Will Aerospace Unit Drive General Dynamics' (GD) Q2 Earnings?

General Dynamics Corporation GD is scheduled to release second-quarter 2019 results on Jul 24, before the opening bell.

A steady flow of contracts should drive the company’s revenues in the upcoming quarterly results.

Let’s take a detailed look at the factors influencing General Dynamics’ second-quarter results.

Aerospace Unit: A Key Catalyst

General Dynamics’ Aerospace segment revenues are expected to have witnessed a rise in the deliveries of G500 aircraft in the second quarter. Moreover, service revenues for the segment exceeded $500 million for the fourth straight time in the first quarter. We may expect similar trends to have continued, thereby boosting the segment’s revenues in the second quarter.

In line with this, the Zacks Consensus Estimate for the company’s largest segment’s second-quarter revenues is pegged at $2,237 million, implying 18% increase from revenues reported in the year-ago quarter.

Q2 Backlog to Wither

General Dynamics has an impressive history of acquiring several orders from both Pentagon and its foreign allies, courtesy of the huge demand for its enhanced military shipbuilding capabilities. However, during the second quarter, the company was unable to secure the big contracts. This could lead to a reduction in the company's backlog in the upcoming quarterly results.

Other Factors at Play

The company’s Marine Systems unit is expected to witness revenue growth, as it foresees increasing demand for submarines and support ships. As a result, the company expects to invest the largest share of its capital budget in this segment for the rest of the year.

Meanwhile, General Dynamics witnesses increased demand from its Navy customers across all three of its shipyards. The demand growth is likely to drive overall revenues in the to-be-reported quarter. Evidently, the Zacks Consensus Estimate for the company’s second-quarter sales is pegged at $9.4 billion, indicating 2.4% growth from the year-ago quarter’s reported figure.

However, General Dynamics has been witnessing higher interest expenses for the last few quarters, primarily due to the debt issued to finance the acquisition of CSRA Inc. Moreover, the company has been incurring higher income tax expenses for the last couple of quarters. We expect such trends to continue in the second quarter and dent the company’s bottom-line performance.

Consequently, the Zacks Consensus Estimate for General Dynamics’ second-quarter earnings is pegged at $2.68, suggesting a decline of 5% from the year-ago quarter’s reported figure.

What the Zacks Model Unveils

Our proven model does not show that General Dynamics is likely to beat earnings estimates in the second quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

General Dynamics has an Earnings ESP of -0.11% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Please note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

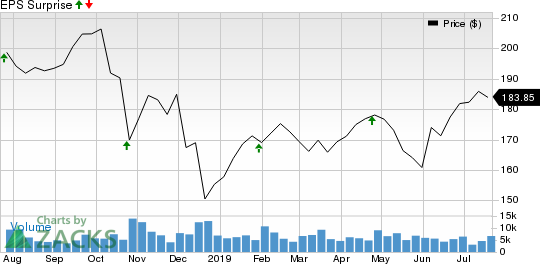

General Dynamics Corporation Price and EPS Surprise

General Dynamics Corporation price-eps-surprise | General Dynamics Corporation Quote

Stocks to Consider

Here are some defense companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Lockheed Martin Corp. LMT is expected to report second-quarter 2019 results on Jul 23. The company has an Earnings ESP of +0.14% and a Zacks Rank #1.

The Boeing Company BA is scheduled to report second-quarter 2019 results on Jul 24. The company has an Earnings ESP of +2.72% and a Zacks Rank #3.

Ducommun Incorporated DCO is scheduled to report second-quarter 2019 results on Aug 5. The company has an Earnings ESP of +12.05% and a Zacks Rank #3.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Dynamics Corporation (GD) : Free Stock Analysis Report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Ducommun Incorporated (DCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research