8 Stocks David Tepper Continues to Buy

- By Tiziano Frateschi

David Tepper ( Trades , Portfolio ) is the founder of Appaloosa Management. He invested in the following stocks in both the third and fourth quarters.

Warning! GuruFocus has detected 3 Warning Sign with HCA. Click here to check it out.

The intrinsic value of HCA

HCA Healthcare Inc. (HCA)

The guru boosted his position by 9.54% in the third quarter, and added 200.95% in the fourth quarter.

With a market cap of $34.98 billion, the health care services company operates general acute care hospitals, psychiatric hospitals and rehabilitation hospitals. Its revenue has increased 10.90% over the past five years.

Larry Robbins (Trades, Portfolio) is the company's largest shareholder among the gurus with 3.53% of outstanding shares, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 3% and Bill Nygren (Trades, Portfolio) with 0.83%.

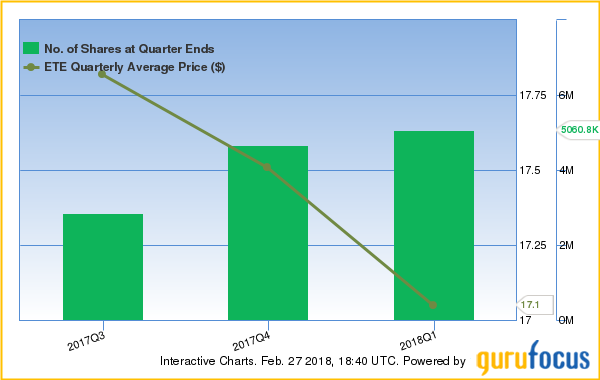

Energy Transfer Equity LP (ETE)

During the third quarter, Tepper boosted the holding by 62.24 % and then increased it 8.31 % in the fourth quarter.

The company, which stores and transports natural gas, has a market cap of $1 8.75 billion. Its revenue has grown 32% over the past five years.

The company's largest guru shareholder is Tepper with 0.47% of outstanding shares, followed by Leon Cooperman (Trades, Portfolio) with 0.1%, Jim Simons (Trades, Portfolio) with 0.08% and Steven Cohen (Trades, Portfolio) with 0.02%.

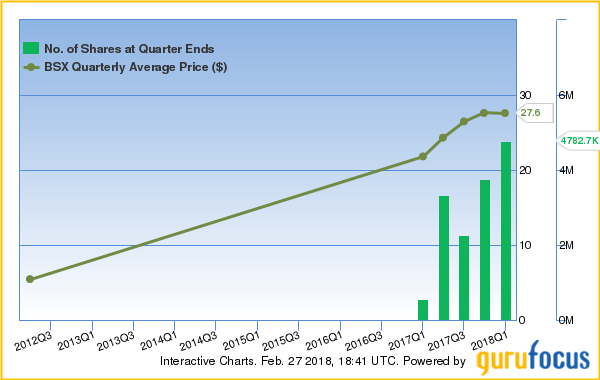

Boston Scientific Corp. (BSX)

Tepper increased the position by 65.79% in the third quarter and added another 27.44% in the fourth quarter.

The medical devices manufacturer has a market cap of $36.82 billion. Its revenue has increased 3.60% over the past five years.

PRIMECAP Management (Trades, Portfolio) is the company's largest shareholder among the gurus with 3.2% of outstanding shares, followed by the Vanguard Health Care Fund with 2.91%, Tepper with 0.27% and Diamond Hill Capital (Trades, Portfolio) with 0.22%.

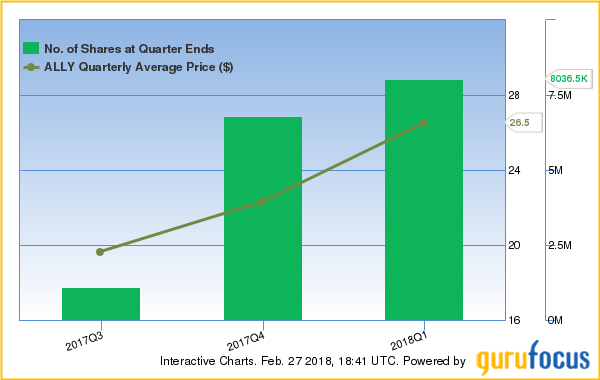

Ally Financial Inc. (ALLY)

In the third quarter, Tepper boosted the holding by 520.37% and added another 18% in the fourth quarter.

The financial services company has a market cap of $12.45 billion. Its revenue has grown by 3.70% over the past five years..

The company's largest guru shareholder is Nygren with 3.99% of outstanding shares, followed by First Pacific Advisors (Trades, Portfolio) with 2.73%, Howard Marks (Trades, Portfolio) with 2.23% and Steven Romick (Trades, Portfolio) with 2.13%.

NRG Energy Inc. (NRG)

In the third quarter, Tepper boosted the holding by 575.30% and added 15.62% in the fourth quarter.

With a market cap of $7.85 billion, the company produces electricity. Its revenue has grown 3.30% over the past five years.

Paul Singer (Trades, Portfolio) is the company's largest guru shareholder with 3.16% of outstanding shares, followed by Tepper with 3.08%, Simons with 1.54% and Alan Fournier (Trades, Portfolio) with 1.04%.

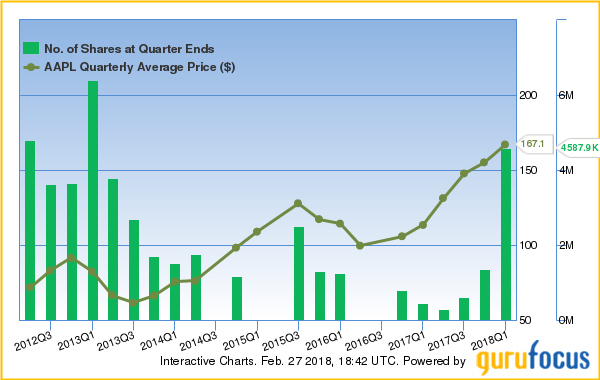

Apple Inc. (AAPL)

The guru increased his stake by 117.76% in the third quarter and added another 237.09% in the fourth quarter.

With a market cap of $849.24 billion, the technology company makes mobile communication and media devices and personal computers. Its revenue has increased 14% over the past five years.

With 3.26% of outstanding shares, Warren Buffett (Trades, Portfolio) is the company's largest guru sharesholder, followed by Pioneer Investments (Trades, Portfolio) with 0.26%, Ken Fisher (Trades, Portfolio) with 0.22% and Spiros Segalas (Trades, Portfolio) with 0.21%.

Facebook Inc. (FB)

In the third quarter, Tepper boosted his stake by 40.05% and added another 67.56% in the fourth quarter.

With a market cap of $521.51 billion, it is the world's largest online social network. Its revenue has grown 42.70% over the past five years.

Frank Sands (Trades, Portfolio) is the company's largest guru shareholder with 0.44 % of outstanding shares, followed by Segalas with 0. 24 %, Tepper with 0. 19 % and Steve Mandel (Trades, Portfolio) with 0. 15 %.

Micron Technology Inc. (MU)

Tepper boosted his stake by 32.20% in the third quarter and by 61.25% in the fourth quarter.

The company, which providesmemory and storage solutions, has a market cap of $50.24 billion. Its revenue has increased 14.60% over the past five years.

PRIMECAP Management is the company's largest shareholder among the gurus with 5.05% of outstanding shares, followed by Tepper with 2.38%, Donald Smith (Trades, Portfolio) with 0.93% and Pioneer Investments with 0.36%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with HCA. Click here to check it out.

The intrinsic value of HCA