Is AEGON N.V. (AEG) A Good Stock To Buy?

"The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak," are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards AEGON N.V. (NYSE:AEG) and see how it was affected.

Is AEGON N.V. (NYSE:AEG) a buy, sell, or hold? The best stock pickers are in a pessimistic mood. The number of long hedge fund bets were cut by 1 recently. Our calculations also showed that aeg isn't among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are seen as underperforming, old financial tools of yesteryear. While there are over 8000 funds trading today, Our experts look at the crème de la crème of this group, approximately 750 funds. These money managers command bulk of the smart money's total asset base, and by shadowing their unrivaled investments, Insider Monkey has uncovered a few investment strategies that have historically surpassed the broader indices. Insider Monkey's flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

[caption id="attachment_746830" align="aligncenter" width="473"]

Matthew Hulsizer of PEAK6 Capital[/caption]

Let's take a look at the key hedge fund action encompassing AEGON N.V. (NYSE:AEG).

What does smart money think about AEGON N.V. (NYSE:AEG)?

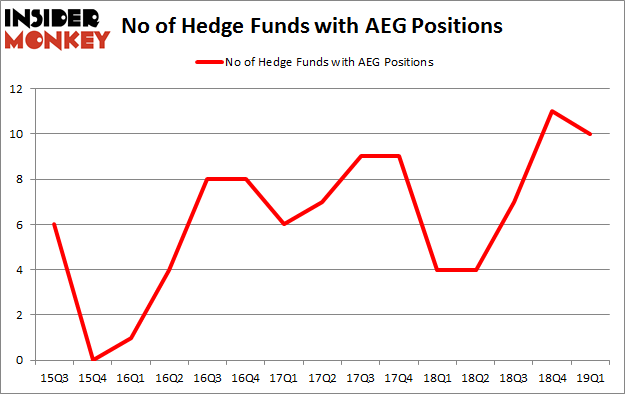

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AEG over the last 15 quarters. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey's hedge fund database, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the number one position in AEGON N.V. (NYSE:AEG). Arrowstreet Capital has a $22.6 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Ken Griffin of Citadel Investment Group, with a $3.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish comprise Jim Simons's Renaissance Technologies, and Paul Marshall and Ian Wace's Marshall Wace LLP.

Judging by the fact that AEGON N.V. (NYSE:AEG) has faced bearish sentiment from the aggregate hedge fund industry, it's easy to see that there were a few money managers that slashed their entire stakes by the end of the third quarter. At the top of the heap, Simon Sadler's Segantii Capital dumped the biggest investment of the "upper crust" of funds watched by Insider Monkey, totaling an estimated $4.8 million in stock. Matthew Hulsizer's fund, PEAK6 Capital Management, also dropped its stock, about $0.2 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let's now review hedge fund activity in other stocks similar to AEGON N.V. (NYSE:AEG). We will take a look at WestRock Company (NYSE:WRK), PagSeguro Digital Ltd. (NYSE:PAGS), 58.com Inc (NYSE:WUBA), and Spectra Energy Corp. (NYSE:SE). This group of stocks' market valuations resemble AEG's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position WRK,23,460835,-6 PAGS,30,1280413,6 WUBA,24,528862,1 SE,50,2178777,36 Average,31.75,1112222,9.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $1112 million. That figure was $31 million in AEG's case. Spectra Energy Corp. (NYSE:SE) is the most popular stock in this table. On the other hand WestRock Company (NYSE:WRK) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks AEGON N.V. (NYSE:AEG) is even less popular than WRK. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on AEG, though not to the same extent, as the stock returned 4.9% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index