Alcoa's Aluminum Stronghold Propels Earnings

Alcoa Corp. (NYSE:AA) saw its stock surge by more than 6% after the market closed on Wednesday after the company beat its second-quarter earnings per share estimate by 18 cents and announced a stock buyback plan worth $500 million.

Despite many economic headwinds causing a price pullback recently, I believe Alcoa's stock is undervalued and could benefit from rising aluminium demand and a dominant market position.

Earnings and outlook

Alcoa's second-quarter production impressed with its alumina totalling 3.23 million metric tons and aluminium adding up to 499,000 tons, more or less in line with its first quarter.

Although production remained on a linear growth trajectory, rising aluminium prices and operational efficiency resulted in Alcoa reporting net income worth $549 million, a significant improvement from the $469 million generated in its first quarter.

Looking ahead, the company could experience a few headwinds as commodity prices might recede, given increasing interest rates and a weakening economy. Nonetheless, Alcoa's historical growth remains robust, with its five-year Ebitda compound annual growth rate standing firm at 18.97%, nearly nine times global GDP growth.

Aluminium market review

Alcoa is currently the eighth largest aluminium producer globally, exposed to a market projected to grow at a compound annual growth rate of 6% until 2026 according to Mordor Intelligence. Coupling these data points with the fact that the company operates in an industry with high barriers to entry means that Alcoa's growth is likely to remain consistent for the foreseeable future.

From a short-term vantage point, Alcoa could benefit from rising demand amid a resurgence of the airline space, continued growth in aluminium packaged staple goods and industrial production increases in China. As such, the company's growth trajectory remains solid irrespective of the time horizon.

Valuation and stock repurchases

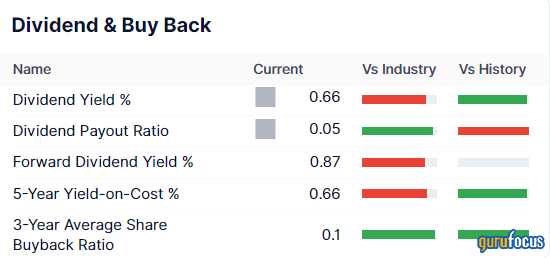

Along with its earnings release, Alcoa announced a $500 million stock buyback program to reward its shareholders. Historically speaking, Alcoa has gravitated more towards buybacks than meaningful dividend distributions, as seen in the diagram below, which illustrates the differing policy relative to its peers.

In isolation, a share buyback would increase the intrinsic value of Alcoa's stock as the company's market capitalization per share would proliferate and thus create a value gap for investors.

Alcoa is also undervalued on a relative basis, with its price-sales ratio trading at a mere 0.68 and its price-earnings being 11.58% below its cyclical peak.

Concluding thoughts

Aloca's recent earnings beat and stock buyback announcement could set the tone for a successful back-end of 2022 in my view. Despite aluminium prices reverting to the mean, the company holds a powerful market position with the opportunity to service an array of hypergrowth demand pockets. Moreover, the stock appears undervalued on a relative basis as things stand.

This article first appeared on GuruFocus.