7 Internet Stocks to Buy on a 2018 Pullback

Will we get a summer pullback? Will it come in the fall? Possibly the fourth quarter? The bottom line is simple: We have no idea when a pullback will materialize. But we do know one thing. When it comes, we should have a list of internet stocks ready to buy.

Why internet?

Simply put, many of these names have been the best performers in the market. While that’s true for 2018, it’s not just this year or the last few years, but since the Great Recession.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

So whether it’s a summer swoon on low volume this month or in September, or a heavy spill next quarter, investors would be smart to keep some powder dry. Assuming we get some form of a correction — be it a 5% drop or a correction of 10% or more — it’ll be a solid opportunity to get long.

So with that said, what internet stock should you buy? Here are seven to consider.

Internet Stocks to Buy: Amazon (AMZN)

It’s pretty hard to start a list of internet stocks to buy on a pullback without naming Amazon (NASDAQ:AMZN).

This thing is an absolute juggernaut. There are not many companies out there growing revenue by a whopping 40% — like Amazon did last quarter — while sporting a market cap of more than $900 billion. I mean seriously, what a machine. Although revenue results slightly missed expectations, earnings of $5.07-per-share were roughly double the $2.53 analysts had expected.

Amazon Web Services — aka the cloud — has been driving a big boost to both earnings and revenue. In fact, Amazon is a leader in the cloud business, edging out Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) in market share. There’s a reason some people like this name for the next decade, despite its huge size.

Further, take the name out of the picture and just look at the charts. We can see how great of a buy-the-dip stock Amazon has been. Uptrend support should come into play between $1,800 and $1,825. Further the $1,750 level should also act as support, near where the 50-day moving average should come into play.

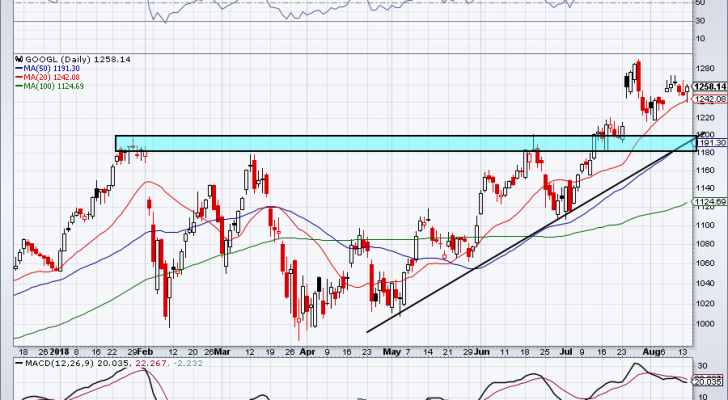

Internet Stocks to Buy: Alphabet (GOOG)

Like Amazon, it’s hard to talk about internet stocks to buy without mentioning Alphabet. That’s especially true following the company’s most recent earnings report.

The quarter was very strong, were revenue surged more than 25% year-over-year. Earnings of $11.75-per-share came in more than $2-per-share ahead of estimates.

Growth remains impressive, with analysts expecting full-year 2018 sales growth of 24% and 2019 growth of 19.4%. On the earnings front, analysts expect earnings to grow 23% this year and 21% next year.

Not too shabby for an $865 billion market cap company, huh?

But there are plenty of opportunities beyond search, mobile, advertising and the cloud. While not in its internet-based wheelhouse, Google’s autonomous driving efforts with Waymo are starting to payoff.

It’s giving 400 rides a day in Phoenix as Waymo works on expansion plans. Morgan Stanley analysts recently estimated the unit to be worth $175 billion. That follows RBC analysts’ estimates, who assigned a long-term enterprise value up to $183 billion for Waymo.

On the chart, a pullback into the $1,180 to $1,220 range is worth checking out.

Internet Stocks to Buy: Yelp (YELP)

Yelp (NASDAQ:YELP) isn’t the most popular name on the block … until recently. After reporting earnings, shares have been surging. The stock jumped almost 30% in the first trading day after the report.

Yelp beat on earnings and revenue expectations. While overall sales grew 12.5% YoY, its largest segment (advertising) grew at more than 20%. Management gave a full-year bump to its guidance, while Yelp saw excellent traction in some of its newer growth segments like reservations and food orders.

Within two days of its earnings report, Yelp stock found itself above a key resistance level. With that in mind, aggressive bulls may consider buying on a pullback to $48. On a deeper correction, conservative bulls may consider buying near $44.

Internet Stocks to Buy: Salesforce (CRM)

Salesforce (NASDAQ:CRM) has been on fire this year, rallying 42% in 2018 and 65% over the past 12 months.

CRM has a plan in place to continue growing revenue at more than 20% annually for at least the next few years. Perhaps M&A will help fuel that goal later down the road, but the cloud still has plenty of legs left.

That’s part of what has driven shares of Salesforce higher, even though many will complain about the company’s earnings-based valuation.

So what should investors do? Those who don’t find CRM attractive can take a pass in favor of other companies. Those who want to take a stab though should look for a pullback.

Near the end of July, there was a pullback that just passed the 50-day moving average, something we have said in the past that should be bought. Conservative bulls can buy a partial position on a pullback to the 50-day and add on a further decline to the 100-day.

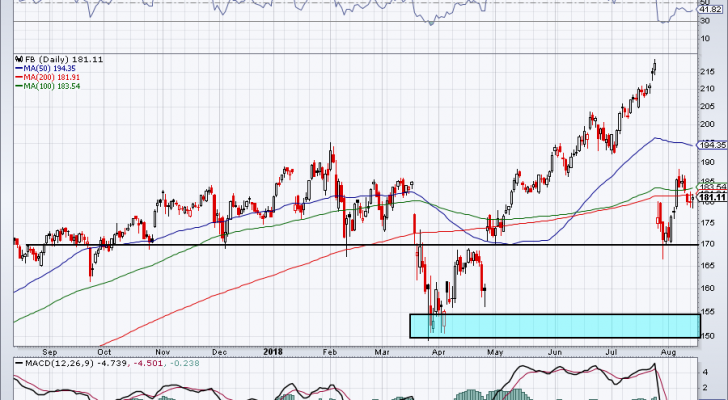

Internet Stocks to Buy: Facebook (FB)

Let’s get social for a minute, starting with Facebook (NASDAQ:FB). Shares crumbled earlier this year, falling from $185 to $150 in just a few days. Those that didn’t buy watched Facebook rally to more than $215 before reporting earnings.

Then management gave investors a very downbeat, depressing quarter in July. After again tumbling, one could make the case that Facebook is a buy right now. In fact, I’m not really disputing that.

However, given the negative outlook from management for the remainder of fiscal 2018, I’d be leery of FB stock. Particularly if and when we get a pullback in the broader market. Will that selling pressure take Facebook back down to the $150s?

It’s possible and if it does, we may want to think about buying again.

Internet Stocks to Buy: Twitter (TWTR)

Shares of Twitter (NYSE:TWTR) had been unstoppable in 2018, surging higher and higher. It seemed like a date with $50 was inevitable. Despite its lack of sales growth and inability to generate a profit a while back, I really liked Twitter because of its platform.

It’s different than Facebook, as it acts as a news distribution platform and a community for many professionals in different fields. Along with breaking and real-time news, Twitter also has an excellent opportunity with live video and instant commentary. For those reasons, I’ve always found it attractive.

Now though, the company is growing its user base (particularly daily active users), is profitable and is growing sales. That’s why shares went from $15 to $45 in seemingly no time flat.

But now what?

Twitter actually looks like it’s trying to carve out a base right now in the low-$30s. It’s still above the 200-day moving average and is finding support down near current levels. Admittedly, $30 looks like a stronger level, but this isn’t a bad start.

Twitter’s being unfairly punished — in my view — for cleaning up the toxic, bot accounts on its platform.

Internet Stocks to Buy: Adobe (ADBE)

Is it tempting to mull over Netflix (NASDAQ:NFLX) on a deeper decline? Or Baidu (NASDAQ:BIDU) and Alibaba (NASDAQ:BABA)? Of course it is. But Adobe (NASDAQ:ADBE) is no slouch either.

Like Salesforce, Alphabet and Amazon, this name continues to see excellent growth thanks to its cloud-based subscription products. As more people head online and e-commerce continues to gain momentum, Adobe is a natural winner.

Plus, it’s not held at the whim of trade war worries and should continue to benefit from a strong economy. Margins are bursting higher, cash flows are climbing and the balance sheet is clean.

Adobe stock has been in a solid uptrend and the 20-day moving average has kept a lid on the stock. Is it reasonable to worry about a top in Adobe? Well, it’s not unreasonable, but I’ve learned to bet with a stock that’s got the wind at its back until that wind changes. Until Adobe changes direction, I don’t want to give up on it.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, he was long CRM.

The post 7 Internet Stocks to Buy on a 2018 Pullback appeared first on InvestorPlace.