Ainsworth Game Technology And Other Mispriced Dividend Stocks

A great investment for income investors with a long time horizon is in dividend-paying companies such as Ainsworth Game Technology. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Furthermore, Ainsworth Game Technology is considered undervalued, which means investors will benefit from both dividend income and capital gains over time. I’ve made a list of value-adding dividend-paying stocks for you to consider for your investment portfolio.

Ainsworth Game Technology Limited (ASX:AGI)

Ainsworth Game Technology Limited designs, develops, produces, leases, sells, and services gaming machines, and other related equipment and services. Ainsworth Game Technology was founded in 1995 and with the stock’s market cap sitting at AUD A$359.11M, it comes under the small-cap stocks category.

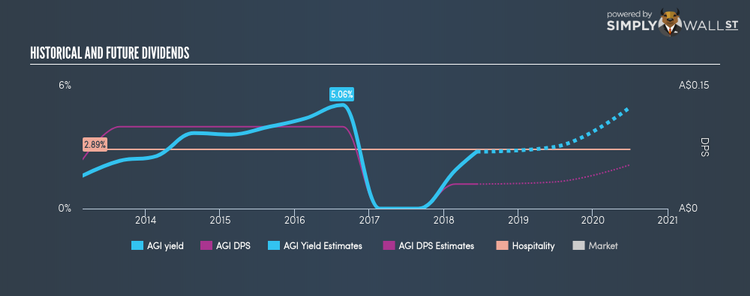

Ainsworth Game Technology has been paying dividend over the past 5 years. It currently paid an annual dividend of AU$0.03, resulting in a dividend yield of 2.78%. At the current payout ratio of 17.73%, AGI’s yield exceeds Australia’s low risk savings rate of 2.37%. Analysts forecast future payout ratio to be 42.36%, indicating that AGI’s upcoming dividend payments are well-covered by earnings. AGI is also trading beneath its true value by 58.15%, making AGI an attractive investment at the current share price of AU$1.08. Dig deeper into Ainsworth Game Technology here.

Australian Pharmaceutical Industries Limited (ASX:API)

Australian Pharmaceutical Industries Limited engages in the wholesale distribution of pharmaceutical, medical, health, beauty, and lifestyle products to pharmacies. Australian Pharmaceutical Industries was established in 1910 and with the market cap of AUD A$664.78M, it falls under the small-cap group.

Over the past 10 years, Australian Pharmaceutical Industries has been distributing dividends back to its shareholders, with a recent yield of 5.19%. At the current payout ratio of 71.30%, API has been able to sensibly grow its dividend per share in the last 10 years, raising its yield to above Australia’s low risk savings rate of 2.37%. In addition to this, API is also undervalued by 51.16%, meaning API can be bought at an attractive price right now. More on Australian Pharmaceutical Industries here.

Tassal Group Limited (ASX:TGR)

Tassal Group Limited, together with its subsidiaries, engages in hatching, farming, processing, marketing, and selling Atlantic salmon in Australia. Tassal Group was started in 1986 and with the company’s market cap sitting at AUD A$725.75M, it falls under the small-cap stocks category.

Tassal Group has been paying dividend over the past 10 years. It currently paid an annual dividend of AU$0.16, resulting in a dividend yield of 3.85%. TGR’s dividend per share have been growing over the past 10 years, with a payout ratio of 44.09%, indicating earnings are able to cover the payments. Furthermore, TGR’s dividend yield exceed Australia’s low risk savings rate which currently sits at 2.37%. TGR is also trading below its intrinsic value by 20.94%, which means TGR is currently an attractive buy for those looking for dividend and capital gains. More detail on Tassal Group here.

For more mispriced dividend stocks to add to your portfolio, explore this interactive list of undervalued dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.