Advanced Drainage (WMS) Looks Promising: Invest in the Stock

Advanced Drainage Systems, Inc. WMS is gaining strength from solid contributions from Allied Products, Infiltrator and the residential end markets. Also, the new production equipment installation has been added to the positives.

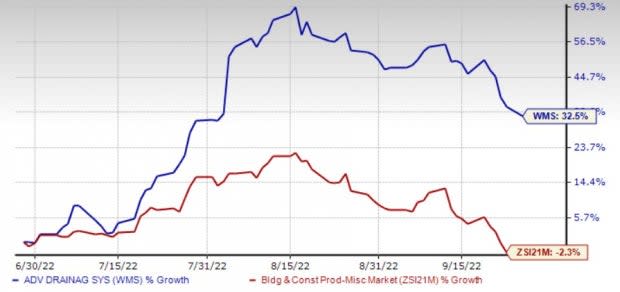

Shares of this leading provider of innovative water management solutions in the stormwater and onsite septic wastewater industries have gained 32.5% in the past three months against the Zacks Building Products – Miscellaneous industry’s 2.3% decline.

Earnings estimates for fiscal 2023 and 2024 have been revised upward by 51.1% and 19.6%, respectively, in the past 60 days, suggesting that sentiments on WMS are moving in the right direction. Let’s delve deeper and find out what’s fueling this Zacks Rank #1 (Strong Buy) stock. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Solid Performance: Headquartered in Hilliard, OH, this company provides innovative water management solutions in stormwater and onsite septic wastewater industries. The company has been navigating the challenges related to inflationary cost pressures in transportation and manufacturing operations with broad-based growth across the construction end markets and geographies it serves, with notable strength in its priority states. The pricing actions have been more than offsetting its raw material costs.

In the first quarter of fiscal 2023, the company’s net sales increased 36.6% year over year to $914.2 million. Domestic Pipe sales rose 40.3%, Domestic Allied Products & Other sales gained 56.6% and Infiltrator sales increased 31.2% during the quarter. These upsides were driven by double-digit sales growth in the U.S. construction end markets. International sales increased 9.4%, given strong sales growth in the Canadian, Mexican and Exports businesses. Notably, adjusted EBITDA rallied 79.5% year over year.

Higher Expected Earnings Growth Rate: For fiscal 2023, the Zacks Consensus Estimate for revenues and earnings is pegged at $3.34 billion and $6.39 per share, reflecting year-over-year growth of 20.4% and 79.5%, respectively.

Higher ROE: WMS’ trailing 12-month ROE is indicative of growth potential. ROE for the trailing 12 months is 48%, much higher than the industry’s 5.7%, reflecting the company’s efficient usage of shareholders’ funds.

Upbeat View: Given solid performance in the fiscal first quarter and backlog of existing orders and business trends, the company raised its views for this fiscal year for revenues and Adjusted EBITDA. Net sales are now expected to be in the range of $3.250 billion to $3.350 billion. Adjusted EBITDA is expected to be in the range of $900-$940 million.

Other Top-Ranked Stocks in the Construction Sector

Arcosa, Inc. ACA, currently sporting a Zacks Rank #1, is a manufacturer of infrastructure-related products and services, serving construction, energy and transportation markets.

ACA’s expected earnings growth rate for 2022 is 19.7%. The Zacks Consensus Estimate for current-year earnings has improved to $2.31 per share from $2.08 over the past 30 days.

United Rentals, Inc. URI, presently sporting a Zacks Rank #1, has been benefiting from a broad-based recovery of activity across its end markets served. Higher margins from rental revenues and used equipment sales are added benefits.

The Zacks Consensus Estimate for URI’s 2022 earnings rose to $31.73 per share from $29.70 in the past 60 days. The estimated figure suggests 43.8% year-over-year growth.

Dycom Industries, Inc. DY is benefiting from the higher demand for network bandwidth and mobile broadband, extended geography, proficient program management and network planning services. Dycom expects considerable opportunities across a broad array of customers.

Dycom’s, currently sporting a Zacks Rank #1, earnings for fiscal 2023 are expected to grow 142.1%. The Zacks Consensus Estimate for DY’s 2022 earnings rose to $3.68 per share from $3.37 in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Drainage Systems, Inc. (WMS) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research