Abiomed (ABMD) to Replace Wyndham in the S&P 500 Benchmark

Abiomed Inc. ABMD is scheduled to join the coveted S&P 500 benchmark before the market opens on May 31. The company is currently part of the S&P MidCap 400 index.

The S&P 500 index is periodically maneuvered to remove stocks that have been acquired by other companies, delisted from the stock exchange or failed to meet the mandatory criteria of the index. Consequently, other companies that meet the criteria are added to the list as replacement to the deleted stocks.

Notably, Abiomed will be replacing Wyndham Worldwide Corp. WYN in the S&P 500 index. The company will be added to the S&P 500 Global Industry Classification Standard (GICS) Health Care Supplies Sub-Industry index.

Benefits for Abiomed

With a portfolio of 500 leading companies that have approximately 80% coverage of the available market capitalization, the S&P 500 index is an important metric for the U.S. equities.

Any company reserving its forte in the S&P 500 stature should have a market capitalization of more than $4 billion. Abiomed currently has a market capitalization of $17.46 billion. Further, the company’s financial viability, adequate liquidity, reasonable price and sector representation has lent it a competitive edge in the U.S. MedTech industry.

We believe that the news should provide a solid boost for Abiomed’s shareholders, which has successfully met all inclusion criterias to join the S&P 500 list. The company’s shares have outperformed the S&P 500 index in a year’s time. The stock has returned 182.2%, significantly higher than the S&P 500’s rise of 12.6%.

Shares are expected to move higher as Abiomed's latest developments indicate probabilities of the company's penetration into the prophylactic high-risk PCI and cardiogenic shock patient market.

Key Factors Driving Abiomed

Impella, Abiomed’s flagship product line, has continued to be the key growth driver. Impella is the world's smallest heart pump. It is a support system of percutaneous, catheter-based devices offering hemodynamic support to the heart.

Recently, the Impella 2.5 was used successfully to treat a 68-year old cardiac patient at Mitsui Memorial Hospital, one of the leading cardiovascular centers in Japan. Such incidents elucidate strong clinical demand for Impella overseas.

Additionally, the installed customer base for Impella CP heart pumps grew by 41 new U.S. hospitals, taking the total count of Impella CP sites to 1,134. The installed customer base for Impella 5.0 heart pumps grew by 14 new U.S. hospitals, taking the total number of Impella 5.0 sites to 498. Further, Abiomed opened 36 new sites of Impella RP for a total of 222 hospitals, which set a record for patients supported. In the reported quarter, the Advisory Board, an independent expert healthcare consultant company acquired by United Healthcare, circulated two additional publications referencing Impella.

Broadening its flagship Impella heart pumps portfolio, Abiomed recently announced the receipt of FDA Pre-Market Approval (PMA) along with SmartAssist, also featuring an optical sensor in April, 2018. The company plans a controlled roll-out of the technologically advanced heart pump at hospital sites with developed heart recovery protocols over the next fiscal year.

The recent CE mark for the Impella 5.5 in Europe enhanced the product line significantly and enabled the company to advance in the field of heart recovery.

In the recently reported fourth quarter, Impella heart pumps garnered worldwide revenues worth $198.3 million, up 42% year over year. In the United States, Impella raked in $146.2 million, up 35% from the year-ago quarter’s level. Internationally, revenues generated from Impella heart pumps were $22.1 million, up a whopping 107%.

Lucrative Market Trends for Coronary Heart Diseases

We believe that Abiomed will continue to benefit from the rising number of patients suffering from coronary heart diseases (CHD) in the United States.

Per data available from Centers for Disease Control and Prevention (CDC), CHD is the most common type of heart disease that claims approximately 380,000 lives annually. Importantly, the United States bears $108.9 billion each year for CHD, which includes the cost of health care services, medications and lost productivity.

Abiomed’s product line focuses on procedures, offers devices which are minimally invasive and help patients overcome the trauma of open surgeries. The company’s products are becoming increasingly popular in lowering patient recovery time and saving hospitalization costs.

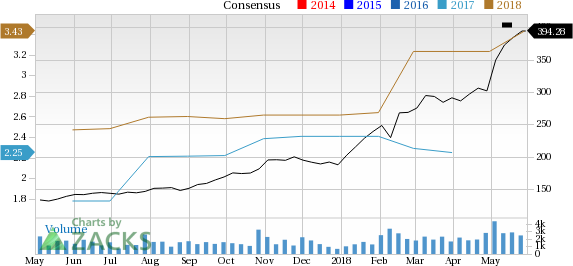

Estimates Moving Up

Buoyed by the these favorable tidings, the Zacks Consensus Estimate for the current quarter earnings have inched up 1.3% to 80 cents per share in a month’s time. For the full year, the Zacks Consensus Estimate rose 6.2% to $3.43.

ABIOMED, Inc. Price and Consensus

ABIOMED, Inc. Price and Consensus | ABIOMED, Inc. Quote

The stock flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Key Picks

A few other top-ranked stocks in the broader medical space are Genomic Health Inc GHDX and Varian Medical Systems, Inc VAR.

Genomic Health has an expected earnings growth rate of 187.5% and a Zacks Rank #1.

Varian Medical has a projected long-term earnings growth rate of 8%. The stock carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wyndham Worldwide Corp (WYN) : Free Stock Analysis Report

Varian Medical Systems, Inc. (VAR) : Free Stock Analysis Report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

Genomic Health, Inc. (GHDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.