Abercrombie (ANF) Tops Q1 Earnings & Sales Estimates, Ups View

Shares of Abercrombie & Fitch Co. ANF jumped more than 14% following the impressive first-quarter fiscal 2023 results, wherein the bottom and top lines surpassed the Zacks Consensus Estimate and improved year over year.

Despite significant inflation and global macroeconomic disruption, results have gained from the continued momentum in the Abercrombie brand and sequential improvement in the Hollister brand. The apparel retailer undertook efforts to improve its inventory across all labels, thereby attracting customers to shop for a diverse range of products like dresses and cargo.

Also, strategic investments across stores, digital and technology via its Always Forward Plan bodes well. Consequently, management has raised its fiscal 2023 view.

Sales & Earnings Picture

Abercrombie has reported adjusted earnings of 39 cents per share in the first quarter, whereas the Zacks Consensus Estimate was pegged at a loss of 2 cents. First-quarter earnings reflected a significant increase of 44.4% from the year-ago period’s 27 cents.

Net sales of $836 million rose 3% year over year and surpassed the Zacks Consensus Estimate of $812 million. Net sales grew 4% on a constant-currency basis.

Sales by Region and Brands

Sales were strong in the United States, up 9% year over year to $636.1 million. International sales declined 12% year over year to $199.9 million. Sales in the EMEA fell 15% to $139.3 million. In APAC, sales grew 11% to $33.3 million. Other sales plunged 19% to $27.3 million.

Brand-wise, net sales at Hollister declined 7% year over year to $400 million, while at Abercrombie, sales advanced 14% to $436 million. Our estimates for Hollister and Abercrombie sales were $406 million and $407.4 million, respectively.

Abercrombie & Fitch Company Price, Consensus and EPS Surprise

Abercrombie & Fitch Company price-consensus-eps-surprise-chart | Abercrombie & Fitch Company Quote

Margins

The gross margin expanded 570 bps to 61%. This can be attributed to 760 basis points from lower freight costs and 230 basis points from AUR growth, partly offset by 320 basis points from higher cotton and raw material costs, and 100 basis points from the adverse currency.

Operating expenses, excluding other operating income, were up 3% year over year. Higher technology expenses and incentive-based compensation more than offset lower digital marketing and fulfillment expenses.

As a percentage of sales, operating expenses of 57.3% expanded 30 bps from 57% in the prior-year quarter.

The adjusted operating income was $38.4 million against a loss of $6 million in the year-ago period.

Other Financials

Abercrombie ended the reported quarter with cash and cash equivalents of $447 million, long-term net borrowings of $297.2 million, and stockholders’ equity of $702 million, excluding non-controlling interests.

The company had a liquidity of $758 million at the end of the fiscal first quarter, which included cash and equivalents, and borrowing available under the ABL Facility. Net cash used for operating activities was $1 million as of Apr 29, 2023.

Store Update

In the fiscal first quarter, the company opened six stores, including three Hollister and Abercrombie stores each. It closed seven Hollister and three Abercrombie stores. As of Apr 29, 2023, its total store base was 758, including 556 stores in the United States and 202 stores internationally.

Outlook

For fiscal 2023, management envisions net sales to grow 2-4% year over year, up from the prior guidance of 1 to 3% growth. It expects the Abercrombie brand to outperform Hollister. Region-wise, the United States is likely to outperform International. Also, fiscal 2023 includes a 53rd week, which is estimated to benefit sales by $45 million. Store expansion is also a growth driver.

Abercrombie expects an operating margin of 5-6%, up from the earlier stated 4-5%. This includes gains of 250 bps from reduced freight and raw material costs, somewhat offset by inflation and increased operating expense investment for the 2025 Always Forward Plan initiatives. The company expects a capital expenditure of $160 million and a tax rate in the high-30s range, down from the previously mentioned mid-40s range.

For second-quarter fiscal 2023, the company expects sales growth of 4-6%. The operating margin is envisioned to be 2-3% compared to breakeven in the prior-year quarter. This is likely due to lower freight and raw material costs, partly offset by a marginal decline in the operating margin from inflation and increased operating expense investment for the 2025 Always Forward Plan initiatives. The effective tax rate is anticipated to be 50%.

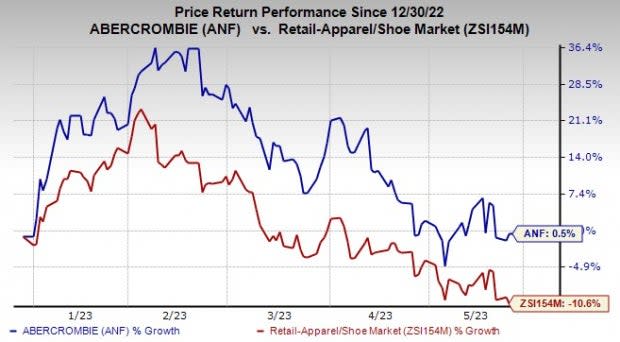

Image Source: Zacks Investment Research

Shares of this Zacks Rank #3 (Hold) company have gained 0.5% in the past three months against the industry's decline of 10.6%.

Stocks to Consider

Here are some better-ranked stocks, namely Tecnoglass TGLS, Kroger KR and TJX Companies TJX.

Tecnoglass manufactures and sells architectural glass and aluminum products for the residential and commercial construction industries. TGLS currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and earnings per share suggests growth of 18.1% and 23.8%, respectively, from the year-ago reported figures. TGLS has a trailing four-quarter earnings surprise of 22.7%, on average.

Kroger, a renowned grocery retailer, currently sports a Zacks Rank of 2 (Buy). KR has a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Kroger’s current financial year’s earnings per share suggests growth of 6.6% from the year-ago reported figure. KR has an expected earnings per share growth rate of 6% for three to five years.

TJX Companies, which operates as an off-price apparel and home fashion retailer, carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 10.5%.

The Zacks Consensus Estimate for TJX Companies’ current financial-year sales and earnings suggests growth of 6.4% and 14.5% from the year-ago period. TJX has a trailing four-quarter earnings surprise of 4.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report