The Acceleron Pharma (NASDAQ:XLRN) Share Price Has Gained 93% And Shareholders Are Hoping For More

One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Acceleron Pharma Inc. (NASDAQ:XLRN) shareholders have seen the share price rise 93% over three years, well in excess of the market return (40%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 20%.

Check out our latest analysis for Acceleron Pharma

Because Acceleron Pharma made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years Acceleron Pharma has grown its revenue at 13% annually. That's pretty nice growth. The share price gain of 24% per year shows that the market is paying attention to this growth. Of course, valuation is quite sensitive to the rate of growth. Of course, it's always worth considering funding risks when a company isn't profitable.

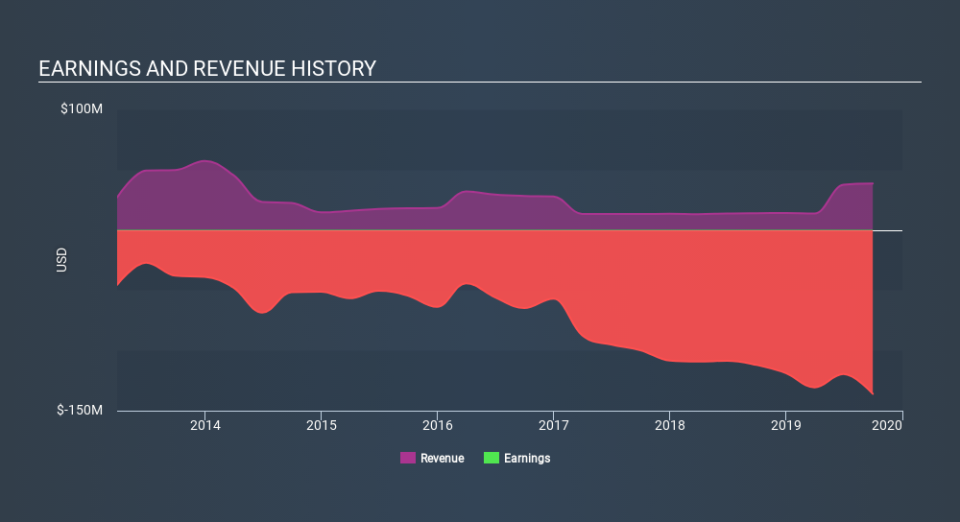

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Acceleron Pharma stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Acceleron Pharma provided a TSR of 20% over the last twelve months. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 5.9% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Acceleron Pharma is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.