Air Products' (APD) LNG Technology Selected for ECA Project

Air Products and Chemicals, Inc. APD has entered into an agreement to provide its proprietary liquefied natural gas (“LNG”) technology, equipment and related process license and advisory services to the Energia Costa Azul (“ECA”) LNG Export Terminal Project. Notably, ECA LNG is a joint venture between Sempra LNG, IEnova and Total.

Air Products’ manufacturing facility in Port Manatee, FL will manufacture the coil wound heat exchangers for its AP-DMR LNG Process technology. This will be shipped to the project export site in Ensenada, Mexico.

Air Products’ LNG equipment will be producing roughly three million tons per annum at the Mexico site. As per the agreement, Air Products’ DMR process technology and engineering, design and manufacturing of the heat exchanger equipment for the liquefaction section will be provided for the single production train.

The company’s LNG technology is critical to meet the world’s rising energy needs and demand for clean energy, processes and cryogenically liquefies valuable natural gas for consumer and industrial use.

Shares of Air Product have gained 10.9% in the past year compared with 21.1% rise of the industry.

Air Products’, in its fourth-quarter fiscal 2020 call, stated that its on-site businesses (representing more than half of its sales) continue to deliver stable cash flow amid a challenging COVID-19 environment. The company announced a landmark gasification and hydrogen for mobility megaprojects, which will help address the increasing energy needs globally.

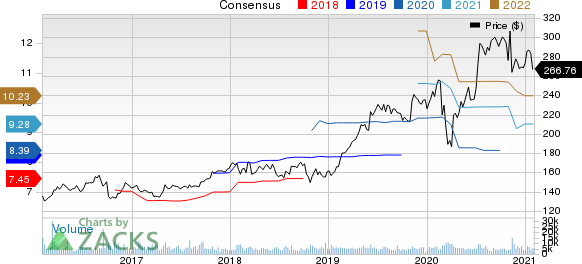

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Key Picks

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Fortescue Metals Group Limited FSUGY, BHP Group BHP and Impala Platinum Holdings Limited IMPUY.

Fortescue has a projected earnings growth rate of 74.2% for the current fiscal. The company’s shares have surged around 124.2% in a year. It currently sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BHP has an expected earnings growth rate of 59.5% for the current fiscal. The company’s shares have gained around 28.6% in the past year. It currently flaunts a Zacks Rank #1.

Impala has an expected earnings growth rate of 189.4% for the current fiscal. The company’s shares have rallied around 37.9% in the past year. It currently sports a Zacks Rank #1.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.