Activision Blizzard Q2 Preview: Rebound Quarter in Store?

There have been several significant acquisitions throughout 2022, and one in particular from a tech titan.

In January, Microsoft MSFT acquired Activision Blizzard ATVI for $68.7 billion to bolster its stance within the gaming industry.

Activision Blizzard is a leader in video game development and an interactive entertainment content publisher, most well-known for Call of Duty.

It was a massive deal; it ranks as the largest acquisition in the gaming industry’s history.

Now, it’s time for ATVI to report quarterly results on Monday, August 1st, after market close.

So, how does the video game giant shape up heading into the quarterly print? Let’s take a deeper dive and find out.

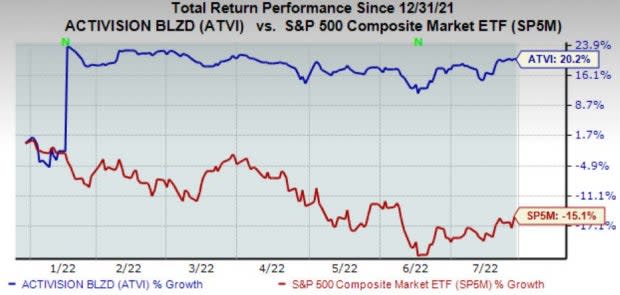

Share Performance & Valuation

Year-to-date, Activision Blizzard shares have primarily traded sideways, aside from the significant boost that the acquisition news gave shares back in January. Still, shares are up 20% in 2022.

Image Source: Zacks Investment Research

However, ATVI shares have declined 4.3% overall over the last year. The one-year chart of share performance looks quite unique, to say the least.

Image Source: Zacks Investment Research

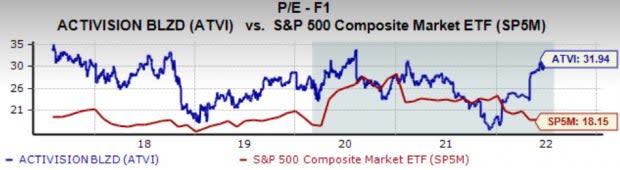

Activision shares appear to be highly elevated in terms of valuation. Its 31.9X forward P/E ratio is well above its five-year median of 27.1X and represents a sizable 76% premium relative to the general market.

In addition, the company sports a Style Score of a D for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts’ earnings estimates have been mixed for the quarter to be reported, with one upwards revision and one downwards revision hitting the tape over the last 60 days.

Image Source: Zacks Investment Research

As it stands, the Zacks Consensus EPS Estimate sits at $0.46, reflecting a concerning 50% decrease in quarterly earnings year-over-year.

In addition, the company’s top-line appears to be weakening as well – the $1.5 billion quarterly revenue estimate pencils in a 20% decrease from year-ago quarterly sales of $1.9 billion.

Quarterly Performance & Market Reactions

Activision Blizzard has posted two consecutive bottom-line misses, undoubtedly heading in the wrong direction. Just in its latest quarter, the company registered a 47% EPS miss.

Quarterly sales numbers have been reported under expectations as of late as well – ATVI has missed on the top-line in each of its previous two quarters, both by double-digit percentages. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Furthermore, the market hasn’t liked what it’s seen from Activision Blizzard as of late, with shares moving downwards following four of the company’s five previous earnings reports.

Bottom Line

The acquisition news has massively boosted year-to-date share performance. Prior to that, ATVI shares were stuck in a nasty downtrend.

In addition, both the top and bottom-line are forecasted to decrease by double-digit percentages, and shares appear elevated in terms of valuation.

ATVI has struggled to report quarterly results above expectations as of late, and the market hasn’t been impressed with quarterly results.

Heading into the quarterly report, Activision Blizzard ATVI is a Zacks Rank #3 (Hold) with an Earnings ESP Score of 32%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Activision Blizzard, Inc (ATVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research