6 Bargain Stocks Growing Earnings

Companies that are growing their earnings are often good investments because they can return a solid profit to investors. According to the discounted cash flow calculator as of Thursday, the following undervalued companies have grown their earnings per share over a five-year period.

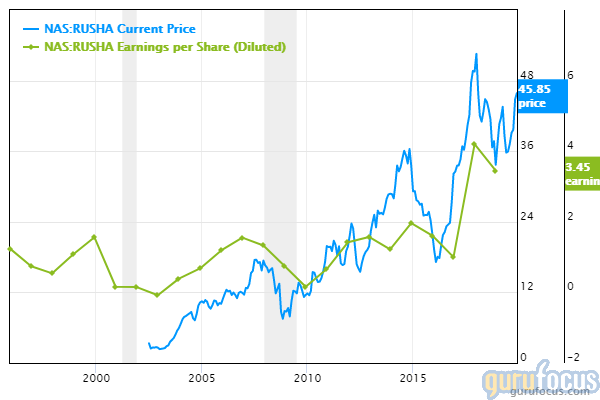

Rush Enterprises Inc.'s (NASDAQ:RUSHA) earnings per share have grown 22.20% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 61.21% margin of safety at $47.30 per share. The price-earnings ratio is 10.89. The share price has been as high as $48.42 and as low as $51.67 in the last 52 weeks; it is currently 1.24% below its 52-week high and 51.67% above its 52-week low.

The commercial vehicle retailer has a market cap of $1.72 billion and an enterprise value of $3.44 billion.

With 2.48% of outstanding shares, Hotchkis & Wiley is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.90% and Ronald Muhlenkamp (Trades, Portfolio) with 0.69%.

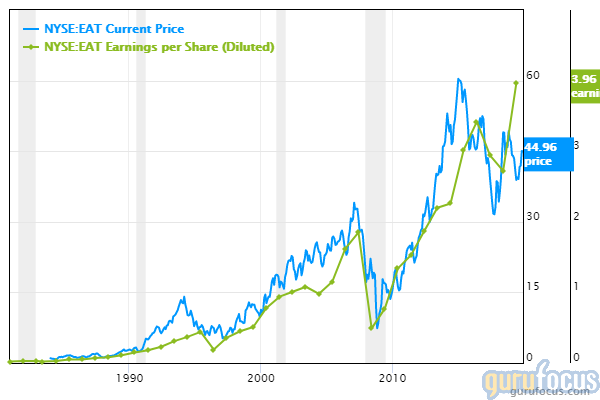

The earnings per share of Brinker International Inc. (NYSE:EAT) have grown 6.90% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 45.61% margin of safety at $42.86 per share. The price-earnings ratio is 11.73. The share price has been as high as $51.72 and as low as $36.44 in the last 52 weeks; it is currently 14.94% below its 52-week high and 20.72% above its 52-week low.

The restaurant operator has a market cap of $1.64 billion and an enterprise value of $4.25 billion.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 1.64% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 1.57% and Lee Ainslie (Trades, Portfolio) with 0.59%.

Usana Health Sciences Inc.'s (NYSE:USNA) earnings per share have grown 8.50% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 23.99% margin of safety at $74.35 per share. The price-earnings ratio is 17. The share price has been as high as $125.61 and as low as $58.30 in the last 52 weeks; it is currently 40.81% below its 52-week high and 27.53% above its 52-week low.

The company, which provides science-based nutritional and personal-care products, has a market cap of $1.61 billion and an enterprise value of $1.45 billion.

With 7.67% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Hotchkis & Wiley with 0.40% and Cohen with 0.06%.

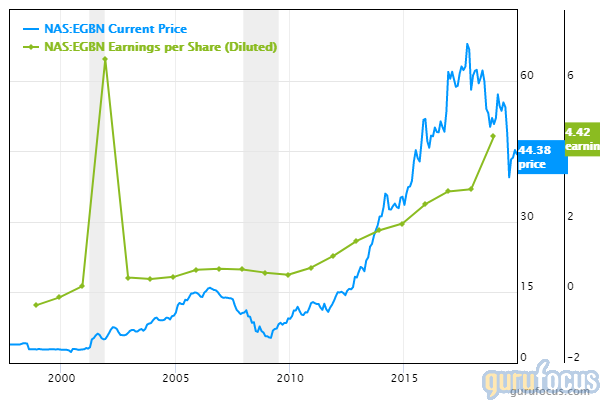

The earnings per share of Eagle Bancorp Inc. (NASDAQ:EGBN) have grown 18.50% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 63.25% margin of safety at $45 per share. The price-earnings ratio is 10.48. The share price has been as high as $60.77 and as low as $37.08 in the last 52 weeks; it is currently 25.97% below its 52-week high and 21.35% above its 52-week low.

The bank has a market cap of $1.51 billion and an enterprise value of $753.03 million.

The company's largest guru shareholder is Mario Gabelli (Trades, Portfolio) with 0.31% of outstanding shares, followed by Hotchkis & Wiley with 0.21% and Ken Fisher (Trades, Portfolio) with 0.18%.

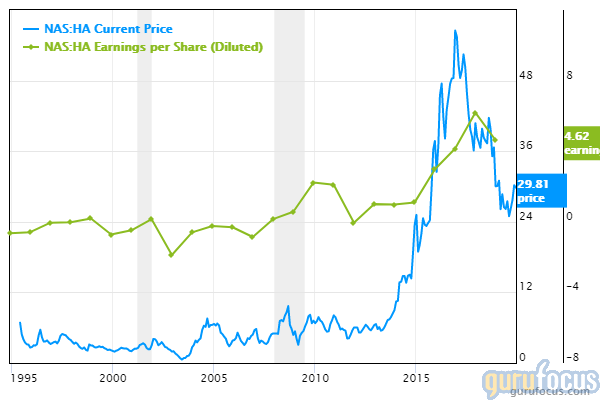

Hawaiian Holdings Inc.'s (NASDAQ:HA) earnings per share have grown 46.10% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 36.42% margin of safety at $29.26 per share. The price-earnings ratio is 6.81. The share price has been as high as $36.87 and as low as $28.11 in the last 52 weeks; it is currently 20.64% below its 52-week high and 28.11% above its 52-week low.

The provider of air transportation for passengers and cargo has a market cap of $1.36 billion and an enterprise value of $1.94 billion.

With 3.04% of outstanding shares, Third Avenue Management (Trades, Portfolio) is the company's largest guru shareholder, followed by the Third Avenue Value Fund (Trades, Portfolio) with 2.36% and Chuck Royce (Trades, Portfolio) with 2.29%.

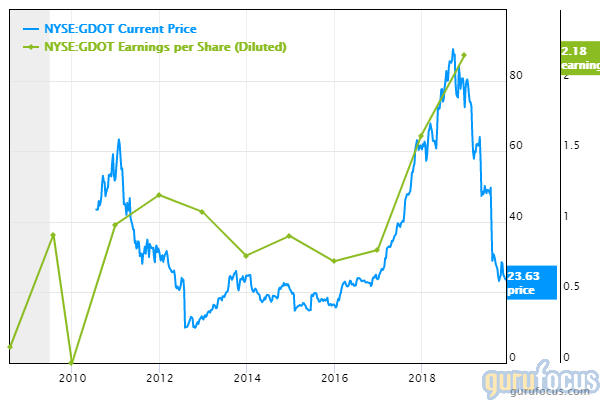

The earnings per share of Green Dot Corp. (NYSE:GDOT) have grown 22.60% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 41.18% margin of safety at $24.63 per share. The price-earnings ratio is 11.95. The share price has been as high as $84 and as low as $22.45 in the last 52 weeks; it is currently 70.68% below its 52-week high and 9.71% above its 52-week low.

The financial technology company has a market cap of $1.27 billion and an enterprise value of $427.06 million.

The company's largest guru shareholder is Philippe Laffont (Trades, Portfolio) with 2.43% of outstanding shares, followed by Cohen with 0.92%, Simons' firm with 10.39%, Richard Snow (Trades, Portfolio) with 0.16% and Joel Greenblatt (Trades, Portfolio) with 0.03%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Low Price-Sales Stocks

David Tepper Trims UnitedHealth, Exits Intelsat

Private Capital Exits Allergan, Universal Health Services

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.