8 Stocks Mark Hillman Continues to Buy

Mark Hillman (Trades, Portfolio)'s Hillman Capital Management bought shares of the following stocks in both the fourth quarter of 2019 and the first quarter of 2020.

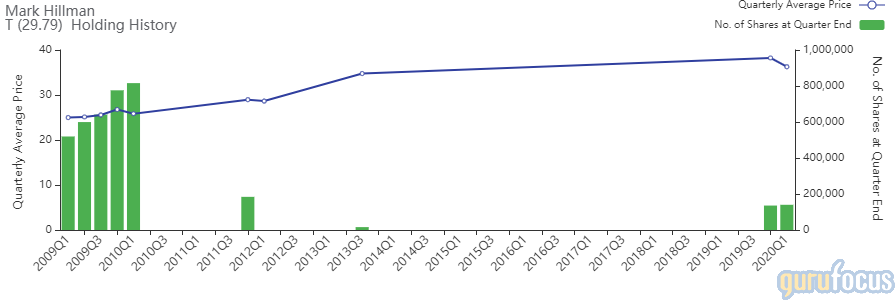

AT&T

The guru boosted the AT&T Inc. (T) position by 748.51% in the fourth quarter and then added 3.13% in the first quarter.

The company, which operates in the telecommunication services industry, has a market cap of $212.25 billion. Its revenue of $4.99 billion has fallen 0.80% over the last five years.

Pioneer Investments (Trades, Portfolio) is the largest guru shareholder of the company with 0.21% of outstanding shares, followed by Paul Singer (Trades, Portfolio)'s Elliott Management with 0.07% and Barrow, Hanley, Mewhinney & Strauss with 0.06.

Compass Minerals

The firm boosted the Compass Minerals International Inc. (CMP) stake by 745.42% in the fourth quarter and 1.69% in the first quarter. The stock has a weight of 3.06% in the portfolio.

The company, which produces salt and sulfate of potash, has a market cap of $1.59 billion and an enterprise value of $2.77 billion. Its revenue of $1.50 billion has risen 5.30% over the last five years.

The company's largest guru shareholder is Robert Bruce (Trades, Portfolio) with 0.41% of outstanding shares, followed by John Hussman (Trades, Portfolio) with 0.06% and Jeff Auxier (Trades, Portfolio) with 0.01%.

Exxon Mobil

The investor increased the Exxon Mobil Corp. (XOM) holding by 175.45% in the fourth quarter and raised it by 15.54% in the first quarter. The stock has a total weight of 2.78% in the portfolio.

The oil and gas company has a market cap of $195.36 billion. Its revenue of $249.07 billion has fallen 4.50% over the last five years.

First Eagle Investment (Trades, Portfolio) is the largest guru shareholder of the company with 0.47% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.16% and T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.11%.

Goldman Sachs Group

In the fourth quarter, the guru increased the Goldman Sachs Group Inc. (GS) position by 28.84%, then raised it another 0.26% in the first quarter. The stock has a total weight of 3.10% in the portfolio.

The global investment banking firm has a market cap of $63.75 billion. Its revenue of $33.01 billion has grown at an average annual rate of 6.40% over the last five years.

Other notable guru shareholders of the company include Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 3.49% of outstanding shares, Dodge & Cox with 3.34% and HOTCHKIS & WILEY with 0.96%.

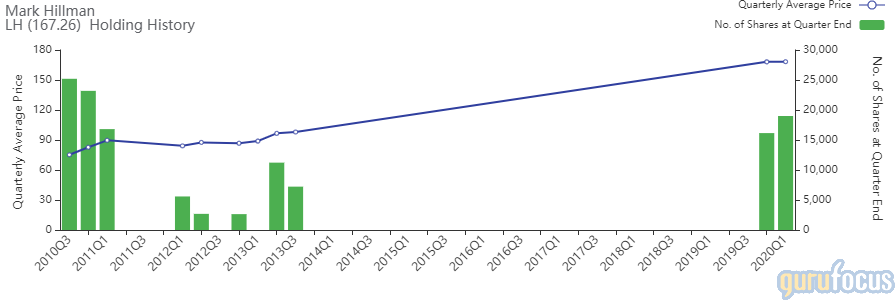

Laboratory Corp of America

Hillman Capital boosted the Laboratory Corp. of America Holdings (LH) position by 120.07% in the fourth quarter and then raised it by 17.63% in the first quarter. The stock has a weight of 2.30% in the portfolio.

The American independent clinical laboratory has a market cap of $16.24 billion. Its revenue of $11.58 billion has risen at an average annual rate of 10.30% over the last five years.

The largest guru shareholder of the company is John Rogers (Trades, Portfolio) with 0.92% of outstanding shares, followed by Wallace Weitz (Trades, Portfolio) with 0.56% and Charles Brandes (Trades, Portfolio) with 0.37%.

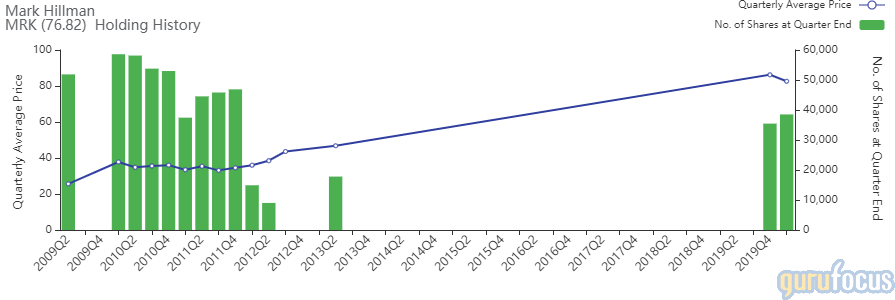

Merck & Co.

In the fourth quarter, the guru added to the Merck & Co. Inc. (MRK) position by 99.13%, then raised it by 8.64% in the first quarter. The stock has a weight of 2.84% in the portfolio.

The pharmaceutical products manufacturer has a market cap of $48.08 billion. Its revenue of $9.61 billion has grown at an average annual rate of 4.50% over the last five years.

The largest guru shareholder of the company is Fisher with 0.35% of outstanding shares, followed by Vanguard Health Care Fund (Trades, Portfolio) with 0.35% and Pioneer Investments (Trades, Portfolio) with 0.33%.

Nordstrom

The guru boosted the Nordstrom Inc. (JWN) position by 288.99% in the fourth quarter and then bolstered it by 3.56% in the first quarter. The stock has a weight of 2.17% in the portfolio.

The fashion retailer has a market cap of $2.82 billion. Its revenue of $15.52 billion has risen at an average annual rate of 7.30% over the last five years.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.86% of outstanding shares, followed by Rogers with 0.38% and Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.16%.

Pfizer

The investor increased the Pfizer Inc. (PFE) holding by 249.04% in the fourth quarter and raised it 7.21% in the first quarter. The stock has a total weight of 2.81% in the portfolio.

The pharmaceutical firm has a market cap of $206.75 billion. Its revenue of $50.66 billion has increased 3.70% over the last five years.

Vanguard Health Care Fund (Trades, Portfolio) is the largest guru shareholder of the company with 1.16% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologes with 0.24%.

Disclosure: I do not own any stocks mentioned.

Read more here:

First Pacific Advisors Trims Microsoft, Howmet Aerospace

8 Stocks Ken Fisher Continues to Buy

The Yacktman Fund Cuts Samsung, PepsiCo

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.