7 High-Yield Stocks With Falling Prices

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener , the following stocks have high dividend yields but performed poorly over the past 12 months.

Warning! GuruFocus has detected 2 Warning Sign with NYH. Click here to check it out.

The intrinsic value of NYH

Marine Petroleum Trust 's (MARPS) dividend yield is 6.19% with a payout ratio of 96%. Over the past 52 weeks, the price has declined 20%. The stock is now trading with a price-earnings (P/E) ratio of 12.8 and a price-sales (P/S) ratio of 10.

The company has a market cap of $9.2 million. It operates as a royalty trust engaged in the administration and liquidation of rights to payments from certain oil and natural gas leases in the Gulf of Mexico.

The profitability rating is 3 of 10. The return on equity (ROE) of 73.79% and return on assets (ROA) of 73.79% are outperforming the industry and are ranked higher than 99% of competitors. Financial strength has a rating of 8 of 10 with no debt. The equity-asset ratio of 1 is above the industry median of 0.49.

Highway Holdings Ltd. 's (HIHO) dividend yield is 9.49% with a payout ratio of 214%. Over the past 52 weeks, the price has declined 8.2%. The stock is now trading with a P/E ratio of 20.5 and a P/S ratio of 1.0.

The company has a market cap of $14.83 million. It is a fully integrated manufacturer of high-quality metal, plastic, electric and electronic components, subassemblies and finished products for Japanese, German and United States OEMs and contract manufacturers.

The profitability rating is 4 of 10. While the ROE of 5.99% is underperforming the sector, the ROA of 4.14% is ranked higher than 56% of competitors. Financial strength has a rating of 9 of 10 with no debt. The equity-asset ratio of 0.69 is above the industry median of 0.54.

The company's largest shareholder among the gurus is Jim Simons (Trades, Portfolio) with 3.7% of outstanding shares.

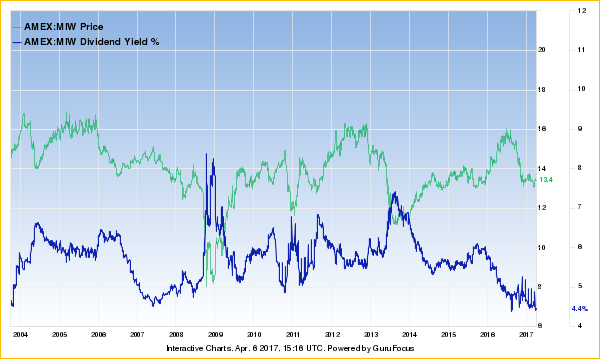

Eaton Vance Michigan Municipal Bond Fund 's (MIW) dividend yield is 4.44% with a payout ratio of 39%. Over the past 52 weeks, the price has fallen 7.7%. The stock is now trading with a P/E ratio of 8.1 and a P/S ratio of 14.2.

It has a market cap of $20.06 million. Eaton Vance Michigan is a closed-end investment company with the objective of providing current income exempt from regular federal income tax, including alternative minimum tax, and, in state-specific funds, tax in its specified state.

The profitability rating is 6 of 10. The ROE of 10.69% and ROA of 5.54% are outperforming the industry and are ranked higher than 62% of competitors. Financial strength has a rating of 7 of 10 with no debt. The equity-asset ratio of 0.64 is above the industry median of 0.84.

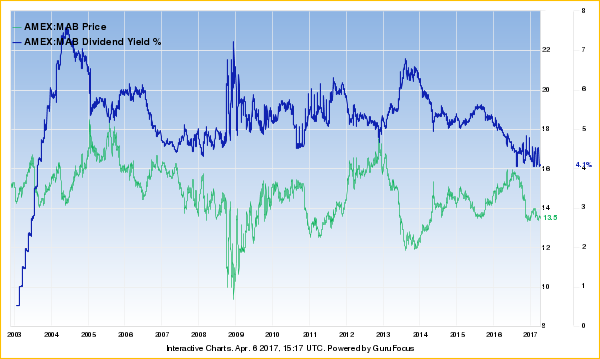

Eaton Vance Massachusetts Municipal Bond Fund 's (MAB) dividend yield is 4.09% with a payout ratio of 37%. Over the past 52 weeks, the price has declined 6.7%. The stock is now trading with a P/E ratio of 8.2 and a P/S ratio of 15.7.

It has a market cap of $23.96 million. Like Eaton Vance Michigan, it is a closed-end investment company that provides current income exempt from regular federal income tax.

The profitability rating is 6 of 10. The ROE of 10.52% and ROA of 5.40% are outperforming the industry and are ranked higher than 67% of competitors. Financial strength has a rating of 5 of 10. The cash-debt ratio of 0.62 is underperforming 78% of competitors, and the equity-asset ratio of 0.65 is below the industry median of 0.84.

Blackrock Virginia Municipal Bond Trust 's (BHV) dividend yield is 4.87% with a payout ratio of 55%. Over the past 52 weeks, the price has dropped by 9.9%. The stock is now trading with a P/E ratio of 10.8 and a P/S ratio of 14.7.

The company has a market cap of $25.42 million. It is a perpetual closed-end municipal bond fund with the objective of providing current income exempt from regular federal income taxes and Maryland personal income taxes.

The profitability rating is 6 of 10. The ROE of 9.12% and ROA of 5.67% are outperforming the industry and are ranked higher than 67% of competitors. Financial strength has a rating of 7 of 10 with no debt. Its equity-asset ratio of 0.63 is below the industry median of 0.84.

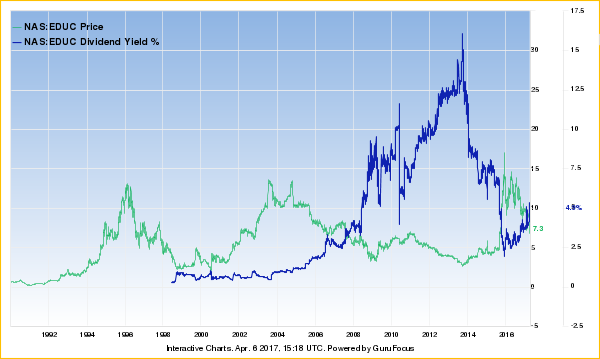

Educational Development Corp. 's (EDUC) dividend yield is 1.69% with a payout ratio of 0.28%. Over the past 52 weeks, the price has declined 45.2%. The stock is now trading with a P/E ratio of 14.3 and a P/S ratio of 0.3.

The company has a market cap of $29.8 billion. Educational Development is the U.S. trade publisher of educational children's books produced by Usborne Publishing Ltd. in the U.K.

The profitability rating is 6 of 10. The ROE of 15.37% and ROA of 3.91% are outperforming the industry and are ranked higher than 61% of competitors. Financial strength has a rating of 4 of 10 with no debt. The equity-asset ratio of 0.21 is below the industry median of 0.56.

The company's largest shareholder among the gurus is Simons with 0.48% of outstanding shares.

Eaton Vance New York Municipal Bond 's (NYH) dividend yield is 4.85 % with a payout ratio of 58 %. Over the past 52 weeks, the price has fallen 6.4 %. The stock is now trading with a P/E ratio of 1 1.2 and a P/S ratio of 14.4 .

The company has a market cap of $ 30.12 million. It is a closed-end investment company whose objective is to provide current income exempt from regular federal income tax, including alternative minimum tax, and, in state-specific funds, tax in its specified state

The profitability rating is 5 of 10. The ROE of 7.71% and ROA of 3.76% are outperforming 53% of competitors. Financial strength has a rating of 5 of 10. The cash-debt ratio of 0.04 is underperforming 97% of competitors, and the equity-asset ratio of 0.59 is below the industry median of 0.84.

Disclosure: I do not own any shares of any stocks mentione d in this article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with NYH. Click here to check it out.

The intrinsic value of NYH