AbbVie (ABBV) Beats on Q1 Earnings, Raises 2021 Guidance

AbbVie Inc. ABBV reported earnings of $2.95 per share for the first quarter of 2021, comfortably beating the Zacks Consensus Estimate of $2.77 and exceeding the guided range of $2.79-$2.83. Earnings rose 21.9% year over year.

The company’s revenues of $13.01 billion beat the Zacks Consensus Estimate of $12.94 billion as well as the company’s expectation of $12.7 billion. The top line improved 51% year over year on a reported basis. However, on an operational basis, revenues increased only 5.2%.

Please note that AbbVie completed the acquisition of Allergan in May 2020. The comparable operational growth rate includes full quarter, current year, and historical results for Allergan, as if the acquisition closed on Jan 1, 2019, at constant currency rates.

AbbVie’s shares were up 0.8% in pre-market trading. AbbVie’s shares have gained 3.5% so far this year compared with the industry’s 1.7% increase.

Quarter in Detail

Key drug Humira recorded sales increase of 2.6% on an operational basis year over year with revenues from the same coming in at $4.9 billion. Sales in the United States climbed 6.9% to $3.91 billion. However, Humira sales in the ex-U.S. markets were down 8.3% on a reported basis and 12.6% on an operational basis to $960 million. International sales were affected by the launch of several direct biosimilar drugs in Europe by other pharma companies including Amgen AMGN, Sandoz and Biogen.

New immunology drugs, Skyrizi and Rinvoq registered sales of $574 million and $303 million, respectively. In the previous quarter, Skyrizi and Rinvoq had recorded sales of $525 million and $281, respectively. Strong sequential growth in sales of both drugs in the last couple of quarters reflects strong uptake.

AbbVie’s oncology/hematology (including Imbruvica and Venclexta) sales rose 7.3% on an operational basis to $1.67 billion in the quarter, driven by strong growth of both Imbruvica and Venclexta.

First-quarter net revenues from Imbruvica were $1.27 billion, up 2.9% year over year. U.S. sales of Imbruvica grossed $999 million, up 3.3% from the year-ago figure. AbbVie’s share of profit from International sales of the drug rose 1.4% to $269 million. Notably, AbbVie shares international profits earned from Imbruvica with Johnson & Johnson JNJ.

The company’s leukemia drug, Venclexta generated revenues of $405 million in the reported quarter, reflecting growth of 24.5% year over year on an operational basis. AbbVie has a partnership with Roche RHHBY for Venclexta.

Other products that delivered an encouraging performance include Creon and Duodopa, which recorded revenue growth of 4% and 4.6%, respectively, on an operational basis. Lupron and Synthroid witnessed a revenue decrease of 16.9% and 5.1%, respectively. Orilissa sales were up 10.7% year over year. Sales of Mavyret were $481 million, down 24.9% operationally.

AbbVie’s aesthetics portfolio sales were up 34.9% on an operational basis to $1.14 billion on the back of robust demand for Botox Cosmetic whose sales increased $44.7% to $477 million.

Sales of neuroscience portfolio increased 10.9% operationally to $1.25 billion driven by Botox Therapeutic and Vraylar. While Botox Therapeutic sales rose 7% to $532 million, sales of Vraylar were up 21.2% to $346 million. AbbVie’s newly launched oral migraine drug, Ubrelvy, brought additional $81 million in revenues.

Eye care portfolio sales declined 9.2% on operational basis to $817 million. Sales of a key drug in the portfolio, Restasis, decreased 13.8% year-over-year to $280 million.

Adjusted SG&A expenses increased 71.5% to $2.74 billion while R&D expenses were $1.51 billion in the first quarter, rising 22% year over year. Adjusted operating margin represented 51% of sales.

2021 Guidance Raised

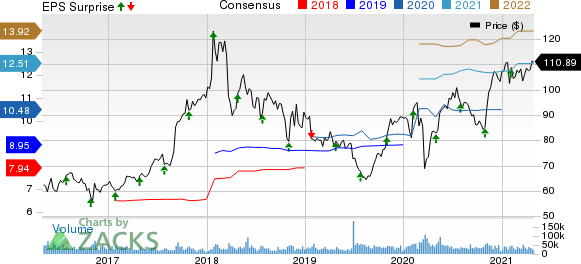

AbbVie raised its adjusted earnings per share (“EPS”) guidance for 2021. The company now expects adjusted EPS to be in the range of $12.37-$12.57 compared with the previously issued guidance of $12.32-$12.52. The strong and increasing earnings expectations reflect robust demand for AbbVie’s products amid the COVID-19 pandemic. The Zacks Consensus Estimate for current-year earnings per share is pegged at $12.51.

AbbVie Inc. Price, Consensus and EPS Surprise

AbbVie Inc. price-consensus-eps-surprise-chart | AbbVie Inc. Quote

Zacks Rank

Currently, AbbVie is a Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research