Airbnb (ABNB) Q3 Earnings Beat Mark, Revenues Increase Y/Y

Airbnb ABNB reported earnings of $1.79 per share for third-quarter 2022, which beat the Zacks Consensus Estimate by 25.8%. Earnings increased 46.7% year over year. The bottom line also surpassed the prior-quarter earnings of 56 cents per share.

Revenues of $2.9 billion increased 28.9% year over year and 37.1%, sequentially. The top line also surpassed the Zacks Consensus Estimate by 1.1%.

The year-over-year increase was driven by a continuous improvement in Nights and Experiences Booked. Also, growth in Average Daily Rates and Gross Booking Value remained a tailwind.

Nights and Experiences Booked remained strong in North America, mainly driven by the United States. Also, the same generated higher value in EMEA, Latin America and the Asia Pacific.

Growth for gross nights booked remained strong in high-density urban areas. Increasing guest demand for non-urban nights drove active listings for non-urban destinations. A continuous recovery in both longer-distance and cross-border travel aided the quarterly performance.

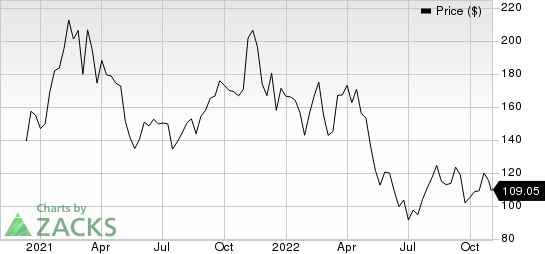

Airbnb, Inc. Price

Airbnb, Inc. price | Airbnb, Inc. Quote

Quarterly Details

Nights and Experiences Booked were 99.7 million, increasing 25% on a year-over-year basis. The metric was driven by strong performances in all regions.

Gross Booking Value amounted to $15.6 billion, which rose 31% from the prior-year quarter’s reported figure.

Gross Booking Value per Night and Experience Booked (or Average Daily Rates) was $156, up 5% year over year, driven by price appreciation.

In terms of trip length, the category of long-term stays of 28 days or more remained strong in the third quarter. Also, 45% of gross nights booked were from stays of at least seven nights. However, long-term stays constituting 20% of gross nights booked were in line with the same quarter’s level last year.

In the reported quarter, gross nights booked in high-density urban areas represented 48% of gross nights booked.

Cross-border travel for the third quarter accounted for 43% of total gross nights booked, up from 33% in the same quarter last year.

Operating Results

Adjusted EBITDA for the third quarter was $1.5 billion, up 32% from the same quarter’s level last year.

Operations and support costs increased 27% year over year to $289.9 million. Product development expenses were $366.2 million, up 6.3% year over year. Sales and marketing expenses rose 31.7% from the year-ago quarter’s figure to $383.2 million. General and administrative expenses amounted to $240.4 million, up 14.1% year over year.

For the third quarter, Airbnb reported a net income of $1.2 billion, up 46% from the third-quarter 2021 level.

Balance Sheet & Cash Flow

As of Sep 30, 2022, cash and cash equivalents, marketable securities and restricted cash amounted to $9.63 billion, down from $9.91 billion reported on Jun 30, 2022.

Long-term debt as of Sep 30, 2022, was $1.986 billion. ABNB’s long-term debt was $1.985 billion as of Jun 30, 2022.

Unearned fees were $1.22 billion at the third-quarter end compared with $1.98 billion at the previous-quarter end.

Net cash provided by operating activities was $966 million for the third quarter of 2022 compared with $800 million in the prior quarter.

Airbnb generated a free cash flow of $960 million in the reported quarter.

Guidance

For fourth-quarter 2022, Airbnb expects revenues between $1.80 billion and $1.88 billion, implying growth between 17% and 23% from the year-ago quarter’s reported number. The Zacks Consensus Estimate for revenues is pegged at $1.90 billion.

Airbnb anticipates the year-over-year growth rate for the Nights and Experiences Booked to be flat in the fourth quarter with the growth rate registered in the reported quarter.

Management expects the Average Daily Rates to reflect the impact of foreign exchange headwinds.

Adjusted EBITDA is expected to be up from the same-quarter level last year.

Zacks Rank & Other Stocks to Consider

Currently, Airbnb has a Zacks Rank #2 (Buy). Investors interested in the broader Zacks Computer & Technology sector can also consider some other top-ranked stocks like US Foods USFD, The Trade Desk TTD and Tencent Music Entertainment Group TME, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

US Foods is set to report third-quarter 2022 results on Nov 10. The Zacks Consensus Estimate for USFD’s earnings is pegged at 59 cents per share, suggesting an increase of 22.9% from the prior-year period’s reported figure. USFD has lost 15% in the year-to-date period. Its long-term earnings growth rate is currently projected at 20%.

The Trade Desk is scheduled to release third-quarter 2022 results on Nov 9. The Zacks Consensus Estimate for TTD’s earnings is pegged at 24 cents per share, suggesting an increase of 33.3% from the prior-year quarter’s reported figure. TTD has lost 42% in the year-to-date period. TTD’s long-term earnings growth rate is currently projected at 24%.

Tencent Music is scheduled to release third-quarter 2022 results on Nov 15. The Zacks Consensus Estimate for TME’s earnings is pegged at 11 cents per share, suggesting an increase of 22.2% from the prior-year quarter’s reported figure. TME has lost 45.2% in the year-to-date period. TME’s long-term earnings growth rate is currently projected at 17.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

The Trade Desk (TTD) : Free Stock Analysis Report

Tencent Music Entertainment Group Sponsored ADR (TME) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research