Abiomed's (ABMD) preCARDIA Buyout Expands Its Product Portfolio

Abiomed, Inc. ABMD recently announced its buyout of preCARDIA to enhance treatment for patients with acute decompensated heart failure (“ADHF”). The acquisition of preCARDIA, a developer of a proprietary catheter and controller, is expected to complement Abiomed’s product portfolio for better patient outcomes.

For investors’ note, the preCARDIA system has received Breakthrough Device Designation by the FDA. Further, the system is available for investigational use only, and is not approved for use outside of clinical studies. However, a commercialization announcement of the system is likely to be made later in the year.

It should also be noted that preCARDIA has completed enrollment of 30 patients in an FDA early feasibility study, which demonstrated favorable results.

With the recent buyout, Abiomed aims to solidify its foothold in the global cardiac business.

Rationale Behind the Buyout

Per estimates, annually, more than a million patients are admitted to hospitals in the United States with ADHF. Further, despite the availability of pharmaceutical treatments, heart failure is the primary cause of hospitalization in patients above the age of 65 years.

The preCARDIA system aids heart failure specialists by offering a minimally-invasive solution having the potential to provide better patient outcomes. Also, cost of care is expected to be lowered with the provision of early intervention with this latest technology. The preCARDIA system has been developed to accelerate the treatment of ADHF-related volume overload by effectively reducing cardiac filling pressures and promoting decongestion to boost the overall cardiac and kidney functions.

Other potential benefits of the system include lesser duration of hospital stay, reduced re-hospitalizations and improved quality of life.

Per an expert associated with the preCARDIA system, the technology regulates the blood flowing into the heart, in turn reducing congestion and improving heart and renal function.

Industry Prospects

Per a report by Allied Market Research, the global congestive heart failure treatment devices market was valued at $10,127.2 million in 2015 and is estimated to reach $14,823.3 million by 2022 at a CAGR of 5.5%. Factors like rising emphasis on early intervention and primary prevention of heart-related disorders, along with technological advancements in treatment devices, are expected to drive the market.

Given the market potential, the latest acquisition is expected to significantly boost Abiomed’s global business.

Notable Developments

Of late, Abiomed has witnessed a few notable developments across its business.

The company, in its fiscal fourth-quarter 2021 results in April, recorded a robust revenue growth, primarily driven by its strength in worldwide Impella heart pump sales.

The same month, Abiomed announced the final results of the physician-led National Cardiogenic Shock Initiative Study. The results demonstrated a significant survival to discharge with greater than 90% native heart recovery when best practices are used, including placement of an Impella heart pump prior to revascularization.

Also in April, the company announced the enrollment of the first patient in PROTECT IV, which is a large, prospective, multi-center randomized controlled trial designed to provide the level of clinical evidence needed to achieve a Class I guideline recommendation for Impella in high-risk percutaneous coronary intervention.

Price Performance

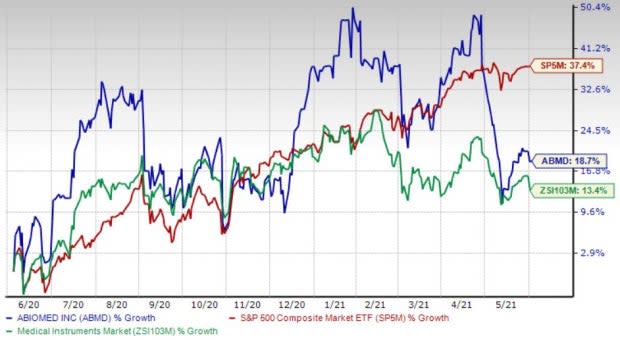

Shares of the company have gained 18.8% in the past year compared with the industry’s 13.4% growth and the S&P 500's 37.5% rise.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Abiomed carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC, DaVita Inc. DVA and Veeva Systems Inc. VEEV, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Henry Schein’s long-term earnings growth rate is estimated at 11.2%.

DaVita’s long-term earnings growth rate is estimated at 14.4%.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research