Aegion (NASDAQ:AEGN) Shareholders Booked A 38% Gain In The Last Five Years

If you buy and hold a stock for many years, you'd hope to be making a profit. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Aegion Corporation (NASDAQ:AEGN) share price is up 38% in the last five years, that's less than the market return. Looking at the last year alone, the stock is up 13%.

View our latest analysis for Aegion

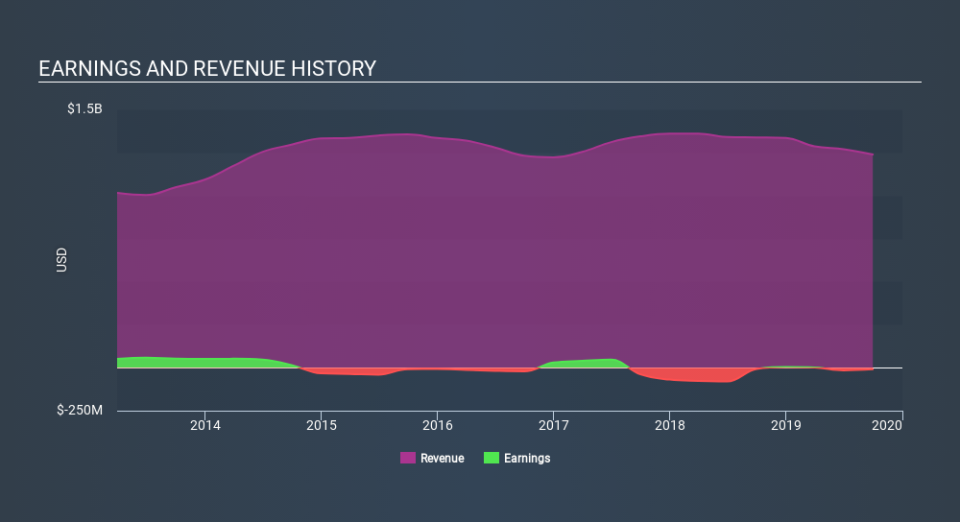

Aegion wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Aegion saw its revenue shrink by 0.4% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 6.6% per year over that time. Arguably that's not bad given the soft revenue and loss-making position. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Aegion shareholders are up 13% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 6.6% over half a decade This suggests the company might be improving over time. You could get a better understanding of Aegion's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.