Do AirBoss of America's (TSE:BOS) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in AirBoss of America (TSE:BOS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for AirBoss of America

How Quickly Is AirBoss of America Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that AirBoss of America has managed to grow EPS by 25% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that AirBoss of America is growing revenues, and EBIT margins improved by 7.5 percentage points to 13%, over the last year. That's great to see, on both counts.

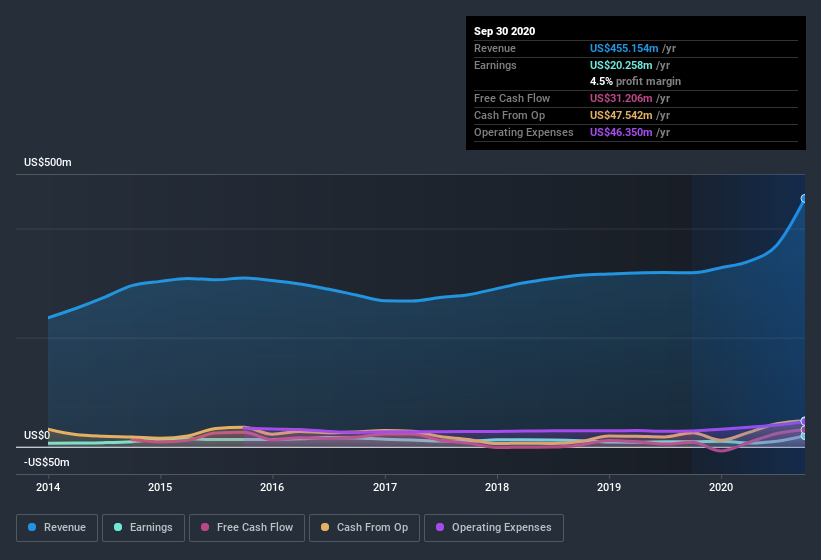

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for AirBoss of America?

Are AirBoss of America Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold -US$534k worth of shares. But that's far less than the US$6.3m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the AirBoss of America's future. It is also worth noting that it was James Flatt who made the biggest single purchase, worth CA$5.6m, paying CA$18.75 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since AirBoss of America insiders own more than a third of the company. In fact, they own 42% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have US$197m invested in the business, using the current share price. That's nothing to sneeze at!

Is AirBoss of America Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about AirBoss of America's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. However, before you get too excited we've discovered 1 warning sign for AirBoss of America that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AirBoss of America, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.