Agilent Eyes Cell Analysis Portfolio Expansion, To Buy ACEA

Agilent Technologies Inc. A has agreed to acquire a privately-held company, ACEA Biosciences Inc. (ACEA), for $250 million in cash.

Headquartered in San Diego, ACEA develops cell analysis instruments for life science research and clinical diagnostics. Its xCELLigence instruments enable real-time monitoring of cell growth, function, and cellular responses to many treatments, providing scientists with the required cellular assays. In addition, ACEA’s NovoCyte flow cytometers are useful in the field of flow cytometry.

ACEA’s instruments target vital life science applications, namely pre-clinical drug discovery and development, toxicology, safety pharmacology, and basic academic research.

This acquisition will enable Agilent to widen its growth prospects and further expand the company’s scope in the fast-growing cell analysis market. The deal complements the company’s product portfolio and will help it offer better services to customers.

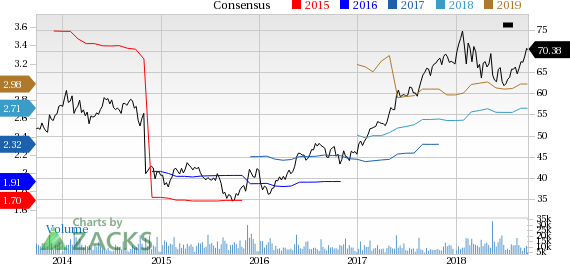

Notably, shares of Agilent have slightly underperformed the industry in the 12-month period. The stock has returned 9.7% compared with the industry’s growth of 15.6%.

Deal Rationale

The buyout will allow Agilent to fortify its presence in the high-growth cell analysis market.

Per a research report, the global cell analysis market is expected to reach $26.0 billion by 2020 from $19.0 billion in 2015, witnessing a compound annual growth rate (CAGR) of 6.56% from 2015 to 2020.

Jacob Thaysen, president of Agilent’s Life Sciences and Applied Markets Group, said, “Innovative approaches to cell analysis are driving market demand and leading to a better understanding of diseases and the discovery of potential therapeutics.”

Given stellar growth in this market, we believe the ACEA deal will help Agilent cash in on the fast-growing cell analysis market.

Our Take

Agilent Technologies is a broad-based original equipment manufacturer of test and measurement equipment. The company has been supplementing organizational growth with strategic acquisitions and collaborations.

The company set foot in this market in 2015 with the acquisition of Seahorse Bioscience. Seahorse’s XF technology has been utilized in research for an extensive range of diseases and disorders.

Over the past few years, strategic acquisitions have played a key role in shaping Agilent’s growth trajectory. All these buyouts have expanded its product portfolio.

We remain optimistic about Agilent's broad-based portfolio and increased focus on segments with higher growth potential.

Agilent Technologies, Inc. Price and Consensus

Agilent Technologies, Inc. Price and Consensus | Agilent Technologies, Inc. Quote

Zacks Rank & Other Key Picks

Currently, Agilent carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the same industry include Infineon Technologies AG IFNNY, ON Semiconductor Corporation ON and Rambus Inc. RMBS, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Infineon Technologies, ON Semiconductor and Rambus is currently projected at 7.5%, 13.2% and 10%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Infineon Technologies AG (IFNNY) : Free Stock Analysis Report

Rambus, Inc. (RMBS) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research