Airline Stock Roundup: AAL's Bullish Q4 Revenue View, ALK, GOL, AZUL in Focus

In the past week,American Airlines’ AAL management provided an improved guidance for fourth-quarter 2021 revenues despite multiple flight cancellations. Alaska Airlines, the wholly-owned subsidiary of Alaska Air Group ALK, trimmed its schedule for the current month following the omicron-induced staff crunch.

Air-travel demand is improving in Latin America with increased vaccinations. Reflecting this buoyant scenario, Gol Linhas Aereas Inteligentes GOL provided an upbeat view for the final quarter of 2021. Owing to the healthy air-travel demand scene, Gol Linhas’ traffic for December improved significantly year over year, as reported in last week’s write up.

Another Brazilian carrier Azul AZUL was also in news in the past week, courtesy of its December traffic report. Like Gol, Azul is benefiting from improved air-travel demand on the domestic front.

Recap of the Latest Top Stories

1 Per an SEC filing, American Airlines now expects total revenues to decline approximately 17% in the fourth quarter of 2021 from the comparable period’s figure in 2019. Previously, the airline estimated the same to decrease around 20%. However, due to mass-scale flight cancellations during the Christmas travel period through the end of the year, American Airlines now predicts capacity to decline 13% in the fourth quarter from the 2019 level compared with the previous expectation of a decrease of 11-13%. Due to reduced capacity, AAL, currently carrying a Zacks Rank #3 (Hold), incurred higher costs. It now expects cost per available seat mile to increase 13-14% in the fourth quarter from the 2019 level. Previously, the carrier estimated the same to increase 8-10%. American Airlines expects total liquidity of approximately $15.8 billion at the end of the fourth quarter.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2. For the fourth quarter of 2021 (detailed results of which will be out on Feb 17), Gol anticipates EBITDA margin to be approximately 35% while it expects EBIT margin to be around 28%. GOL estimates average fuel price per liter to be R$4.11. Gol predicts passenger revenue per available seat kilometers to increase 35% year over year in the fourth quarter. It expects cost per available seat kilometers, excluding fuel, to decrease 12% from the fourth-quarter 2020 level. Total demand, measured in revenue passenger kilometers, is forecast to increase 15.4% year over year. Total capacity, measured in available seat kilometers, is expected to climb 13.2% year over year.

3. Per a Reuters report, Alaska Airlines reduced its flight schedule nearly 10% through January 2022 to combat the omicron-induced staffing shortage. With employees falling sick due to this highly transmissible COVID-19 variant, Alaska Airlines’ operations took a massive hit and the airline was compelled to slash flight schedule. Citing its concerns, management said, "As we have entered 2022, the continued impacts of Omicron have been disruptive in all our lives and unprecedented employee sick calls have impacted our ability to operate our airline reliably".

4. Azul reported a 1.9% decline in traffic (on a consolidated basis) for December 2021 from the levels achieved in December 2019 (pre-coronavirus). The decline was mainly due to weakness on the international front. Consolidated load factor (% of seats filled by passengers) dipped 0.6 percentage points (p.p) to 82.9% last month with the capacity contraction (1.2%) being less than the reduction in traffic. International traffic in December declined a massive 60.9% from the comparable period’s level in 2019. However, the scenario was much brighter on the domestic front with traffic increasing 20.9% from the December 2019 levels.

Performance

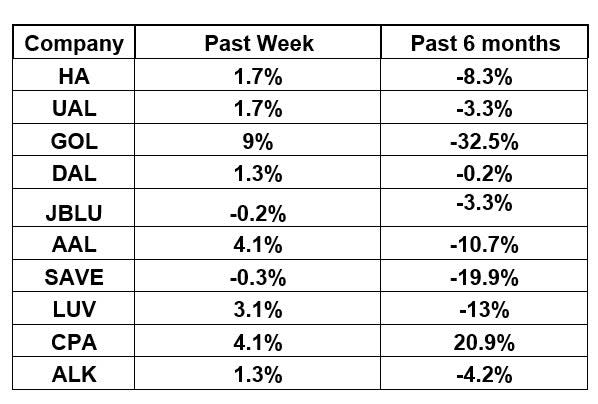

The following table shows the price movement of major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks have traded in the green over the past week. As a result, the NYSE ARCA Airline Index has increased 2.5% to $84.68. Over the past six months, the NYSE ARCA Airline Index has depreciated 10.9%.

What's Next in the Airline Space?

Fourth-quarter earnings reports from United Airlines UAL and American Airlines are scheduled to be out on Jan 19 and Jan 20, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

AZUL (AZUL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research