The 7 Reactions You Need To See About The Blackberry Buyout

Prem Watsa left the board of Blackberry (BBRY) only several weeks ago. Today, his company, Fairfax Holdings, has offered to buy Blackberry for $9 a share. Here are some of the insightful reactions from investors and traders on the StockTwits Blackberry Stream:

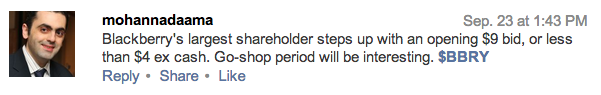

1.) Most of the attention will now shift to the go-shop period, which is when a company in a buyout seeks competing offers:

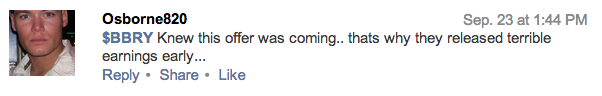

2.) Some are saying this buyout offer is the reason why Blackberry pre-released disappointing earnings on last week:

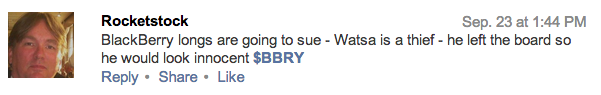

3.) And why did Watsa leave the Blackberry board in the first place? A few investors are anticipating a class action lawsuit:

4.) Is Blackberry worth more than Watsa’s proposed offer?:

5.) Watsa was buying at $50 a share back in 2010:

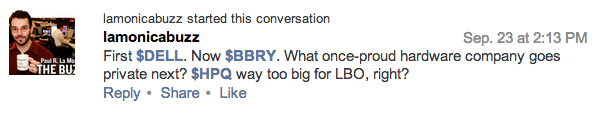

6.) Once household tech names are getting taken private. First Dell and now Blackberry:

7.) Fairfax Holdings and Watsa will receive a huge break-up fee if the deal falls apart:

Related Articles