Abbott's (ABT) Epic Max Tissue Valve Receives FDA Approval

Abbott Laboratories, Inc. ABT recently announced the receipt of the FDA approval for the company's Epic Max stented tissue valve to treat people with aortic regurgitation or stenosis. The new valve is intended to preserve and simplify future options for patients to manage their heart valve disease.

The latest regulatory clearance is expected to significantly boost Abbott’s structural heart business of the broader Medical Devices segment.

About Epic Max Tissue Valve

Epic Max is developed to achieve excellent hemodynamics or blood flow. Its low-profile frame enables potential future transcatheter interventions for patients. This new valve is built on the Epic surgical valve platform, utilizing its long-term performance and durability.

This device is the newest addition to Abbott's Epic surgical valve platform, which has trusted safety and strong clinical outcomes, with an optimized design to enhance valve blood flow.

Benefits of Epic Max Tissue Valve

The aortic valve is one of the heart valves most commonly impacted by cardiovascular disease, frequently requiring replacement. Per management, Abbott's Epic Max design optimizes blood flow for patients and has a low profile that makes future cardiac interventions simpler.

Image Source: Zacks Investment Research

It is worth mentioning that when the aortic valve doesn't close properly or fails to fully open, the heart doesn’t pump blood efficiently and flow to the body is reduced. If left untreated, aortic valve disease can lead to heart failure, stroke, blood clots or death. Bioprosthetic valves like Epic Max are suggested for patients who require valve replacement and aren't suitable for taking blood-thinning medication.

Progress Within Structural Heart Space

This month, Abbott announced favorable findings on remote pressure monitoring. This study result was presented at the Technology and Heart Failure Therapeutics Conference in Boston, MA. The data revealed that monitoring patients remotely with hemodynamic pressure sensing technology can significantly improve the survival rate of heart failure patients with reduced ejection fraction (HFrEF).

The same month, Abbott announced significant progress with Navitor, the company’s latest-generation transcatheter aortic valve implantation (TAVI) system. The company announced late-breaking data for Navitor during presentations at the annual Cardiovascular Research Technologies (CRT) meeting held in Washington, D.C. (Feb 25-28, 2023).

Results from this study supported Navitor's recent FDA approval to treat people with severe aortic stenosis who are at high or extreme risk for open-heart surgery.

Industry Prospects

Per a report by Allied Market Research, the global TAVI market was valued at $4,559 million in 2020 and is anticipated to reach $16,937 million by 2030 at a CAGR of 14%. Factors like the increase in the prevalence of aortic stenosis, rise in demand for various TAVI procedures and rise in the elderly population are likely to drive the market.

Given the market potential, the latest regulatory clearance is expected to strengthen Abbott's global structural heart business.

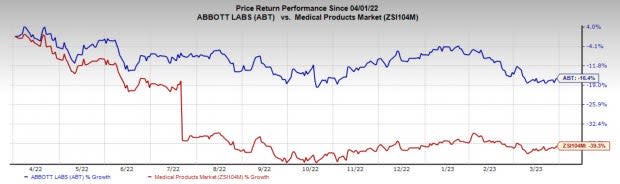

Price Performance

Shares of the company have gained 4.2% in a year against the industry’s fall of 9.6%.

Zacks Rank and Key Picks

Abbott carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 1.7% against the industry’s 17.5% growth in the past year.

Henry Schein, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 12.4% compared with the industry’s 10.9% decline in the past year.

Avanos, carrying a Zacks Rank #2 at present, has an estimated growth rate of 1.8% for 2023. AVNS’ earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 13.7% compared with the industry’s 17.5% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report