Do Air Products and Chemicals's (NYSE:APD) Earnings Warrant Your Attention?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Air Products and Chemicals (NYSE:APD). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Air Products and Chemicals

How Quickly Is Air Products and Chemicals Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Air Products and Chemicals managed to grow EPS by 9.8% per year, over three years. That's a good rate of growth, if it can be sustained.

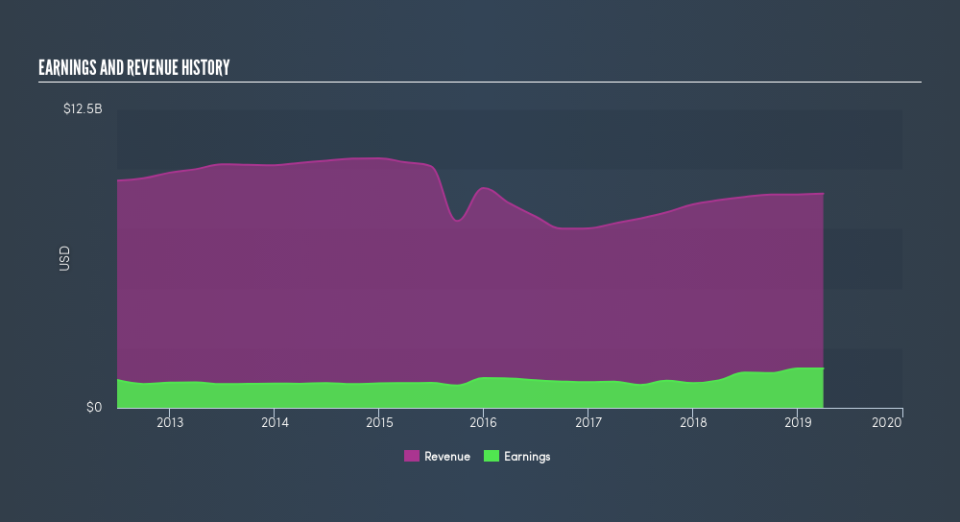

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Air Products and Chemicals's EBIT margins were flat over the last year, revenue grew by a solid 3.1% to US$9.0b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Air Products and Chemicals?

Are Air Products and Chemicals Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's a pleasure to note that insiders spent US$3.2m buying Air Products and Chemicals shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the Chairman, Seifollah Ghasemi, who made the biggest single acquisition, paying US$3.2m for shares at about US$160 each.

On top of the insider buying, it's good to see that Air Products and Chemicals insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$118m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Air Products and Chemicals Deserve A Spot On Your Watchlist?

One important encouraging feature of Air Products and Chemicals is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. If you think Air Products and Chemicals might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

As a growth investor I do like to see insider buying. But Air Products and Chemicals isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.