Airbnb, Inc.'s (NASDAQ: ABNB) Insider Selling Leaves the Bullish Story Intact

This article first appeared on Simply Wall St News.

In contrast to many promising growth stocks, Airbnb, Inc. (NASDAQ: ABNB) spent the entirety since its IPO debut in a consolidation.

An apparent reason for this was timing and the nature of their business. Yet, as the travel goes back to normal, the company scored the second positive quarter in a row.

See our latest analysis for Airbnb

Q4 Earnings Results

GAAP EPS: US$0.08 (beat by US$0.04)

Revenue: US$1.53b (beat by US$70m)

Revenue growth: +78.1%

Other highlights

73.4 million bookings in Q4 (+8% Q/Q)

Forward bookings for the summer season +25% compared to 2019

Q1 Revenue guidance: US$1.41b -US$1.48b

Co-founder and CEO Brian Chesky noted that even with the influence of Omicron, Q4 Nights and Experiences were overall down only 3% compared to 2019. Furthermore, he said that 20% of stays were for one month or longer. Finally, he stated that the ongoing remote work trend that untethered millions of people from their workplaces is an incredible opportunity for Airbnb. The company is now guiding for the first Q1 with a positive EBITDA.

The Last 12 Months Of Insider Transactions At Airbnb

The Co-Founder, Nathan Blecharczyk, made the biggest insider sale in the last 12 months. That single transaction was for US$68m worth of shares at US$140 each. So it's clear an insider wanted to take some cash off the table, even below the current price of US$180. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation.

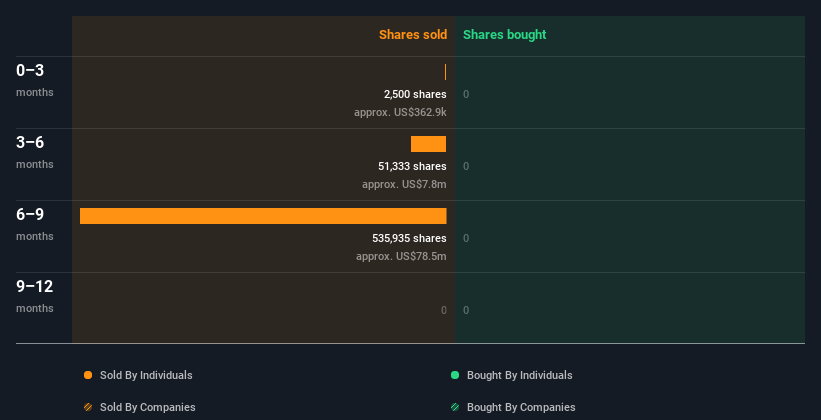

In the last year, Airbnb insiders didn't buy any company stock. Below, you can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months. If you want to know precisely who sold, for how much, and when, click on the graph below!

Airbnb Insiders Are Selling The Stock

Over the last three months, we've seen significant insider selling at Airbnb. In total, Co-Founder Joseph Gebbia sold US$363k worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership of Airbnb

Many investors like to check how much of a company is owned by insiders. Generally, it's a good sign if insiders own a significant number of shares in the company. Airbnb insiders own about US$35b worth of shares (which is 31% of the company). This kind of significant ownership by insiders generally increases the chance that the company is run in the interest of all shareholders.

What Does This Data Suggest About Airbnb Insiders?

An insider hasn't bought Airbnb stock in the last three months, but there was some selling. When insiders sell, they can sell for many reasons. Thus, while a US$85m sale is significant, it is not large enough to raise any alarms compared to the massive stake that insiders hold.

While the company is not trading cheaply by the usual metrics, it is a growth story that highly depends on the investment horizon.

Insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. At Simply Wall St, we found 2 warning signs for Airbnb that deserve your attention before buying any shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.