AGCO Corp's (AGCO) Earnings & Revenues Trump Estimates in Q1

AGCO Corporation AGCO reported first-quarter 2020 adjusted earnings per share of 86 cents, flat year over year. The figure, however, beat the Zacks Consensus Estimate of 30 cents, reflecting a positive earnings surprise of 186.6%.

Including one-time items, the company reported net income of 85 cents per share in the first quarter compared with the 84 cents recorded in the prior-year quarter.

Revenues declined 3.4% year over year to $1,928 million due to production disruptions caused by the coronavirus outbreak. However, the figure beat the Zacks Consensus Estimate of $1,768 million. Excluding unfavorable currency-translation impact of 3.6%, net sales inched up 0.2% year over year.

Operational Update

Cost of sales dropped 4% to $1,478 million in the first quarter from the year-earlier period. Gross profit edged down 1.3% to $451 million in the March-end quarter from the $457 million recorded in the year-ago period. Gross margin came in at 23.3% for the January-March quarter compared with the prior-year quarter’s 22.8%.

Selling, general and administrative expenses slid to $248 million from the prior-year quarter’s $262 million. Adjusted income from operations increased 7.4% year over year to $101 million. Consequently, operating margin came in at 5.2% compared with the year-earlier quarter’s 4.7%.

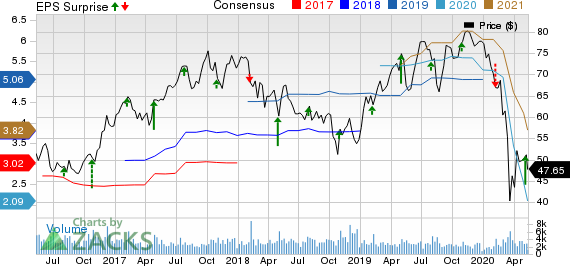

AGCO Corporation Price, Consensus and EPS Surprise

AGCO Corporation price-consensus-eps-surprise-chart | AGCO Corporation Quote

Segment Performance

Sales in the North America segment climbed 11.2% year over year to $552 million during the January-March period. The segment reported operating income of $61 million compared with the prior-year quarter’s $31 million.

Sales in the South America segment were down 1.4% year over year to $154 million. The segment reported an operating loss of $8.8 million compared with the prior-year quarter’s $8.5 million.

The EME (Europe/Middle East) segment’s sales came in at $1,113 million compared with the $1,211 million recorded in the year-ago period. The EME’s operating income slipped 20.3% year over year to $102 million.

Sales in the Asia/Pacific segment were down 17.8% year over year to $109 million. The segment reported operating loss of $1.3 million, as against the year-ago quarter’s operating profit of $3.4 million.

Financial Update

AGCO reported cash and cash equivalents of $387 million as of Mar 31, 2020, down from the $433 million recorded as of Dec 31, 2019. The company utilized $435.3 million of cash in operating activities during the three-month period ended Mar 31, 2020, compared with the $329.9 million reported in the prior-year period.

On Apr 9, AGCO completed a new term loan facility that provided additional liquidity of approximately $520 million.

Guidance

Given the uncertainty related to the industry demand and production constraints on account of the coronavirus outbreak, AGCO has withdrawn its financial guidance for the current year. However, the company continues to support retail sales activity in its global markets.

Replacement demand for aged fleet, lower commodity prices and a cautious farmer sentiment are influencing farm-equipment demand. Recently, the USDA announced a $16-billion COVID-19 Aid Package for U.S. farmers and livestock, which is likely to offset the negative impact of lower commodity prices to some extent.

Share Price Performance

Over the past year, AGCO’s stock has lost 33.2%, compared to the industry’s loss of 14.8%.

Zacks Rank and Stocks to Consider

AGCO currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the Industrial Products sector are Silgan Holdings Inc. SLGN, Ampco-Pittsburgh Corporation AP and Energous Corporation WATT. While Silgan sports a Zacks Rank #1 (Strong Buy), Ampco-Pittsburgh and Energous carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Silgan has a projected earnings growth rate of 11.3% for 2020. The company’s shares have gained 6% over the past three months.

Ampco-Pittsburgh has an expected earnings growth rate of 2.70% for the current year. The stock has appreciated 4% in the past three months.

Energous has an estimated earnings growth rate of 17.3% for the ongoing year. The company’s shares have rallied 17% in three months’ time.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Silgan Holdings Inc (SLGN) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

AmpcoPittsburgh Corporation (AP) : Free Stock Analysis Report

Energous Corporation (WATT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research