Agilent (A) Withdraws Q2 & FY20 View Amid Coronavirus Crisis

Agilent Technologies (A) has withdrawn its earlier announced guidance for the second quarter and fiscal 2020 on account of the coronavirus outbreak. The company has been facing disruption in business activities owing to coronavirus crisis.

Although Agilent’s fiscal second-quarter revenues grew 2% (up 1% on a core basis) through March, it witnessed significant disruption in business activities in late March, particularly in the United States and Europe. Its customers have either closed or restricted access to Agilent’s facilities in a bid to slow the spread of the virus.

The company is taking all the necessary steps to reduce expenses and protect the safety, health, and well being of employees and customers.

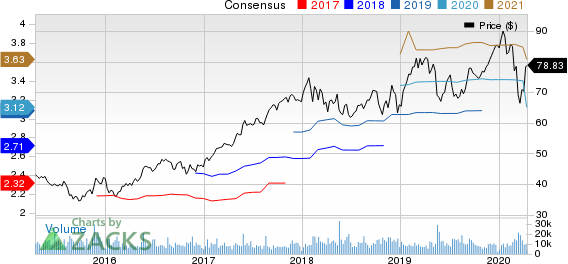

Agilent Technologies, Inc. Price and Consensus

Agilent Technologies, Inc. price-consensus-chart | Agilent Technologies, Inc. Quote

Guidance Withdrawn

During fiscal first-quarter 2020 conference call, Agilent provided its guidance for the second quarter and fiscal 2020. It had expected fiscal second-quarter revenues between $1.28 billion and $1.32 billion, and earnings per share in the range of 72-76 cents.

Agilent had anticipated fiscal 2020 revenues in the range of $5.50-$5.55 billion, indicating core growth of 4-5%, and non-GAAP earnings in the range of $3.38-$3.43 per share.

It had cautioned that the outbreak of coronavirus is a concern for the company and would impact end-user demand.

It has now withdrawn this guidance, citing that the uncertainty of the impact of the outbreak on financial and operating results cannot be reasonably estimated at this time.

Bottom Line

The coronavirus outbreak has dealt further blow to the electronic and testing equipment industry, which was already reeling under the protracted U.S.-China trade tensions and waning global demand. Factory closures across the globe, impact of restrictions imposed by different governments, supply chain disruptions, and low demand for goods, among others, have hit the sector hard.

However, Agilent’s financial position and long-term prospects remain strong. Its expanding product portfolio and end-market strength should continue to remain key growth drivers. The acquisition of BioTek Instruments should serve as a tailwind for Agilent. Further, the company’s focus on aligning investments toward more attractive growth avenues and innovative high-margin product launches is a positive.

The company will release fiscal second-quarter results on May 21.

Zacks Rank & Key Picks

Agilent currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Stamps.com Inc. STMP, Fiverr International Lt. FVRR and eBay Inc. EBAY. While Stamps.com and Fiverr International sport a Zacks Rank #1 (Strong Buy), eBay carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Stamps.com, eBay and Fiverr International is currently projected at 15%, 11.6% and 44.2%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

eBay Inc. (EBAY) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Stamps.com Inc. (STMP) : Free Stock Analysis Report

Fiverr International Lt. (FVRR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research