ACADIA's (ACAD) Q3 Earnings and Revenues Beat Estimates

ACADIA Pharmaceuticals Inc. ACAD reported third-quarter 2021 loss of 9 cents per share, narrower than the Zacks Consensus Estimate of a loss of 27 cents. In the year-ago quarter, the company incurred a loss of 54 cents per share.

Total revenues, comprising net sales of ACADIA's only marketed drug Nuplazid (pimavanserin), increased 9% year over year to $131.6 million for the third quarter driven by volume growth. The top line also beat the Zacks Consensus Estimate of $127.4 million.

Nuplazid is the first and the only FDA-approved treatment for hallucinations and delusions associated with Parkinson’s disease psychosis.

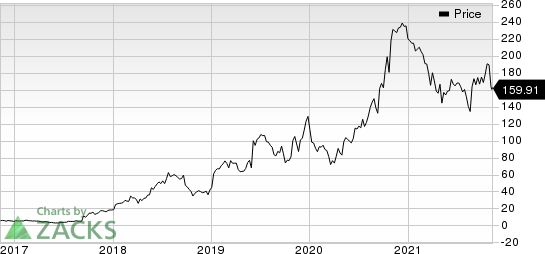

Shares of Acadia were up almost 7% in after-market trading following the earnings announcement, as investors welcomed the narrower-than-expected loss and sales growth. Yet, shares of the company have plunged 63.4% in the year so far compared with the industry’s 12.2% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Research and development (R&D) expenses were $58.6 million for the quarter, down 51.2% from the year-ago period, as the company acquired CerSci Therapeutics during the year-ago quarter.

Selling, general and administrative (SG&A) expenses were almost flat year over year at $81.7 million.

As of Sep 30, 2021, ACADIA had cash, cash equivalents and investments worth $540.3 million compared with $556.9 million on Jun 30, 2021.

2021 Guidance

Owing to the continuing negative impact of the COVID-19 pandemic, ACADIA lowered the upper range of its financial guidance for 2021. Nuplazid net sales are now expected in the range of $480-$500 million for 2021 compared with the earlier projection of $480-$515 million. The Zacks Consensus Estimate for the metric stands at $487.3 million.

The company also lowered its expectation for R&D expenses to the range of $230-$245 million from $250-$270 million expected earlier. Its SG&A expense guidance for the full year is now expected in the range of $385-$405 million, reflecting a decline from the upper end of the earlier expectation of $385-$415 million.

Pipeline Updates

ACADIA announced that it has scheduled a meeting with the FDA before the end of 2021 to discuss additional analyses that will support a potential re-filing of the supplemental new drug application (sNDA) for Nuplazid focused on specific subgroups of dementia without the need for an additional clinical study. The sNDA is seeking label expansion for Nuplazid as a potential treatment of hallucinations and delusions associated with dementia-related psychosis (“DRP”).

We remind investors that the company completed a Type A End of Review meeting in the previous quarter related to the FDA’s complete response letter for its sNDA for Nuplazid in DRP. The FDA stated in the meeting that Nuplazid should be studied by individual subgroups of dementia and advised ACADIA to conduct an additional clinical study in each of the subgroups in which the company is seeking approval.

Several additional studies on Nuplazid targeting different central nervous system (“CNS”) indications are currently underway. These studies include the phase III ADVANCE study for treating negative symptoms of schizophrenia.

Apart from Nuplazid, ACADIA is also developing other pipeline candidates. The company is evaluating its pipeline candidate trofinetide in a phase III LAVENDER study for the treatment of Rett syndrome, a rare neurodevelopmental congenital CNS disorder for girls aged between 5 and 20 years. Top-line data from the same is anticipated in fourth-quarter 2021.

The company is also evaluating ACP-044 for the treatment of postoperative pain following bunionectomy surgery in a phase II study. Top-line data from the study is now anticipated in first-quarter 2020. Earlier, it was expected to report the data in fourth-quarter 2021. The delay is attributable to slower-than-expected enrolment of participants due to postponement of surgeries as a result of the pandemic.

ACADIA Pharmaceuticals Inc. Price

ACADIA Pharmaceuticals Inc. price | ACADIA Pharmaceuticals Inc. Quote

Zacks Rank & Stocks to Consider

ACADIA currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Alkermes ALKS, Endo International ENDP and Regeneron Pharmaceuticals REGN, each carrying a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Alkermes’ earnings per share estimates for 2021 have increased from $0.61 to $0.68 in the past 60 days. The same for 2022 has risen from $1.06 to $1.11 in the past 60 days. The stock has rallied 47% in the year so far.

Endo’s earnings per share estimates for 2021 have increased from $2.29 to $2.32 in the past 60 days. The same for 2022 has risen from $2.24 to $2.25 over the same period.

Regeneron’s earnings per share estimates for 2021 have increased from $54.28 to $63.32 in the past 60 days. The same for 2022 has risen from $44.11 to $47.01 over the same period. The stock has rallied 28.9% in the year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Endo International plc (ENDP) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research