This 8.7%-Yielder Sees a Return to Growth Coming in 2018

Crestwood Equity Partners (NYSE: CEQP) has had its share of struggles in recent years. The master limited partnership's (MLP) financial situation was just too tight to handle a worsening oil market, which forced it to take several actions to get back on solid ground. While this process took time, those initiatives are starting to pay off. As a result, the company ended 2017 with its strongest financial position in years, which means its 8.7%-yielding distribution is on a firm foundation. In fact, with visible growth coming down the pipeline, that payout appears poised to head even higher in the coming year.

Drilling down into the numbers

At first glance, Crestwood's fourth-quarter results don't look very appealing:

Metric | Q4 2017 | Q4 2016 | Year-Over-Year Change |

|---|---|---|---|

Adjusted EBITDA | $110.9 million | $125.6 million | -11.7% |

Distributable cash flow | $56.8 million | $77.8 million | -27% |

Distribution coverage ratio | 1.4 times | 1.9 times | -26.3% |

Data source: Crestwood Equity Partners.

However, the company's underlying results are heading in the right direction:

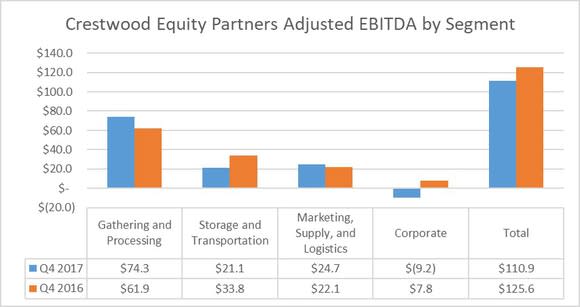

Data source: Crestwood Equity Partners. Chart by author. In millions of dollars.

As that chart shows, earnings in the company's gathering and processing segment as well as marketing, supply, and logistics improved versus the year-ago period. In fact, if we eliminate the big swing in the corporate column, Crestwood's operating earnings rose 2% year-over-year. Further, the results came in ahead of the $104 million that analysts expected.

Driving the improvement was the gathering and processing segment thanks to volume growth on its Bakken, Delaware Basin, Powder River Basin, and Marcellus systems. One of the drivers was the start-up of the Nautilus System in the Delaware Basin, which supports the regional operations of global oil and gas giant Royal Dutch Shell. That system should drive growth in the coming years since Shell expects to invest $1 billion per year in the region to boost its oil output up to 155,000 barrels per day by 2020.

Meanwhile, earnings in the marketing, supply, and logistics segment edged higher even though the company sold its U.S. Salt business during the quarter. Driving the improvement was an increase of natural gas liquids volumes sold.

The lone weak spot was the storage and transportation business, which includes its Stagecoach joint venture with utility Consolidated Edison (NYSE: ED). While natural gas storage and transportation volumes rose year-over-year, Crestwood's earnings dropped due to the expiration of two rail loading contracts and weaker margins. That said, this segment should enjoy a boost later in 2018 thanks to a 5% bump in cash distributions from its joint venture with Consolidated Edison.

Crestwood could open up the taps and send more cash to investors in the coming years. Image source: Getty Images.

A look at what's ahead

According to CEO Robert Halpin, "2017 marked another year of operational and financial execution for Crestwood as we delivered results at the upper end of our increased financial guidance for adjusted EBITDA and distributable cash flow and achieved our long-term targets for leverage and coverage." The CEO further noted that, "2017 was a trough year for cash flow" and that 2018 would mark the beginning of its recovery. That's evident in the company's guidance, with it expecting adjusted EBITDA to rise from $395 million last year to a range of $390 million to $420 million in 2018, or about 10% higher at the midpoint. Distributable cash flow, meanwhile, should be in the range of $195 million to $225 million. While that will be slightly lower than 2017's $227.8 million, after adjusting for the sale of U.S. Salt, cash flow would be about 10% above last year. More importantly, it's enough cash to cover the company's distribution by 1.2 to 1.3 times, which is a very comfortable level for an MLP.

That excess cash, along with joint venture arrangements and a strong balance sheet, gives Crestwood the funding it needs to invest up to $300 million on growth projects. Halpin noted that "as we bring our highly accretive organic capital projects online we anticipate significant cash flow ramps in the latter half of 2018 and 2019 and believe Crestwood will be in a position to reevaluate its distribution growth objectives in the second half of 2018." In other words, the company could begin boosting its already generous payout later this year if everything goes according to plan. While it's unknown how much the company might raise the payout, one analyst estimates that the company could increase it at a 5% annual rate from 2019 through 2021 while still maintaining a conservative 1.2 times coverage ratio.

All signs point to more income heading to investors

Crestwood Equity Partners completed the turn around of its operations last year. Because of that, it expects to return to growth mode in 2018 as companies like Royal Dutch Shell ramp production and its joint venture with Consolidated Edison increases distributions. Those factors suggest that the company's high-yield payout is not only safe but likely heading higher in the coming years, making Crestwood an excellent option for income-seeking investors to consider.

More From The Motley Fool

Matthew DiLallo owns shares of Crestwood Equity Partners LP. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.