7 Must-Buy Stocks as U.S. Retail Sales Tick Up in September

While the word pandemic very well remains in headlines, a steadily improving health situation and resumption of business activities as well as active social lifestyle have instilled a sense of confidence among consumers. Markedly, Americans continued with their spending spree in September, shrugging-off concerns related to rising prices and supply chain disruptions. The unexpected increase in retail sales did surprise industry experts, who were anticipating a pullback in spending.

For now, Americans continue to fill their shopping carts. The Commerce Department stated that U.S. retail and food services sales in September rose 0.7% sequentially to $625.4 billion, following an upwardly revised reading of 0.9% in August. Demand for big-ticket items and goods was healthy, as consumer preference shifted away from services. Consumer spending activity, one of the pivotal factors driving the economy, was strong with sales rising across most of the categories during the month.

Buoyant Shoppers Lift U.S. Retail Sales

The Commerce Department’s report suggests that sales at furniture & home furnishing stores jumped 0.2%, while the same at building material & supplies dealers rose 0.1% on a sequential basis. Sales at miscellaneous store retailers and general merchandise stores grew 1.8% and 2%, respectively. Again, at sporting goods, hobby, book & music stores, the metric advanced 3.7%.

Sales at motor vehicle & parts dealers and clothing & clothing accessories outlets increased 0.5% and 1.1%, respectively. While sales at food & beverage stores climbed 0.7%, sales at food services & drinking places grew 0.3%. Meanwhile, receipts at gasoline stations were up 1.8%. Non-store retailers witnessed a rise of 0.6% in sales.

However, sales at health & personal care stores declined 1.4%, while the same at electronics & appliance stores fell 0.9%.

Will Momentum in Sales Continue in Holidays?

There is a lingering fear among the market pundits regarding whether the sales momentum witnessed in the last two months will continue in the holiday season. The industry is currently dealing with supply chain bottlenecks, rising freight charges and labor shortages. The spillover effect of the same will be quite visible during the festive season as well. Well, inability to meet the demand, failure to restock inventory at fair prices or delay in getting the products delivered to consumers’ doorsteps could compound retailers’ woes.

However, in spite of the persisting challenges, retailers are finding innovative ways to make the most of the season. To beat the COVID-19 blues, retailers are increasing product visibility on online platforms, enhancing customer engagement on social channels and making logistics improvements. Companies are deploying a reasonable number of seasonal associates to deal with curbside and in-store pickup of online purchases as well as doorstep delivery. Additionally, they are appointing more full-time and seasonal warehouse staff to ensure smooth supply of inventories to stores from distribution centers.

That said, we have highlighted seven stocks from the Retail - Wholesale sector that look well positioned based on their sound fundamentals and earnings growth prospects. These stocks have either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

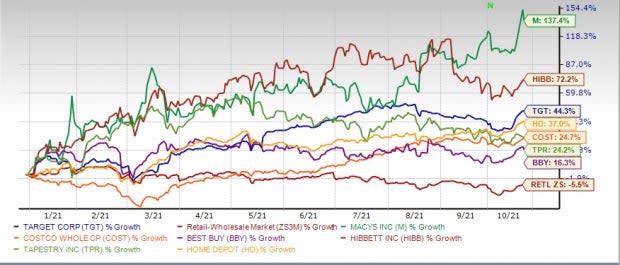

Price Performance Year-to-Date

Image Source: Zacks Investment Research

7 Prominent Picks

Macy's, Inc. M, one of the nation’s premier omni-channel retailers, is worth betting on. Despite a tough retail landscape, the company has managed to stay afloat, courtesy of its Polaris Strategy. The strategy includes rationalizing store base, revamping assortments and managing costs prudently. Markedly, customers have been responding well to the company’s expanded omni-channel offerings such as curbside, store pickup and same-day delivery. In this respect, its tie-up with DoorDash for expediting delivery service is encouraging. Macy's also collaborated with Sweden-based buy-now, pay-later group — Klarna — for offering online shoppers financial ease and payment flexibility. The company is constantly improving its mobile and website features to deliver enhanced shopping experience. This Zacks Rank #1 company has a trailing four-quarter earnings surprise of 269.8%, on average. The Zacks Consensus Estimate for its current financial year sales and earnings per share suggests growth of 37.3% and 269.7%, respectively, from the year-ago period.

You may invest in Hibbett, Inc. HIBB, an athletic-inspired fashion retailer. Management anticipates that pent-up demand and compelling merchandise coupled with superior customer service and a best-in-class omni-channel platform should continue to drive top and bottom-line performance. The company’s focus on both in-store and online experience, distribution capabilities and vendor relationships will help generate sustainable profitable growth. The company expects mid-teens growth in comparable sales for fiscal 2022. This Zacks Rank #1 company has a trailing four-quarter earnings surprise of 124.6%, on average. The Zacks Consensus Estimate for its current financial year sales and earnings per share indicates an improvement of 18.3% and 84.6%, respectively, from the year-ago period.

We suggest betting on Best Buy Co., Inc. BBY. This specialty retailer of consumer electronics and related services has been witnessing robust demand across channels. Continued growth in online revenues backed by robust omni-channel capabilities and customer-centric approach is a key upside. During second-quarter fiscal 2022, Best Buy witnessed robust sales across the Domestic and the International segments, owing to strong demand for technology products and services. It is on track with programs like Total Tech Support, which provides support for fixing computers, laptops, appliances, smart home devices and connected devices. Best Buy has expanded its In-Home Advisor program that includes advisors who guide customers to select the right technology solution. This Zacks Rank #1 company has a trailing four-quarter earnings surprise of 31.9%, on average. The Zacks Consensus Estimate for its current financial year sales and earnings per share suggests growth of 9.5% and 26.2%, respectively, from the year-ago period.

Tapestry, Inc. TPR is another great pick. The company has been benefiting from the successful execution of the Acceleration Program. The program is aimed at transforming the company into a leaner and more responsive organization. It intends to build significant data and analytics capabilities with focus on enhancing digital and omni-channel capabilities, and operating with a clearly defined path and strategy for each of its brands namely Coach, Kate Spade and Stuart Weitzman. This provider of luxury accessories and branded lifestyle products has a trailing four-quarter earnings surprise of 65.2%, on average. The Zacks Consensus Estimate for its current financial year sales and earnings per share indicates an improvement of 11.6% and 12.5%, respectively, from the year-ago period. The stock carries a Zacks Rank #2.

Investors can also count on The Home Depot, Inc. HD. Continued boom in renovations and construction activities bode well for the company. It has been gaining from strong growth in its Pro (professional) and DIY (Do-It-Yourself) customer categories, and continued digital momentum. Over the years, this home improvement retailer has created an efficient delivery network with options like buy online pickup in store with convenient pickup lockers, buy online deliver from store with express car and van delivery, and curbside pickup. Impressively, this Zacks Rank #2 company has a trailing four-quarter earnings surprise of 9.2%, on average. The Zacks Consensus Estimate for its current financial year sales and earnings per share suggests growth of 10.1% and 20.5%, respectively, from the year-ago period.

You may add Target Corporation TGT to your portfolio. The company has been making multiple changes to its business model to adapt and stay relevant in the ever-evolving retail landscape. To gain consumer’s wallet share, the company has been deploying resources to enhance omni-channel capacities and adopt strategies to provide a seamless shopping experience. Target's contactless Drive Up and Order Pickup services, and same-day delivery with Shipt have been playing a crucial role in getting products delivered to customers conveniently. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 36.7%, on average. The Zacks Consensus Estimate for its current financial year sales and earnings per share suggests growth of 11.6% and 37.4%, respectively, from the year-ago period.

Costco Wholesale Corporation COST is another potential pick. The company’s growth strategies, better price management, decent membership trends and increasing penetration of the e-commerce business have been contributing to its upbeat performance. Cumulatively, these factors have been aiding the Issaquah, WA-based company in registering impressive sales numbers. Costco’s net sales increased 15.8% to $19.50 billion for the retail month of September — the five-week period ended Oct 3, 2021 — from $16.84 billion in the last year. This followed an improvement of 16.2%, 16.6% and 16.9% in August, July and June, respectively. Remarkably, this Zacks Rank #2 company has a trailing four-quarter earnings surprise of 7.7%, on average. The Zacks Consensus Estimate for its current financial year sales and earnings per share suggests growth of 8.2% and 7.4%, respectively, from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Hibbett, Inc. (HIBB) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research