Accident & Health Stock Q1 Earnings Due Apr 27: AFL, EIG, AMSF

The first-quarter earnings season is expected to be mixed for Insurance industry players. The Accident and Health Insurance space, in particular, is likely to have witnessed prudent underwriting and an increase in underwriting exposure, which, in turn, is likely to boost the companies’ first-quarter results. Yet, soft pricing and increased claims frequency might have been spoilsports. Some of the Accident and Health insurers like Aflac Incorporated AFL, Employers Holdings, Inc. EIG, and AMERISAFE, Inc. AMSF are set to reveal quarterly numbers tomorrow.

The Insurance - Accident and Health space belongs to the Finance sector (one of the 16 broad Zacks sectors within the Zacks Industry classification), whose overall earnings are projected to decline 13.9% year over year, while revenues are expected to jump 2.6%, per the latest Earnings Preview. The year-over-year decrease in earnings, especially for Accident and Health insurers, is expected to have been caused by a soft pricing environment and reduced investment yields on fixed-income securities. Nonetheless, an increase in earned premiums might have partially offset the negatives.

Let’s delve deeper and take a look at the key factors that are likely to have impacted Accident and Health insurers during the first quarter.

Major Influencing Factors

Throughout the first quarter, business activities were rapidly returning to normal levels. With increased business activities and rising awareness about the benefits of having accident insurance coverages, workers’ compensation insurance products might have witnessed increased demand in the first quarter. This might have boosted revenues of Accident and Health insurers in this time period.

High hazard underwriting expertise and intensive claims management of the Accident and Health insurance providers might have aided the companies in the first quarter. An efficient operating platform with a competitive expense ratio might have enabled the companies to generate a higher level of underwriting profit.

The pre-existing competitive environment in the Accident and Health space is likely to have kept pricing under pressure. Also, elevated spending on growth initiatives to gain a competitive edge might have affected their earnings in the short term. The return of business activities to normal levels is expected to have resulted in higher claims for the companies and negatively impact their results. Yet, the rise in claims might have offered the industry players some opportunities to increase pricing, which might take effect at a later stage.

Reduced investment yields on fixed-income securities might have affected the companies in the first quarter. Even though the Fed approved a rate hike in March, it was too low to have any significant impact on investment yields in the quarter under review.

Accident and Health Insurers Reporting on Apr 27

Given such a backdrop, let us see how the following three companies are placed ahead of their first-quarter earnings release tomorrow.

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

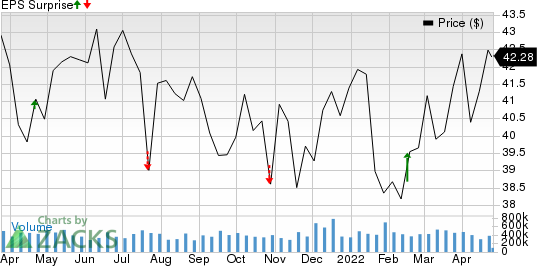

Aflac Incorporated: Its Aflac U.S. segment is likely to have benefited from new business formation, lower incurred benefits, a strong dental and vision network, solid premium persistency rates and improving sales in the first quarter. The Zacks Consensus Estimate for pretax operating earnings in the segment is pegged at $292 million. Also, net investment income stemming from a sound private equity portfolio is likely to have favored the Aflac Japan segment in the first quarter. The consensus mark for pretax operating earnings for this segment is pegged at $850 million.

Due to substantial investments in core technology platforms or digital capabilities, costs might have remained high during this time period, thereby affecting profits. Also, a spike in the benefit ratio might have weighed on Aflac’s margins. The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top lines is $1.38 per share and $5.2 billion, respectively. This indicates a year-over-year earnings and revenue decline of 9.8% and 12.2%, respectively. As far as earnings surprises are concerned, Aflac beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average of 18.2%.

Aflac Incorporated Price and EPS Surprise

Aflac Incorporated price-eps-surprise | Aflac Incorporated Quote

Our proven model predicts an earnings beat for AFL this time around as well. This is because it has an Earnings ESP of +1.76% and a Zacks Rank #3. (Read more: Aflac to Report Q1 Earnings: What's in the Cards?)

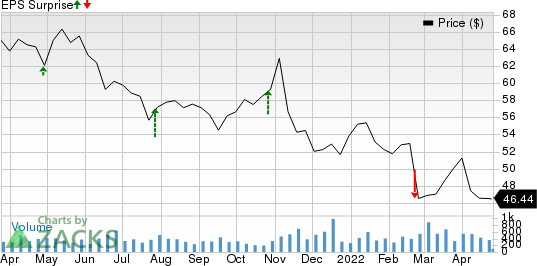

Employers Holdings: The Zacks Consensus Estimate for net premiums earned in the first quarter indicates a 10.4% year-over-year increase. Based in Reno, NV, Employers Holdings is expected to have benefited from a solid presence in attractive markets and prudent underwriting.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top lines is 47 cents per share and $165.9 million, respectively. This indicates a year-over-year earnings decline of 7.8% but a revenue increase of 1.4%. As far as earnings surprises are concerned, Employers Holdings beat the Zacks Consensus Estimate twice in the last four quarters and missed on the other two occasions, delivering an average surprise of 6.9%.

Employers Holdings Inc Price and EPS Surprise

Employers Holdings Inc price-eps-surprise | Employers Holdings Inc Quote

Our proven model predicts an earnings beat for Employers Holdings this time around as well. This is because it has an Earnings ESP of +16.13% and a Zacks Rank #3.

AMERISAFE: The Zacks Consensus Estimate for net premiums earned in the first quarter indicates a 7% year-over-year decrease. Further, the consensus mark for net investment income signals a 7.6% decrease from the year-ago period. Also, the net combined ratio is expected to have increased in the first quarter, thereby affecting its profits.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top lines is 61 cents per share and $72 million, respectively. This indicates a year-over-year earnings and revenue decline of 19.7% and 7.1%, respectively. As far as earnings surprises are concerned, AMERISAFE beat the Zacks Consensus Estimate thrice in the last four quarters and missed once, delivering an average negative surprise of 3.4%.

AMERISAFE, Inc. Price and EPS Surprise

AMERISAFE, Inc. price-eps-surprise | AMERISAFE, Inc. Quote

Our proven model does not predict an earnings beat for AMERISAFE this time around. This is because it has an Earnings ESP of +6.56% but a Zacks Rank #5 (Strong Sell).

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aflac Incorporated (AFL) : Free Stock Analysis Report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

Employers Holdings Inc (EIG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research