Should You Be Adding Kelso Technologies (TSE:KLS) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Kelso Technologies (TSE:KLS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Kelso Technologies

Kelso Technologies's Improving Profits

In the last three years Kelso Technologies's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Kelso Technologies's EPS soared from US$0.042 to US$0.064, over the last year. That's a impressive gain of 54%.

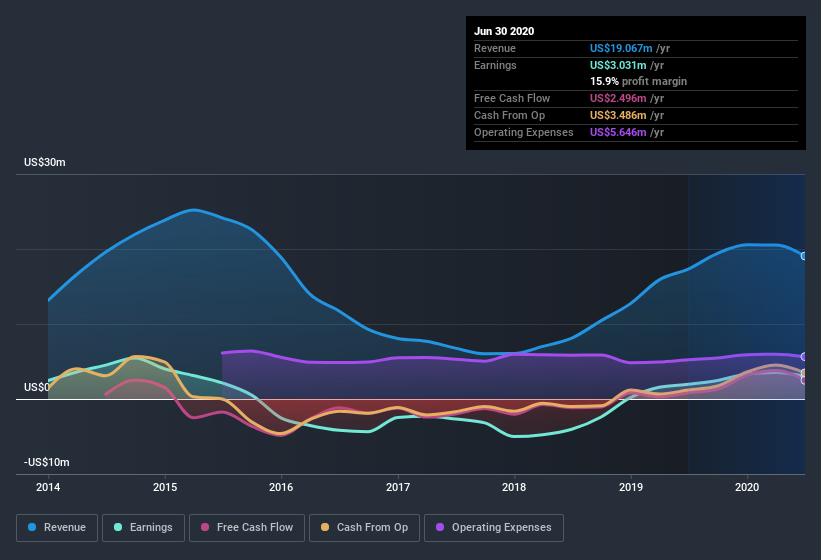

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Kelso Technologies's EBIT margins were flat over the last year, revenue grew by a solid 9.9% to US$19m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Kelso Technologies isn't a huge company, given its market capitalization of CA$35m. That makes it extra important to check on its balance sheet strength.

Are Kelso Technologies Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One positive for Kelso Technologies, is that company insiders paid US$18k for shares in the last year. While this isn't much, we also note an absence of sales. It is also worth noting that it was Independent Director Edward Cass who made the biggest single purchase, worth CA$7.4k, paying CA$0.73 per share.

Should You Add Kelso Technologies To Your Watchlist?

You can't deny that Kelso Technologies has grown its earnings per share at a very impressive rate. That's attractive. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. To put it succinctly; Kelso Technologies is a strong candidate for your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Kelso Technologies you should know about.

As a growth investor I do like to see insider buying. But Kelso Technologies isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.