ABB's Q1 Earnings and Revenues Beat Estimates, Orders Up Y/Y

ABB Ltd. ABB reported better-than-expected first-quarter 2021 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

Operational earnings came in at 31 cents per share, beating the consensus estimate of 28 cents. Also, the figure recorded an increase of 3.3% on a year-over-year basis.

Top-Line Details

ABB’s first-quarter revenues totaled $6,901 million, up 11% from the year-ago quarter. The upside can be attributed to revenue growth across most of its segments. On a comparable basis, revenues grew 7%. Also, the top line surpassed the consensus estimate of $6,626 million.

Total orders were $7,756 million, increasing 6% year over year. The metric increased 1% on a comparable basis, supported by solid recovery in most of its short-cycle businesses. Exiting the first quarter, the company’s order backlog was $14,750 million.

Segmental Details

ABB reports revenues under four segments as discussed below:

Electrification: Revenues totaled $3,140 million, increasing 13% year over year. Orders were up 13% year over year to $3,531 million driven by strength across data centers, food & beverage, rail and e-mobility industries.

Process Automation: Revenues were $1,407 million, declining 4% year over year. Orders decreased 6% to $1,656 million. Orders were weak across most of industries.

Motion: Revenues amounted to $1,667 million, up 10% from the year-ago quarter. Orders increased 1% to $1,917 million on account of strength across short-cycle business.

Robotics & Discrete Automation: Revenues were $853 million, increasing 27% year over year. Orders grew 4% to $841 million. Orders were backed by high orders for machine automation and robotics.

Operational EBITA Margin

In the reported quarter, ABB’s total cost of sales increased 7.6% year over year to $4,633 million. It represented 67.1% of first-quarter revenues compared with 69.3% a year ago. Gross margin was 32.9%, up from 30.7%. Selling, general and administrative expenses increased 0.9% to $1,263 million.

Operational earnings before interest, taxes and amortization (EBITA) in the quarter increased 50.8% to $959 million. Operational EBITA margin increased 360 basis points to 13.8%.

Balance Sheet and Cash Flow

Exiting first-quarter 2021, ABB had cash and cash equivalents of $3,466 million, up from $3,278 million recorded in the previous quarter. Long-term debt was $5,619 million, higher than $4,828 million at the end of the previous quarter.

In the first three months of 2021, net cash provided by operating activities totaled $543 million compared with $577 million used in a year-ago period.

Outlook

ABB expects end markets like buildings, mining & metals, power distribution utilities, automotive, marine & ports and food and beverage to witness solid growth. However, weakness across the oil and gas and conventional power generation end markets might affect its near-term results.

For 2021, the company predicts revenues (comparable basis) to grow 5% or more on a year-over-year basis. For second-quarter 2021, it anticipates orders and revenues (comparable basis) to increase more than 10%.

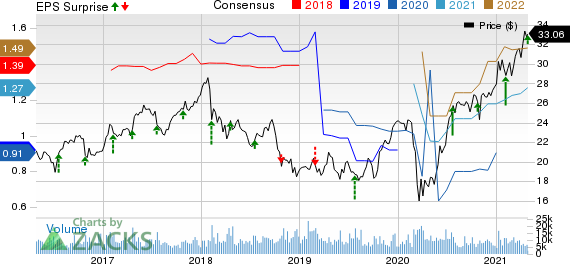

ABB Ltd Price, Consensus and EPS Surprise

ABB Ltd price-consensus-eps-surprise-chart | ABB Ltd Quote

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks are Alcoa Corporation AA, Lakeland Industries, Inc. LAKE and Energy Recovery, Inc. ERII. While Alcoa and Lakeland Industries currently sport a Zacks Rank #1 (Strong Buy), Energy Recovery carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alcoa delivered a positive earnings surprise of 56.78%, on average, in the trailing four quarters.

Lakeland Industries delivered a positive earnings surprise of 230.73%, on average, in the trailing four quarters.

Energy Recovery delivered a positive earnings surprise of 232.08%, on average, in the trailing four quarters.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alcoa Corp. (AA) : Free Stock Analysis Report

ABB Ltd (ABB) : Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE) : Free Stock Analysis Report

Energy Recovery, Inc. (ERII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research