ADT's Sunpro Buyout to Aid Its Rooftop Solar Growth Prospects

ADT Inc. ADT acquired Sunpro Solar in a cash and stock transaction worth $825 million. The announcement of the acquisition deal was made by ADT on Nov 9.

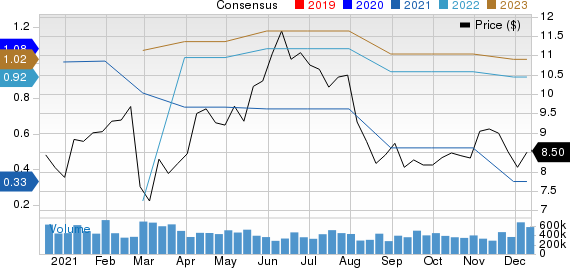

In the last two trading days, shares of ADT lost 1.8%, ending the trading session at $8.50 on Friday.

Sunpro provides solar power systems for rooftops of residential and commercial facilities in the United States. It has operations in 22 states in the country, and a team of 3,600 dedicated and experienced people.

Inside the Headlines

The buyout price of $825 million comprises a $160-million cash component and the rest includes ADT’s 77.8 million common stock. The acquired business will be a standalone business of ADT and will operate as the latter’s indirect wholly-owned subsidiary.

With the addition of Sunpro, ADT is now well-positioned to reap the benefits of the growing need for energy management and the rising importance of sustainable solar energy. Sunpro is now rebranded as ADT Solar, with a focus on the rooftop solar business. Extended product and service offerings, customer base, market exposure, and an efficient workforce are buyout benefits for ADT.

In financial terms, ADT anticipates immediate accretion to its earnings before interest, tax, depreciation and amortization (EBITDA), and free cash flow from the Sunpro buyout. Also, in the coming 12 months, the buyout is predicted to boost ADT’s earnings per share. Notably, ADT has only assumed vehicle loans and leases of $20 million of Sunpro as part of the buyout.

In the first three quarters of 2021, ADT invested $16 million in acquiring businesses (net of cash acquired).

Zacks Rank, Price Performance and Earnings Estimate Trend

With a market capitalization of $7 billion, ADT currently carries a Zacks Rank #5 (Strong Sell). High costs and expenses are concerning for the company in the quarters ahead. Healthy monthly recurring revenues, solid product offerings and acquisition benefits are prevailing tailwinds.

For 2021, ADT revised its revenue projection to $5,200-$5,250 million from the previously mentioned $5,050-$5,250 million. Adjusted EBITDA are expected to be $2,150-$2,200 million compared with the previously stated $2,100-$2,200 million.

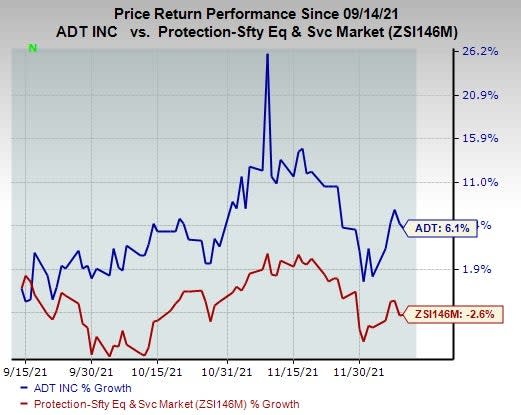

In the past three months, ADT’s shares have gained 6.1% against the industry’s decline of 2.6%.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for ADT’s earnings is pegged at 33 cents per share for 2021 and 92 cents for 2022, suggesting growth of 120% and 104.4% from the respective 60-day-ago figures. Earnings estimates for the fourth quarter of 2021 at 11 cents reflect a 42.1% decline from the 60-day-ago figure.

ADT Inc. Price and Consensus

ADT Inc. price-consensus-chart | ADT Inc. Quote

Three Players in the Sector With Active Buyouts

Three stocks in the Zacks Industrial Products sector, which are actively engaged in buyouts, are discussed below.

Helios Technologies, Inc. HLIO acquired China-based Shenzhen Joyonway Electronics & Technology Co., Ltd.’s electronic control systems and parts business in October 2021. Helios purchased Italy-based NEM S.r.l in July 2021, while it bought BJN Technologies, LLC in January 2021. HLIO presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Helios’ shares have gained 19.4% in the past three months. The Zacks Consensus Estimate for HLIO’s earnings has increased 7.9% for 2021 and 9.8% for 2022 in the past 60 days.

Applied Industrial Technologies, Inc. AIT acquired Gibson in January 2021 and R.R. Floody in August 2021. The R.R. Floody buyout has been strengthening its offerings in the automation technology space and boosting its reach across the U.S. Midwest market. AIT presently carries a Zacks Rank #2 (Buy).

Shares of Applied Industrial have gained 19.5% in the past three months. The Zacks Consensus Estimate for AIT’s earnings has increased 1.9% for fiscal 2022 (ending June 2022) and 2.2% for fiscal 2023 (ending June 2023) in the past 60 days.

Allegion plc ALLE acquired technology company Yonomi in January 2021, and certain assets of Astrum Benelux B.V. and WorkforceIT B.V. in July 2021. ALLE presently carries a Zacks Rank #3.

Shares of Allegion have lost 6.1% in the past three months. The Zacks Consensus Estimate for earnings has decreased 1.6% for 2021 and has been unchanged for 2022 in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

ADT Inc. (ADT) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Helios Technologies, Inc (HLIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research