7 Stocks Ken Fisher Continues to Buy

- By Tiziano Frateschi

Ken Fisher (Trades, Portfolio), t he founder of Fisher Investments, bought shares of the following stocks in both the fourth quarter of 2018 and first quarter of 2019.

Warning! GuruFocus has detected 5 Warning Signs with ACIW. Click here to check it out.

The intrinsic value of ACIW

ACI Worldwide Inc. (ACIW)

In the fourth quarter, the guru boosted his position by 239.24% and added 17.74% in the first quarter.

With a market cap of $3.97 billion, the company develops software products. Its revenue of $1 billion has grown 2.30% over the last five years.

Fisher is the largest guru shareholder of the company with 0.9% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.33% and Wallace Weitz (Trades, Portfolio) with 0.28%

Adobe Inc.(ADBE)

The investor added 298.24% to his holding in the fourth quarter and 76.12% in the first quarter.

The software company has a market cap of $132.83 billion. Its revenue of $9.55 billion has grown 19.10% over the last five years.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 4.06% of outstanding shares, followed by Steve Mandel (Trades, Portfolio) with 1.05%, Frank Sands (Trades, Portfolio) with 0.79% and Spiros Segalas (Trades, Portfolio) with 0.71%.

Align Technology Inc. (ALGN)

Fisher boosted his holding by 65.04% in the fourth quarter and by 139.68% in the first quarter.

The orthodontics company has a market cap of $23.25 billion. Its revenue of $1.96 billion has climbed 24.90% over the last five years.

Sands is the largest guru shareholder of the company with 4.11% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 3.15% and Andreas Halvorsen (Trades, Portfolio) with 0.70%.

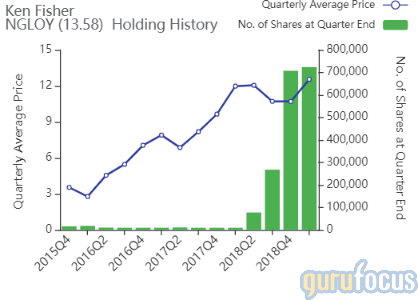

Anglo American PLC (NGLOY)

In the fourth quarter, the guru boosted the holding by 163.99% and added 2.33% in the first quarter.

The mining company has a market cap of $39.60 billion. Its revenue of $27.60 billion has grown 4.40% over the last five years.

The company's largest guru shareholder is Fisher with 0.03% of outstanding shares.

Autodesk Inc. (ADSK)

The investor added 4.08% to his position in the fourth quarter and increased it 54.89% in the first quarter.

The company, which provides computer-aided design software, has a market cap of $37.79 billion. Its revenue of $2.56 billion has increased 0.70% over the last five years.

With 1.75% of outstanding shares, Mandel is the company's largest guru shareholder, followed by Chase Coleman (Trades, Portfolio) with 0.40% and Jana Partners (Trades, Portfolio) with 0.17%.

Baozun Inc. (BZUN)

The guru added 0.05 to his stake in the fourth quarter and 71.07% in the first quarter.

With a market cap of $2.61 billion, the company provides digital and e-commerce services. Its revenue of $807.02 million has grown 54.90% over the last five years.

Another notable guru shareholder is the Matthews Asia Small Companies Fund (Trades, Portfolio) with 0.07% of outstanding shares.

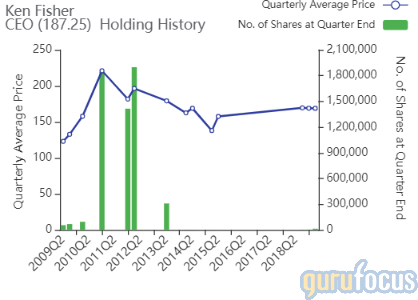

CNOOC Ltd. (CEO)

In the fourth quarter, Fisher increased the holding 28.85% and then boosted it 279.47% in the first quarter.

The Chinese offshore oil and gas producer has a market cap of $83.90 billion. Its revenue of $34.75 billion has declined 9% over the last five years.

Simons' firm is the company's largest guru shareholder with 0.15% of outstanding shares, followed by Howard Marks (Trades, Portfolio) with 0.07%, Jeremy Grantham (Trades, Portfolio) with 0.01% and Lee Ainslie (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

6 Companies Growing Earnings Per Share

6 Poorly Performing Stocks in Gurus' Portfolios

Insiders Roundup: Facebook Amyris

N ot a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with ACIW. Click here to check it out.

The intrinsic value of ACIW