Air Products (APD) and Shandong Binhua Sign Gas Supply Contract

Air Products and Chemicals, Inc. APD announced its long-term gas supply contract with Shandong Binhua New Material Co. Ltd. (Binhua). The latter is a subsidiary of Befar Group, a leading petroleum and chemical enterprise in China.

Per the deal, Air Products will build, own and operate several onsite gas production facilities in the Binzhou Port-Centered Chemical Industry Park in phases, including an energy-efficient air separation unit (ASU), to meet Binhua’s gaseous oxygen and nitrogen demand. Liquid Products will also be given to other customers in the park and the growing merchant market in Shandong Province. All these facilities will be fully functional in the next year.

The investment of Air Products will help strengthen the integrated gases supply position to enable the rapid development of the world-class park in Binzhou and the transformation and upgrade of the chemical industry under China’s 14th Five-Year Plan.

Air Products' highly energy-efficient facilities will provide reliable gases to this project for producing a range of chemical materials for use in high-growth new materials and new energy products.

Shares of Air Product have gained 27.8% over a year compared with 17.7% rise of the industry.

Air Products’, in its fourth-quarter fiscal 2020 call, stated that its on-site businesses (representing more than half of its sales) continue to deliver stable cash flow amid a challenging COVID-19 environment. The company announced a landmark gasification and hydrogen for mobility megaprojects, which will help address the increasing energy needs globally. It is also committed to boost shareholders’ value. The company increased its dividend for the 38th consecutive year.

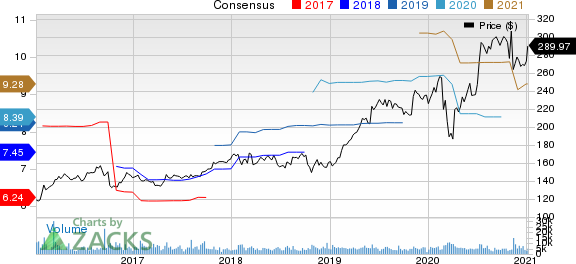

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Key Picks

Air Products currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Fortescue Metals Group Limited FSUGY, BHP Group BHP and Impala Platinum Holdings Limited IMPUY.

Fortescue has a projected earnings growth rate of 53.6% for the current fiscal. The company’s shares have surged 172.4% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BHP has an expected earnings growth rate of 43.3% for the current fiscal. The company’s shares have gained around 23% in the past year. It currently flaunts a Zacks Rank #1.

Impala has an expected earnings growth rate of 131.7% for the current fiscal. The company’s shares have surged around 35.7% in the past year. It currently sports a Zacks Rank #1.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited (BHP) : Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research