Air Products (APD) Inks Agreement to Invest $2B in Indonesia

Air Products and Chemicals, Inc. APD announced that it signed a definitive deal to invest roughly $2 billion for a world-scale coal-to-methanol manufacturing facility in East Kalimantan, Indonesia.

Per the long-term on-site contract, PT. Ithaca Resources and PT. Bakrie Capital Indonesia are expected to supply the coal feedstock and have agreed to offtake the methanol production for sale in Indonesia.

Notably, Air Products will develop, own and operate the air separation, gasification, syngas clean-up, utilities and methanol production assets to manufacture methanol. Per management, the investment in Indonesia is in sync with Air Products’ long-term plan to deploy capital into high-return industrial gas projects.

The company also stated that the facility, which includes its Syngas Solutions dry-feed gasifier, is expected to manufacture approximately two million tons of methanol per year from roughly six million tons of coal per year. The project is anticipated to come online in 2024.

Air Products is undertaking a range of gasification projects in China and the Jazan plant in Saudi Arabia in addition to the latest project in Indonesia.

The company’s shares have gained 14.9% in the past year against the industry’s 22.6% decline.

Last month, Air Products withdrew its earnings guidance for 2020 due to the unknown duration and impacts of the coronavirus pandemic. The company also did not provide earnings guidance for the fiscal third quarter due to uncertainties.

Air Products expects declines in the Americas and EMEA merchant volumes to sustain. Further, in the fiscal third quarter, the company expects it to be more pronounced and potentially longer, depending on the duration and impacts of the coronavirus pandemic.

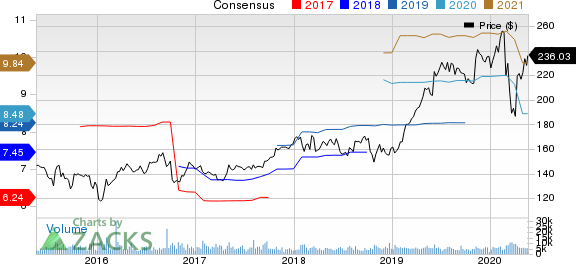

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Stocks to Consider

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Agnico Eagle Mines Limited AEM, Newmont Corporation NEM and Barrick Gold Corporation GOLD, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Agnico Eagle has an expected earnings growth rate of 75.3% for 2020. The company’s shares have surged 64.6% in the past year.

Newmont has an expected earnings growth rate of 85.6% for 2020. Its shares have rallied 116.2% in the past year.

Barrick has a projected earnings growth rate of 64.7% for 2020. The company’s shares have rallied 130.3% in a year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research