Akre Capital Cuts Berkshire Hathaway, Dollar Tree

Chuck Akre (Trades, Portfolio)'s Akre capital Management, LLC sold shares of the following stocks during the first quarter of 2020.

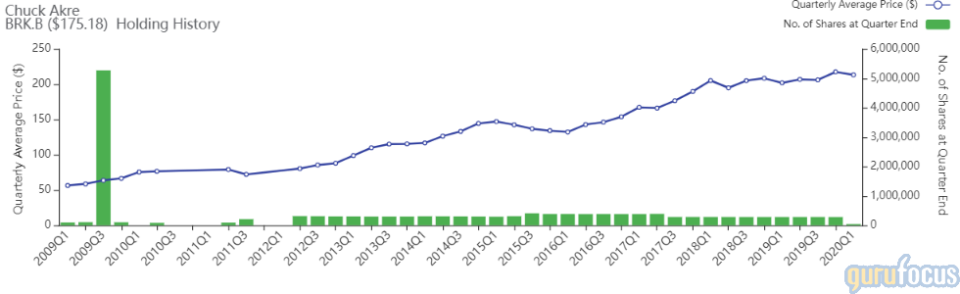

Berkshire Hathaway

The firm cut the Berkshire Hathaway Inc. (BRK.B) position by 83.45%. The portfolio was impacted by -0.49%.

The holding company has a market cap of $425.47 billion and an enterprise value of $490.73 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 2.57% and return on assets of 1.29% are underperforming 76% of companies in the insurance industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.41 is below the industry median of 2.39.

The largest guru shareholder of the company is Bill Gates (Trades, Portfolio)' foundation with 2.05% of outstanding shares, followed by Bill Ackman (Trades, Portfolio)'s Pershing Square Capital Management with 0.17% and Diamond Hill Capital (Trades, Portfolio) with 0.10%.

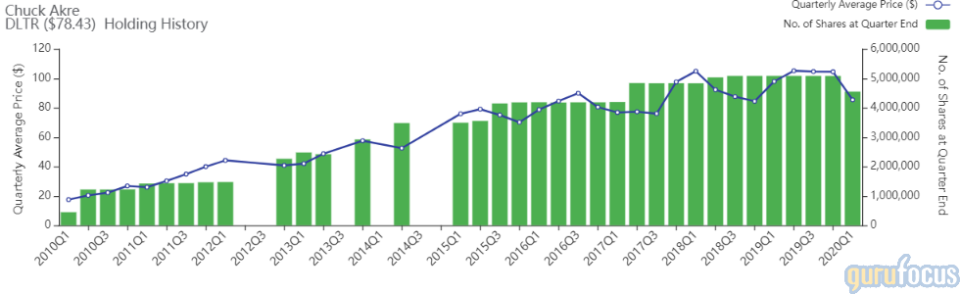

Dollar Tree

The firm trimmed its Dollar Tree Inc. (DLTR) position by 10.48%. The trade had an impact of -0.46% on the portfolio.

The operator of discount stores has a market cap of $18.48 billion and an enterprise value of $28.28 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 13.95% and return on assets of 4.51% are outperforming 74% of companies in the retail, defensive industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.05 is below the industry median of 0.38.

Akre is the largest guru shareholder of the company with 1.92% of outstanding shares. Other notable shareholders include Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.44% and Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.31%.

Primo Water

The firm closed its Primo Water Corp. (PRMW) holding. The portfolio was impacted by -0.33%.

American Tower

The firm cut its position of American Tower Corp. (AMT) by 2.01%, impacting the portfolio -0.30%.

The operator of cell towers has a market cap of $105.61 billion and an enterprise value of $135.91 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 38.49% and return on assets of 4.74% are outperforming 67% of companies in the REITs industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.07.

The largest guru shareholder of the company is Akre with 1.59% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.22% and Pioneer Investments (Trades, Portfolio) with 0.07%.

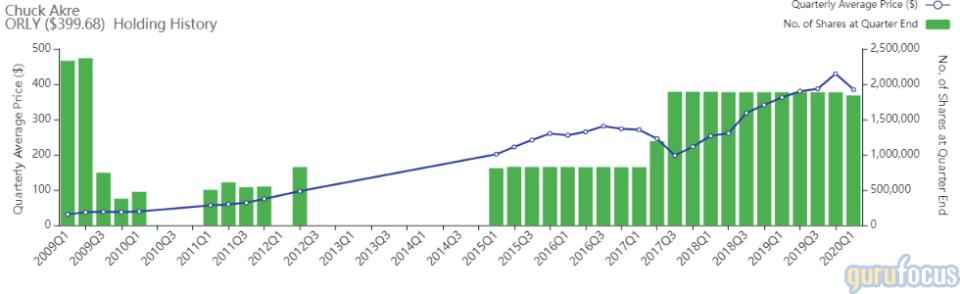

O'Reilly Automotive

The investment firm cut its position in O'Reilly Automotive Inc. (ORLY) by 2.33%. The trade had an impact of -0.18% on the portfolio.

The seller of aftermarket automotive parts has a market cap of $29.56 billion and an enterprise value of $35.73 billion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 484.93% and return on assets of 14.1% are outperforming 93% of companies in the retail, cyclical industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.01 is below the industry median of 0.42.

The largest guru shareholder of the company is Akre's firm with 2.48% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 1% and David Abrams (Trades, Portfolio) with 0.70%.

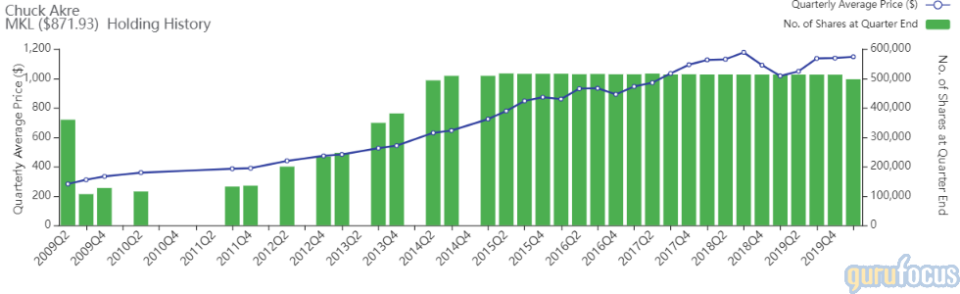

Markel

The firm reduced its holding in Markel Corp. (MKL) by 3%. The trade had an impact of -0.16% on the portfolio.

The insurance company has a market cap of $11.83 billion and an enterprise value of $11.60 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on assets of -0.53% and return on equity of -1.87% are underperforming 86% of other companies in the insurance industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 1.07 is below the industry median of 2.39.

The largest guru shareholder of the company is Akre's firm with 3.61% of outstanding shares, followed by Chris Davis (Trades, Portfolio) with 1.57% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.57%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Weitz Investment Exits Booking, Trims Expedia

8 Stocks Mark Hillman Continues to Buy

First Pacific Advisors Trims Microsoft, Howmet Aerospace

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.