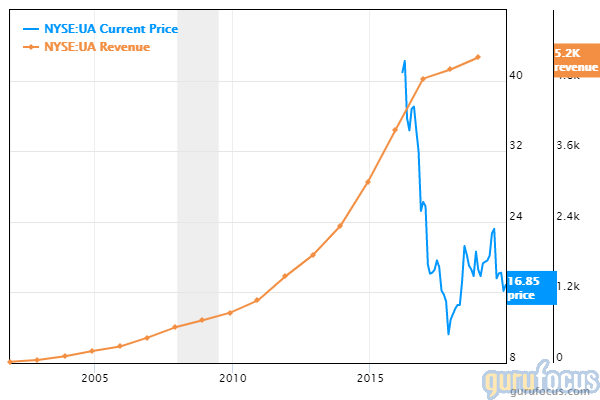

Under Armour

Shares of Under Armour Inc. (NYSE:UA) declined 21.61% over the past six months. The stock is held by four gurus.

The company's largest guru shareholder is Pioneer Investments with 0.02% of outstanding shares, followed by Joel Greenblatt (Trades, Portfolio) with 0.01% and John Hussman (Trades, Portfolio) with 0.01%.

The company, which manufactures athletic apparel, footwear and gear, has a market cap of $8.04 billion. The stock was trading with a price-earnings ratio of 74.10. As of Thursday, the share price of $17.01 was 30.71% below the 52-week high and 13.02% above the 52-week low. Over the past decade, it has lost 58.72%.

The return on equity of 5.43% and return on assets of 2.51% are outperforming 51% of companies in the manufacturing - apparel and accessories industry.

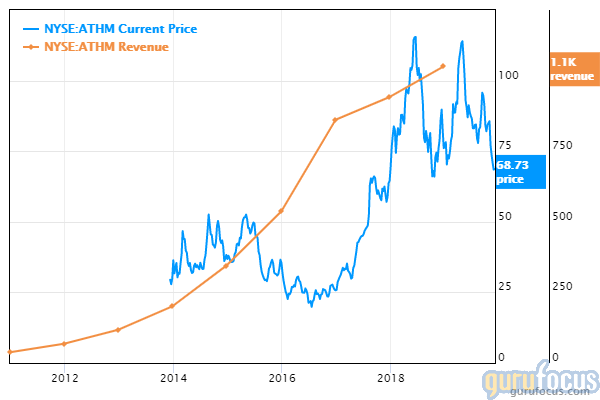

Autohome

Shares of Autohome Inc. (NYSE:ATHM) declined 24.40% over the past six months. Three gurus hold the stock.

With 0.27% of outstanding shares, Pioneer Investments is the largest guru shareholder of the company, followed by Ray Dalio (Trades, Portfolio) with 0.04% and Simons' firm with 0.01%.

The interactive media company, which focuses on automobiles, has a market cap of $8.28 billion. The stock was trading with a price-earnings ratio of 18.6. As of Thursday, the share price of $65.83 was 44.21% below the 52-week high and 0.57% above the 52-week low.

The return on equity of 26.22% and return on assets of 19.3% are outperforming 86% of companies in the interactive media industry. Over the past decade, it has gained 118%.

Erie Indemnity

Erie Indemnity Co. (ERIE) declined 22.52% over the past six months. The stock is held by five gurus.

The company's largest guru shareholder is Chuck Royce (Trades, Portfolio) with 0.35% of outstanding shares, followed by Dalio with 0.07% and Pioneer Investments with 0.02%.

The insurance company has a market cap of $7.77 billion. The stock was trading with a price-earnings ratio of 27.53.

The return on equity of 31.38% and return on assets of 17.36% are outperforming 95% of companies in the insurance industry.

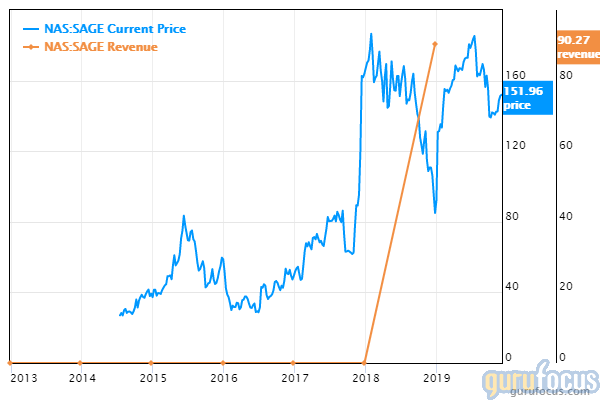

Sage Therapeutics

Shares of Sage Therapeutics Inc. (NASDAQ:SAGE) declined 14.86% over the past six months. Four gurus hold the stock.

With 1.69% of outstanding shares, Spiros Segalas (Trades, Portfolio) is the largest guru shareholder of the company, followed by Ron Baron (Trades, Portfolio) with 0.82% and Andreas Halvorsen (Trades, Portfolio) with 0.51%.

The clinical-stage biopharmaceutical company has a $3.22 billion market cap. The stock was trading with a price-book ratio of 2.89. As of Thursday, the share price of $61 was 90% below the 52-week high.

The return on equity of -61.41% and return on assets of -56.38% are outperforming 65% of companies in the biotechnology industry.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Bargain Stocks Growing Earnings

5 Low Price-Sales Stocks

David Tepper Trims UnitedHealth, Exits Intelsat

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.