Aetna (AET) Reaches 52-Week High on a Solid Second Quarter

Shares of Aetna Inc AET hit a 52-week high of $199.32 in Friday’s trading session before closing a tad lower at $198.86, primarily driven by the company’s solid performance in the second quarter.

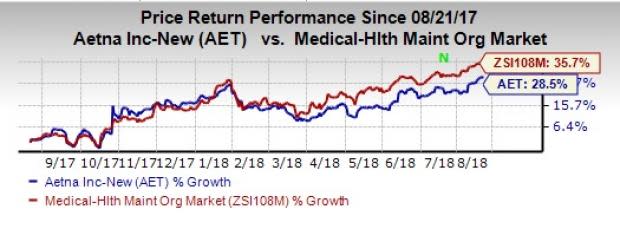

The stock has rallied 28.5% in the past year, underperforming its industry’s growth of 35.7%.

The company stoked/retained investors' favorable sentiment surrounding the stock with earnings beat in the second quarter wherein it maintained its trend of surpassing estimates from the last four quarters.

During the second quarter, earnings of $3.43 per share beat the Zacks Consensus Estimate by 11.7% and grew 0.3% year over year. Results reflected a strong performance from the company's Healthcare segment, which in turn, aided revenues by 4.1% year over year in the reported period.

Investors are also impressed by Aetna’s reach in Medicare business, which has been expanding over the last several quarters. The sale of a substantial portion of its Group Health Insurance segment consisting of its domestic group life insurance, group disability insurance and absence management businesses for $1.45 billion in cash is also viewed favorably by investors. The business was already underperforming and the deal will enable Aetna to focus on its core businesses such as Medicare and Health Care. We also expect the sale proceeds to be used in enhancing Aetna’s customer experience, business investments and debt repayment.

Aetna’s strong balance sheet is also encouraging. Total assets were $58.3 billion as of Jun 30, 2018, up 5.7% year over year. Long-term debt decreased 4.6% from the year-end 2017 levels to $7.8 billion. Debt-to-capitalization ratio was 31.9% as of Jun 30, 2018, down 510 basis points from Dec 31, 2017 levels. Its strong balance sheet enables the company to invest in growth-boosting projects.

We believe that this Zacks Rank #3 (Hold) company has great growth potential, also apparent from its long-term earnings growth rate of 10.3% and a favorable Growth Score of B.

Stocks to Consider

Investors looking for some better-ranked impressive stocks may consider options like WellCare Health Plans, Inc. WCG, Anthem, Inc. ANTM and UnitedHealth Group Incorporated UNH, each carrying a Zacks Rank #2 (Buy).

WellCare Health Plans, Inc. provides managed care services for government-sponsored health care programs. The company came up with a positive earnings surprise in all the last four quarters with an average beat of 53.89%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Operating as a health benefits company in the United States, Anthem, Inc. pulled of an encouraging positive earnings surprise of 6.65% over the preceding four quarters.

UnitedHealth operates as a diversified health care company in the United States. The stock delivered a positive surprise of 3.71%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aetna Inc. (AET) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

WellCare Health Plans, Inc. (WCG) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research