8 Stocks Ken Fisher Continues to Buy

Ken Fisher (Trades, Portfolio), founder of Fisher Asset Management, bought shares of the following stocks in both the fourth quarter of 2019 and the first quarter of 2020.

Alexion Pharmaceuticals

The guru increased the Alexion Pharmaceuticals Inc. (NASDAQ:ALXN) position by 2.59% in the fourth quarter and then boosted it 127.04% in the first quarter.

The company, which develops drugs for rare, life-threatening medical conditions, has a market cap of $21.51 billion. Its revenue of $4.99 billion has grown 15% over the last five years.

Jim Simons (Trades, Portfolio)' Renaissance Technologies is the largest guru shareholder of the company with 1.68% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.34% and David Carlson (Trades, Portfolio) with 0.24%.

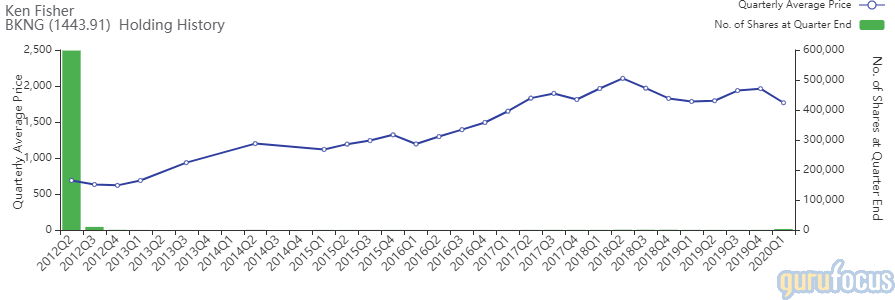

Booking

Fisher raised the Booking Holdings Inc. (NASDAQ:BKNG) stake by 0.95% in the fourth quarter and added 258.79% in the first quarter. The stock has a weight of 0.01% in the portfolio.

The online travel agency has a market cap of $56.44 billion and an enterprise value of $60.88 billion. Its revenue of $15.06 billion has risen 17.50% over the last five years.

The company's largest guru shareholder is Dodge & Cox with 3.47% of outstanding shares, followed by Pioneer Investments with 0.75% and Yacktman Asset Management (Trades, Portfolio) with 0.52%.

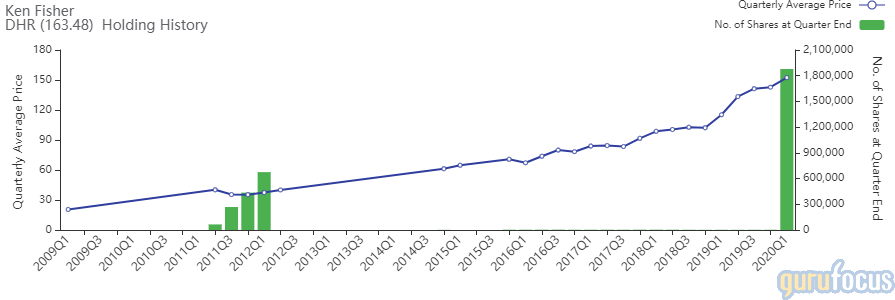

Danaher

The investor increased the Danaher Corp. (NYSE:DHR) holding by 1.84% in the fourth quarter and boosted it 38,462.76% in the first quarter. The stock has a total weight of 0.32% in the portfolio.

The company, which operates in the medical diagnostics and research industry, has a market cap of $114.28 billion. Its revenue of $17.92 billion grown 5.80% over the last five years.

Daniel Loeb (Trades, Portfolio) is the largest guru shareholder of the company with 0.53% of outstanding shares, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 0.47% and Spiros Segalas (Trades, Portfolio) with 0.30%.

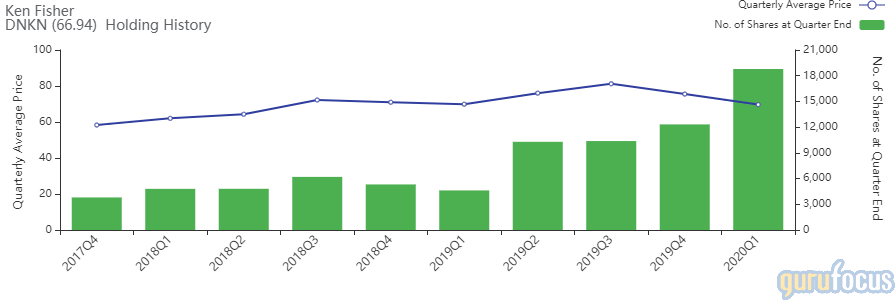

Dunkin' Brands

In the fourth quarter, the guru increased the Dunkin' Brands Group Inc. (NASDAQ:DNKN) position by 18.7% and raised it another 52.48% in the first quarter.

The coffee and doughnut chain has a market cap of $5.21 billion. Its revenue of $1.37 billion has grown at an average annual rate of 19.10% over the last five years.

Other notable guru shareholders of the company include Renaissance Technologies with 0.42% of outstanding shares, Steven Cohen (Trades, Portfolio) with 0.41% and John Hussman (Trades, Portfolio) with 0.07%.

Knowles

Fisher boosted the Knowles Corp. (NYSE:KN) position by 191.23% in the fourth quarter and then raised it by 110.2% in the first quarter. The stock has a weight of 0.04% in the portfolio.

The company, which provides micro-acoustic and precision device solutions, has a market cap of $1.31 billion. Its revenue of $838 million has fallen at an average annual rate of 2% over the last five years.

The largest guru shareholder of the company is John Rogers (Trades, Portfolio) with 3.88% of outstanding shares, followed by Fisher with 2.31% and Simons' firm with 0.60%.

Lam Research

In the fourth quarter, the guru added to the Lam Research Corp. (LRCX) position by 6.69% and boosted it by 53,842% in the first quarter. The stock has a weight of 0.16% in the portfolio.

The company, which operates in the semiconductors industry, has a market cap of $35.50 billion. Its revenue of $9.61 billion has grown at an average annual rate of 20.60% over the last five years.

The largest guru shareholder of the company is Pioneer Investments with 0.78% of outstanding shares, followed by Fisher with 0.37% and the Parnassus Endeavor Fund (Trades, Portfolio) with 0.34%.

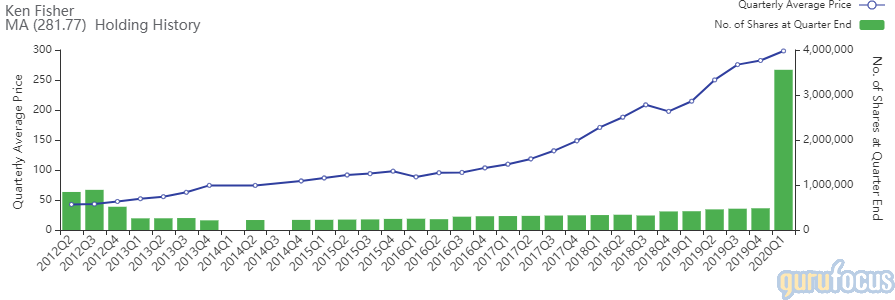

Mastercard

The guru bolstered the Mastercard Inc. (NYSE:MA) position by 1.95%% in the fourth quarter and then raised it by 637.88% in the first quarter. The stock has a weight of 1.07% in the portfolio.

The payment processor has a market cap of $273.46 billion. Its revenue of $17 billion has risen at an average annual rate of 16.40% over the last five years.

The largest guru shareholder of the company is Tom Russo (Trades, Portfolio) with 0.63% of outstanding shares, followed by Chuck Akre (Trades, Portfolio) with 0.53%.

MercadoLibre

The investor increased the MercadoLibre Inc. (NASDAQ:MELI) holding by 7.13% in the fourth quarter and boosted it 12,650% in the first quarter. The stock has a total weight of 0.13% in the portfolio.

The company, which operates online commerce marketplaces, has a market cap of $36.93 billion. Its revenue of $69.62 billion has increased 30.50% over the last five years.

Steve Mandel (Trades, Portfolio)'s Lone Pine Capital is the largest guru shareholder of the company with 1.95% of outstanding shares, followed by Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors with 1.42% and Al Gore (Trades, Portfolio) with 1.40%.

Disclosure: I do not own any stocks mentioned.

Read more here:

The Yacktman Fund Cuts Samsung, PepsiCo

T Rowe Price Equity Income Fund Buys 8 Stocks

Diamond Hill Cuts United Airlines, Philip Morris

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.