Is AEW UK Long Lease REIT PLC (LON:AEWL) Thriving Or Barely Surviving In The Real Estate Sector?

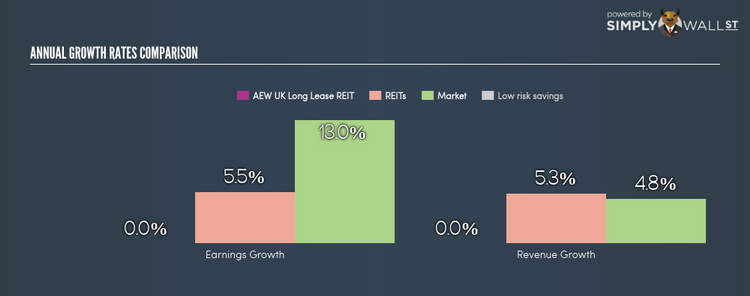

AEW UK Long Lease REIT PLC (LSE:AEWL) is a GBP£81.91M real estate investment trust (REIT), which is a collective vehicle for investing in real estate that began in the US and has since been adopted worldwide as an investment asset. Real estate analysts are forecasting for the entire industry, negative growth in the upcoming year , and an overall negative growth rate in the next couple of years. Unsuprisingly, this is below the growth rate of the UK stock market as a whole. Below, I will examine the sector growth prospects, as well as evaluate whether AEW UK Long Lease REIT is lagging or leading in the industry. View our latest analysis for AEW UK Long Lease REIT

What’s the catalyst for AEW UK Long Lease REIT’s sector growth?

Concerns surrounding rate increases and treasury yield movements have made investors dubious around investing in REIT stocks. This is because REITs tend to be dependent on debt funding. They are also considered as bond investment alternatives due to their high and stable dividend payments. In the previous year, the industry endured negative growth of -7.90%, underperforming the UK market growth of 11.51%. Given the lack of analyst consensus in AEW UK Long Lease REIT’s outlook, we could potentially assume the stock’s growth rate broadly follows its REIT industry peers. This means it is an attractive growth stock relative to the wider UK stock market.

Is AEW UK Long Lease REIT and the sector relatively cheap?

The REIT sector’s PE is currently hovering around 11x, below the broader UK stock market PE of 18x. This means the industry, on average, is relatively undervalued compared to the wider market – a potential mispricing opportunity here! Though, the industry returned a similar 11.57% on equities compared to the market’s 12.78%. Since AEW UK Long Lease REIT’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge AEW UK Long Lease REIT’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? REIT stocks are currently expected to grow slower than the average stock on the index. This means if you’re overweight in this sector, your portfolio will be tilted towards lower-growth. However, the sector is trading at a discount to the market, which may be reflective of the lower expected growth. If your investment thesis for AEW UK Long Lease REIT hasn’t changed, now may be an opportune time to accumulate more shares in the real estate stock.

Are you a potential investor? If you’ve been keeping an eye on the REIT sector, now may be the right time to dive deeper into the stock-level. Although it is expected to deliver lower growth on an industry level relative to the rest of the market, it is also trading at a PE below the average stock. In the case that the market is overly pessimistic on the real estate sector, there could be a mispricing opportunity to take advantage of.

For a deeper dive into AEW UK Long Lease REIT’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other real estate stocks instead? Use our free playform to see my list of over 100 other real estate companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.