Is Abercrombie (ANF) Poised for Growth Amid Supply Headwinds?

Abercrombie & Fitch Company ANF remains poised for growth, given the strong consumer demand trends despite the ongoing supply-chain woes. The company’s efforts to reduce square footage, expand digital penetration and increase shareholder value have been drivers. Its cost-minimization measures, and strategic investments across marketing, technology and fulfillment also bode well.

However, supply-chain disruptions and higher freight costs are likely to persist in the days ahead. The company expects higher operating expenses due to elevated fulfillment expenses and marketing spend.

Recent Outlook Update

Last week, Abercrombie updated its fourth-quarter and fiscal 2021 outlook, driven by the resurgence in COVID-19 cases due to the Omicron variant. The company noted that it continues to witness strong customer demand, which is likely to result in the highest annual operating income and margin in more than 10 years along with an accelerated sales trend post the holiday season.

Sturdy demand for the company’s winter and holiday collection, particularly in jeans, dresses and sweaters, contributed to its sales during the Black Friday/Cyber Monday period. However, the company witnessed weak inventory in key categories due to port congestions and transportation delays.

As a result, Abercrombie failed to keep up with customer demand, which led to a loss in sales during the peak holiday season. Notably, the Hollister and Gilly Hicks brands suffered the most. Management expects fourth-quarter fiscal 2021 sales to be flat to down on a two-year basis compared with the earlier mentioned 3-5% rise. This can be attributable to unexpected inventory delays as well as COVID-related impacts and restrictions. However, fourth-quarter fiscal 2021 sales are anticipated to grow 4-6% year over year to $1.122 billion.

For fiscal 2021, net sales are envisioned to rise 19-20% year over year and 2-3% on a two-year basis.

For fourth-quarter fiscal 2021, the company’s gross margin is now expected to be flat with the 2019 reported level of 58.2%. The view includes double-digit AUR improvement on both year-over-year and two-year basis, driven by lower promotions and markdowns.

On the flip side, the adverse impacts of $75 million of freight cost pressure due to the increasing ocean and air rates as well as higher air deliveries remain concerning. The company anticipates operating expenses, excluding other operating income, to be up in the low to mid-single digits to the adjusted level of $565 million reported in 2019.

For fiscal 2021, the operating margin is estimated to be 9-10%, whereas it reported 1.7% and 2.3% in fiscal 2020 and 2019, respectively. The company expects a capital expenditure of $90-$95 million, down from the previously communicated $100 million.

What’s More?

Abercrombie is making significant progress in expanding digital and omni-channel capabilities to better engage with consumers. The digital business has been gaining from the addition of customers in the channel, backed by robust digital marketing efforts. Also, high customer retention and spend per customer are likely to continue aiding sales growth.

The company remains encouraged with its strong online presence and expects to keep gaining from the platform. It plans to continue investing in bolstering omni-channel capabilities, including curbside and ship-from-store services. It is also striving to optimize capacity at its distribution centers to meet the increased digital demand.

Abercrombie is working toward rationalizing its store base by reducing dependence on underperforming tourist-driven locations. As part of its store optimization plans, Abercrombie plans to reposition larger-format flagship locations to smaller omni-channel-enabled stores. Progressing on these efforts, the company permanently closed 137 locations, representing 1.1 million productive gross square feet of its store base in fiscal 2020.

Abercrombie has been on track with its cost minimization measures. Management remains on track to control spending by undertaking measures like occupancy cost reduction through store closures and right-sizing. The company remains on track and leverages some of its structural cost-savings to boost top-line growth through investments in brand marketing, digital experience, and growing Gilly Hicks and Social Tourist brands.

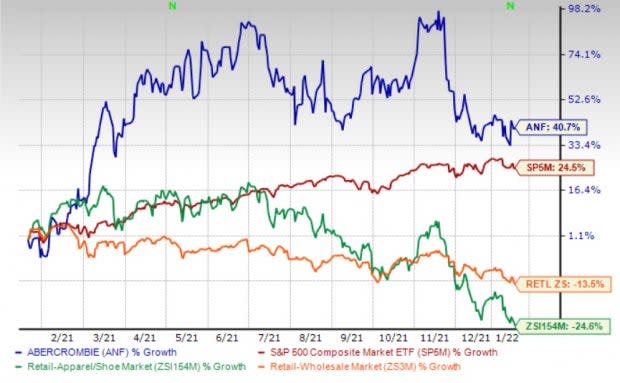

Backed by the aforementioned positives, the Zacks Rank #3 (Hold) stock has rallied 40.71% in a year against the industry’s decline of 24.6%. It also compared favorably with the sector’s decline of 13.5% and the S&P 500’s growth of 24.5%.

Image Source: Zacks Investment Research

Stocks to Consider

We have highlighted three better-ranked companies in the Retail - Wholesale sector, namely The Buckle Inc. BKE, Designer Brands DBI and Capri Holdings CPRI.

Buckle, a retailer of casual apparel, footwear and accessories in the United States, presently flaunts a Zacks Rank #1 (Strong Buy). The BKE stock has rallied 10% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Buckle’s sales and EPS for the current financial year suggests growth of 38.2% and 79%, respectively, from the year-ago levels. BKE has a trailing four-quarter earnings surprise of 42.8%, on average.

Designer Brands, a leading apparel retailer, presently sports a Zacks Rank #1. Shares of DBI have rallied 47.6% in the past year.

The Zacks Consensus Estimate for Designer Brands’ sales and EPS for the current financial year suggests respective growth of 43.8% and 143.1% from the year-ago period’s reported figures. DBI has a trailing four-quarter earnings surprise of 116%, on average.

Capri Holdings, which operates membership warehouses, presently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 1024.9%, on average. Shares of CPRI have rallied 35.5% in the past year.

The Zacks Consensus Estimate for Capri Holdings’ sales and EPS for the current financial year suggests respective growth of 33.2% and 181.1% from the year-ago period’s reported figures. CPRI has an expected EPS growth rate of 32.2% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Buckle, Inc. The (BKE) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research