9 Stocks Robert Olstein Continues to Buy

- By Tiziano Frateschi

Robert Olstein (Trades, Portfolio) is the chairman and chief investment officer of Olstein Capital Management. The guru invested in the following stocks in both the third and fourth quarters.

Warning! GuruFocus has detected 5 Warning Signs with PKOH. Click here to check it out.

The intrinsic value of PKOH

Park-Ohio Holdings Corp. (PKOH)

In the third quarter, the guru increased his position by 25.30% and then added 33.08% in the fourth quarter.

With a market cap of $501.85 million, the U.S.-based company is engaged in industrial supply chain logistics and diversified manufacturing. Its revenue has grown 6.30% over the past five years.

Mario Gabelli (Trades, Portfolio) is the company's largest shareholder among the gurus with 6.13% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 1.27% and Jim Simons (Trades, Portfolio) with 0.69%.

Wabash National Corp. (WNC)

In the third quarter, Olstein boosted the holding by 63.80% and then increased it 32.14% in the fourth quarter.

The truck manufacturer has a market cap of $1.36 billion. Its revenue has increased 6% over the past five years

The largest shareholder among the gurus is Royce with 7.75% of outstanding shares, followed by Joel Greenblatt (Trades, Portfolio) with 0.65% and John Hussman (Trades, Portfolio) with 0.26%.

Helen of Troy Ltd. (HELE)

The guru increased his position by 29.40% in the third quarter and added another 49.95% in the fourth quarter.

The El Paso, Texas-based company, which owns brands like OXO and Conair, has a mareket cap of $2.41 billion. Its revenue has grown 9% over the past five years.

Ken Fisher (Trades, Portfolio) is the company's largest guru shareholder with 2.9% of outstanding shares, followed by Olstein with 0.12% and Jeremy Grantham (Trades, Portfolio) with 0.11%.

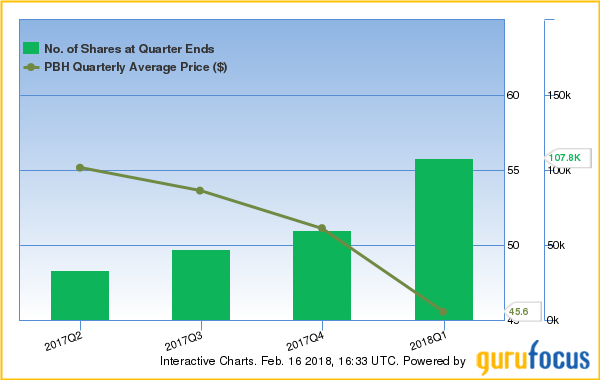

Prestige Brands Holdings Inc. (PBH)

In the third quarter, Olstein increased his holding by 26.03% and boosted it by 85.50% in the fourth quarter.

The health care company has a market cap of $1.87 billion. Its revenue has grown 12.40% over the past five years.

The company's largest shareholder among the gurus is Fisher with 2.79% of outstanding shares, followed by Simons with 0.28%, Olstein with 0.2% and Greenblatt with 0.2%.

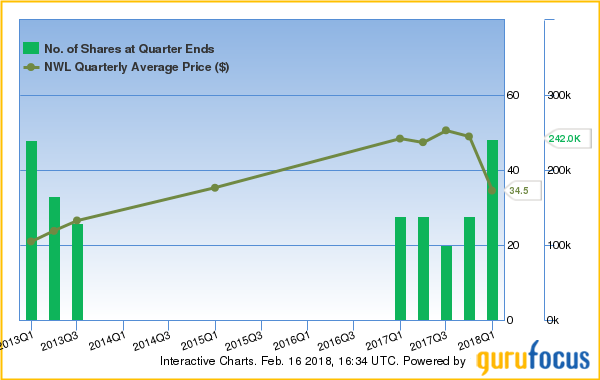

Newell Brands Inc. (NWL)

Olstein added 39% to the holding in the third quarter and then boosted it 74.10% in the fourth quarter.

With a market cap of $13.68 billion, the company owns a variety of household products brands, including Rubbermaid, Sharpie, Sunbeam, Paper Mate and Graco. Its revenue has grown by 9.30% over the past five years.

Lee Ainslie (Trades, Portfolio) is the company's largest guru shareholder with 1.43% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.59%, Andreas Halvorsen (Trades, Portfolio) with 0.55% and Barrow, Hanley, Mewhinney & Strauss with 0.26%.

Universal Health Services Inc. (UHS)

The investor increased his stake by 27.27% in the third quarter and raised it by 33.93% in the fourth quarter.

The health care services provider has a market cap of $10.9 billio. Its revenue has increased 7.80% over the past five years

The company's largest guru shareholder is Ainslie with 6.18% of outstanding shares, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 4.89%, Larry Robbins (Trades, Portfolio) with 2.42% and Halvorsen with 1.26%.

International Business Machines Corp. (IBM)

In the third quarter, the investor increased his holding by 50% and added another 35.71% in the fourth quarter.

The technology company has a market cap of $136.64 billion. Its revenue has declined 1.60% over the past five years.

Warren Buffett (Trades, Portfolio) is the company's largest guru shareholder with 4% of outstanding shares, followed by Simons with 0.12%, Barrow, Hanley, Mewhinney & Strauss with 0.07% and Tweedy Browne (Trades, Portfolio) with 0.03%.

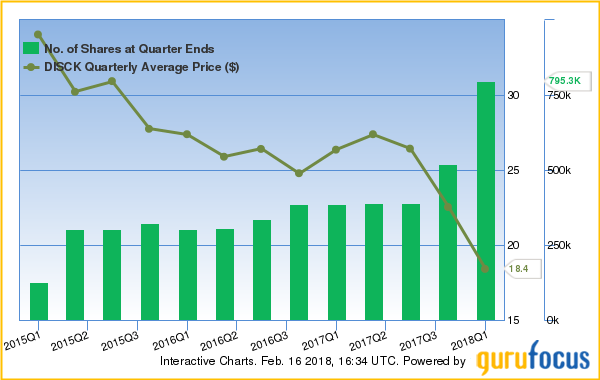

Discovery Communications Inc. (DISCK)

Olstein raised his stake by 32.72% in the third quarter and increased it 53.23% in the fourth quarter.

The media and entertainment company has a market cap of $8.44 billion. Its revenue has grown 23.50% over the past five years.

With 1.94% of outstanding shares, Hotchkis & Wiley is the company's largest guru shareholder, followed by Simons with 0.46%, Gabelli with 0.34% and Arnold Van Den Berg (Trades, Portfolio) with 0.32%.

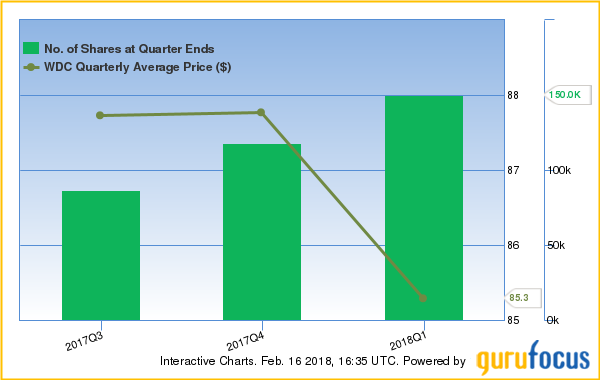

Western Digital Corp. (WDC)

In the third quarter, the investor added 36.42% and another 27.12% in the fourth quarter.

The data storage company has a market cap of $23.83 billion. Its revenue has grown 2.10% over the past five years

David Tepper (Trades, Portfolio) is the company's largest guru shareholder with 0.87% of outstanding shares, followed by Simons with 0.49%, PRIMECAP Management with 0.36% and First Eagle Investment (Trades, Portfolio) with 0.27%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with PKOH. Click here to check it out.

The intrinsic value of PKOH